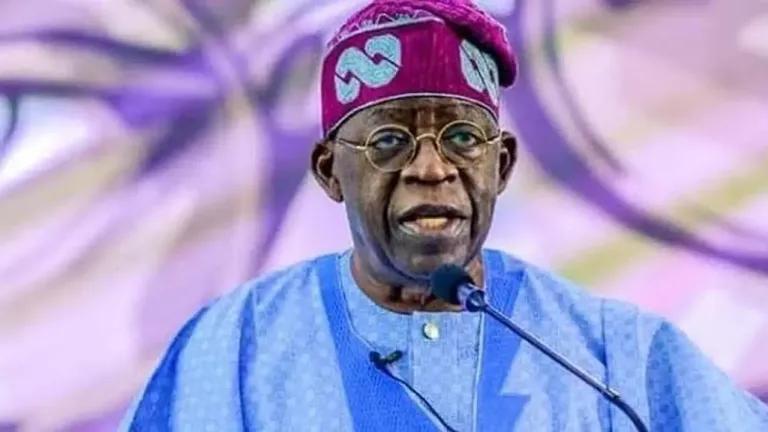

Africa-Press – Zambia. As President Bola Tinubu sets out for another loan to improve Noheria, experts have projected that Nigeria’s public debt will exceed $100 billion

This comes as Tinubu seeks legislative approval for new external and domestic loans totaling approximately $24 billion.

The administration justifies the borrowing as essential to address Nigeria’s infrastructure deficit, stimulate economic growth, and fund critical sectors such as agriculture, health, education, and security.

In a letter to the National Assembly, Tinubu stated, “In light of the significant infrastructure deficit and the paucity of financial resources amid declining domestic demand, prudent economic borrowing is essential to close the financial shortfall.”

The loans are also intended to stabilize the naira and enhance job creation, according to the presidency.

The IMF has also raised alarms, projecting that Nigeria’s debt service-to-revenue ratio could approach 100% by 2026 if current trends persist, leaving little room for social spending.

President Tinubu’s administration inherited a debt of ₦87.38 trillion in June 2023. The debt has overseen a rapid increase of ₦56.6 trillion in borrowing.

The new loan request, comprising $21.5 billion, €2.2 billion, 15 billion Japanese yen, and a €65 million grant, is expected to push the debt to ₦162.03 trillion (approximately $100 billion at current exchange rates) if approved.

Additionally, Tinubu has requested ₦757.98 billion in domestic bonds to address pension liabilities and $2 billion in foreign currency-denominated instruments to diversify funding sources.

For More News And Analysis About Zambia Follow Africa-Press