Africa-Press – Uganda. Yields on Uganda’s short-term government debt edged higher in the latest Treasury Bill auction (No. 1207), as the Bank of Uganda (BoU) balanced robust investor demand with a deliberate issuance strategy aimed at controlling costs and managing liquidity.

Held on June 18, the auction revealed a steep uptick in demand, particularly for the 91-day bill. However, despite this overwhelming interest, the central bank accepted only a limited portion of the short-term bids, further reinforcing a pattern of tight issuance that has dominated recent auctions.

BoU instead leaned heavily on the 364-day tenor, accepting over Shs 414 billion at a cut-off yield of 15.65%, affirming its role as the government’s preferred tool for short-term funding.

According to Impala Market, a financial advisory and market analytics firm, “The Bank of Uganda is walking a fine line. It’s managing near-term funding needs with a cautious eye on inflation expectations and fiscal risk. The steepening yield curve is a direct result of this strategy.”

Market Signals: Secondary Market Anticipated Tightening

In the run-up to the auction, trading activity in the secondary market hinted at further yield firming, particularly at the short end. Yields on the 91-day T-bill had dipped as low as 10.76%, only to jump to 12.01% in the auction — the largest shift among the three tenors.

Meanwhile, yields on the 182-day and 364-day T-bills remained largely consistent with market expectations, reflecting a pricing consensus that investors have now internalised BoU’s cautious but predictable approach.

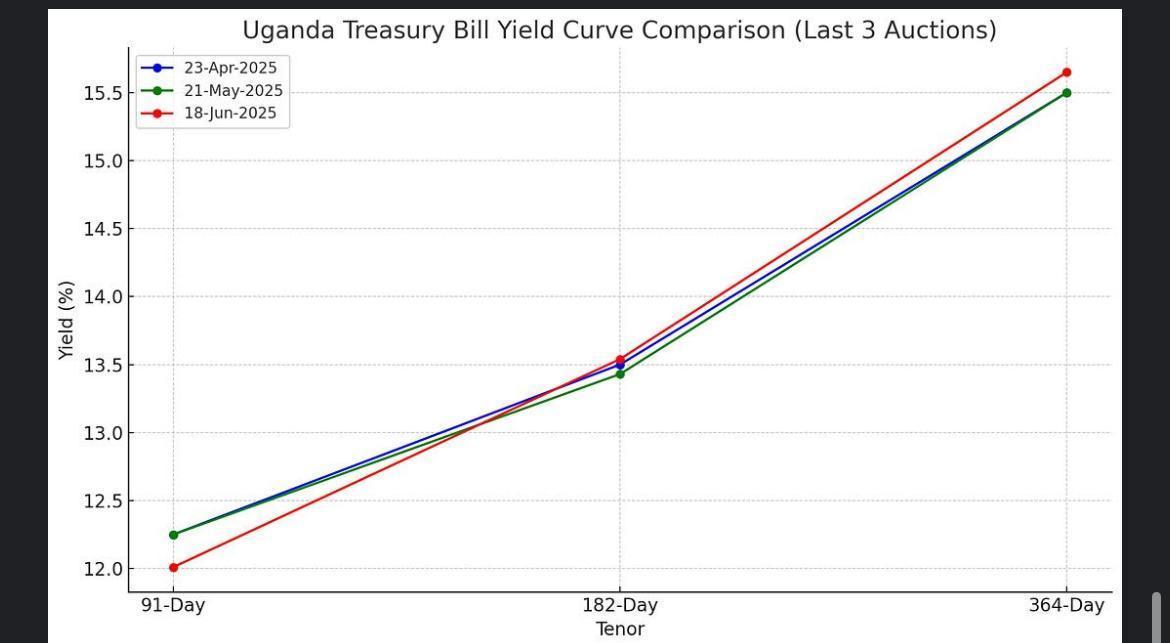

The Yield Curve: Subtle Steepening

A review of the last three auctions shows a gradual but noticeable steepening of the yield curve, with the 182-day paper acting as the pivot. Analysts at Impala Market attribute this to growing reinvestment risk as the fiscal year enters its second half, compounded by uncertainty around the timing of external funding inflows.

“The market is clearly anticipating some volatility in H2 2025,” Impala Market noted in a post-auction commentary.

“Despite the recent Shs 2.4 trillion private placement and early signs of World Bank disbursements, there’s caution in pricing, particularly for paper maturing within 6 months.”

Strategic Shifts: What Comes Next?

BoU’s apparent under-issuance of the 91-day T-bill — now three months into a tightening cycle — has made the short end scarce, inadvertently nudging investors toward the more readily available 364-day paper despite rising yields.

Looking ahead, the market is watching several key developments including if the

BoU adjust its issuance mix with sustained demand for the 91-day paper, there’s growing pressure for the central bank to loosen its grip.

The ceiling for 182-day yields. The mid-tenor now offers a compelling trade-off between yield and duration, making it a favorite among short-term investors.

Could yield curve flattening return.

If BoU holds rates steady and expected foreign inflows materialize, we may see a compression in the curve starting July.

Investment Strategy Outlook

Impala Market offers the following recommendations:

Short-term investors: The 182-day T-bill currently offers a sweet spot in terms of risk and return.

Medium-term allocators: The 364-day paper remains attractive above 15.50%, but beware of reinvestment timing risks.

Macro-watchers: A flattening curve could be on the horizon if funding inflows gain traction and BoU refrains from further tightening.

As the second half of 2025 unfolds, fiscal updates and political signals will play a key role in shaping auction outcomes. For now, BoU’s balancing act continues — steady, cautious, and closely watched by a market hungry for yield but alert to risk.

Source: Nilepost News

For More News And Analysis About Uganda Follow Africa-Press