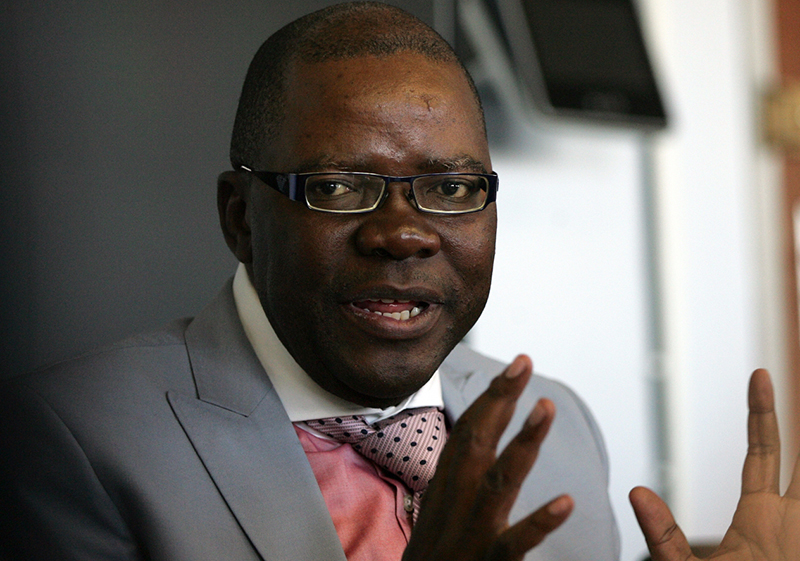

FORMER finance minister and top opposition politician Tendai Biti claimed Monday that the government would launch a new local currency this week.

Revealing the plans on Twitter, the MDC national deputy chairperson condemned the move as “pure undiluted insanity”.

The government had not responded to the claims Tuesday afternoon but Finance Minister Mthuli Ncube recently indicated that the country would have its own currency within 12 months.

Biti has repeatedly proposed that the country adopts the South African Rand instead of launching a new currency or continuing with the current monetary regime which is dominated by the US dollar.

“The regime will, this week, introduce a new Zimbabwe currency not backed by any reserves and without the context of structural reforms which are a prerequisite of currency reform,” he claimed on Twitter.

“That move is pure undiluted insanity. An un-bankable currency is just the bond note by another name.

“There is no country in the world that has voluntarily dollarised and that has ever succeeded in de-dollarising.

“Zimbabwe will not be the first. Whilst a currency is about fundamentals, ultimately the most important fundamental is confidence.”

He added; “There is absolutely no trust in this regime.

“Considering the harm and damage inflicted on this economy by its central bank over the year to now, the question to be posed is; does Zimbabwe really need a central bank?

“In my submission, it can and will do without one.”

Finance minister Ncube confirmed last month that the was government working on plans to re-introduce a local currency.

“On the issue of raising enough foreign currency to introduce the new currency, we are on our way already, give us months, not years…in less than 12 months,” he said.

The government ditched the Zimbabwe dollar in 2009 after it had been rendered virtually worthless by hyperinflation.

Instead, a multi-currency regime dominated by the US dollar was adopted but the respite was short-lived as the country ran short of the foreign currency due to poor export productivity and international financial support.

In 2016, monetary authorities introduced the surrogate bond coins and, later, notes, in a widely condemned scheme that has largely failed to address the country’s currency problems.