Africa-Press – Zambia. Former Minister of Finance, Bwalya Ng’andu has attributed the strengthening of the Kwacha to consistent high copper prices on the international market and renewed confidence in Government’s policy direction.

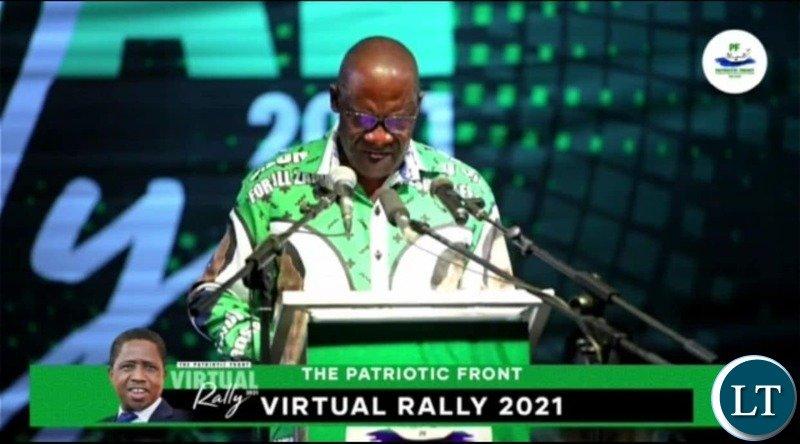

Speaking during a Patriotic Front (PF) Virtual Rally, Dr Ng’andu who is also former Bank of Zambia (BOZ) Deputy Governor. said one important factor responsible for the strengthening of the Kwacha is the price of copper that has been fairly high for a period of time.

“It is not just a blip but over a period of time we have seen copper price rising, reaching even the margin of US$ 10,000 per tonne over a consistent period of time. That means that there are inflows now, improved inflows into the foreign exchange market through the Mineral Royalty tax that the mining companies pay.

“So, if you accept the notion that Exchange Rate is fixed by dynamics on the supply side and on the demand side then you very well understand that because there are more dollars coming into the market, the kwacha obviously is in a place where it can get stronger,” Dr Ng’andu said.

He added that the appreciation of the kwacha can also be attributed to the successes of the PF Government policies. Dr Ng’andu recalled that between September and November last year, the country was going through issues of debt default, which created a scenario that the Zambian economy was about to implode.

He said because of this, many players withdrew from the market and there were no foreign offshore investors to investors in the securities market. Dr Ng’andu explained that this meant that there was no additional foreign exchange in the market.

“But now I think there is renewed confidence in what we are doing, I think there is now a firm belief that our policies, our policy direction is correct but also that we are implementing these policies correctly and that is beginning to create this improvement in confidence and we have seen now a number of offshore investors coming back into the market and playing a very active role in supporting the inflow of foreign currency into the Zambian market,” he said.

On energy, Dr Ng’andu said at the time the PF Government assumed office, Zambia’s power generation capacity stood at 1,900 Megawatts (MW). He said the PF Government has added 1,350 MW of power to the national electricity grid, bringing the power generation capacity to the current 3,250 MW.

“If this process continues, very soon we will be able to generate far beyond what we need and consequently can become a net exporter of power in the region,” Dr Ng’andu said.

Meanwhile, Bloomberg reported that Zambia’s kwacha jumped the most since December 2019 as soaring commodity prices helped ease investor concerns about a debt revamp by Africa’s first pandemic-era sovereign defaulter.

The currency gained 5.1% against the dollar at 6.41 p.m. in Lusaka. It has advanced 13.6% this month, making it the world’s best performing currency in the period tracked by Bloomberg.

Zambia depends on copper for more than 70% of its foreign-exchange earnings, and sustained high prices of the commodity is helping boost dollar supply. Investors have also been lured by local currency bond yields of nearly 33%, with the expectation that the government will finalize a long-awaited deal with the International Monetary Fund after elections next month.

Copper’s record prices have been more than enough to offset a 3.6% drop in the southern African nation’s production in the six months through June compared to the same period a year earlier. Copper climbed as much 3.2%, the most since May 27 on Monday.