Africa-Press – Zimbabwe. THE Securities Exchange Commission of Zimbabwe (SecZim) has partnered with local universities to develop technology-driven systems aimed at improving prudential supervision and combating money laundering (AML).

The initiative arose from a recent competition in which universities created innovative ICT solutions to address regulatory challenges. SecZim said the competition is part of a broader strategy to invest in young innovators and build a new generation of professionals capable of supporting a transparent, efficient, and technology-led capital market.

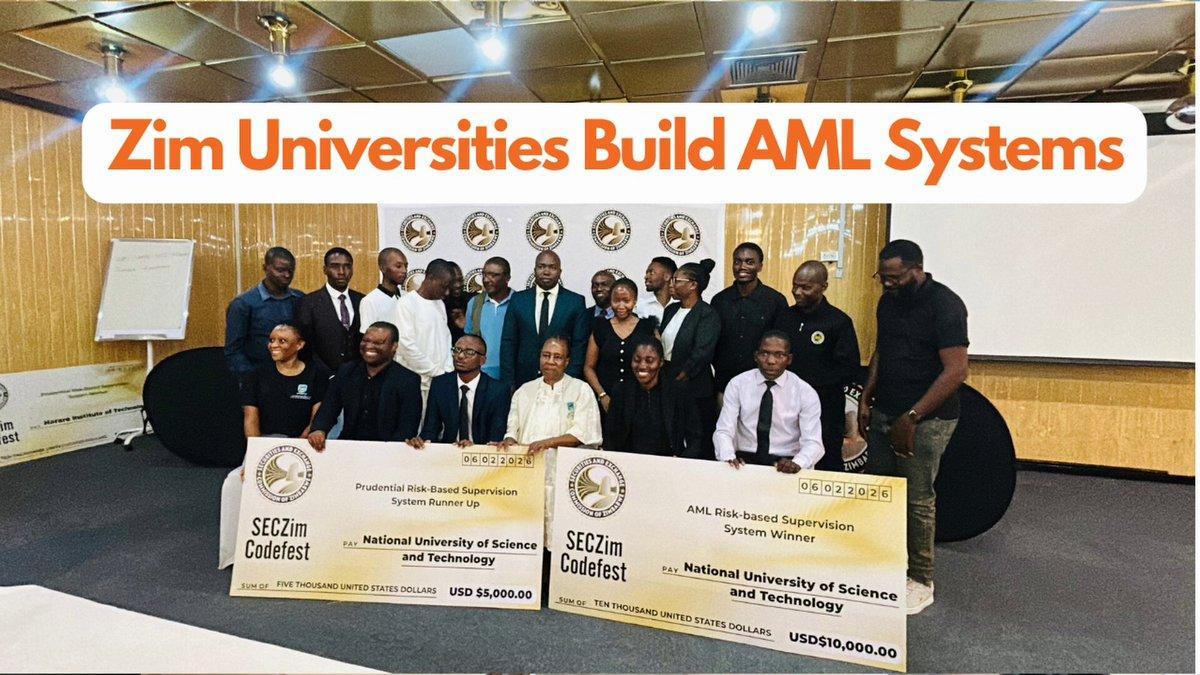

The competition was open to all universities in Zimbabwe, with four institutions — University of Zimbabwe, Midlands State University (MSU), Harare Institute of Technology (HIT), and the National University of Science and Technology (NUST) — qualifying. HIT and NUST progressed to the finals, each receiving US$15 000.

NUST won first prize for its AML Risk-Based Supervision prototype and placed second in Prudential Risk-Based Supervision, while HIT claimed first in Prudential Risk-Based Supervision and second in AML.

SecZim commissioner and non-executive director Tichaona Mushambadope said the initiative demonstrates how partnerships between regulators and universities can produce home-grown solutions tailored to Zimbabwe’s financial sector.

He said the competition process was guided by capital market regulations, with prototypes subjected to a rigorous vetting and adjudication process involving sister organisations and relevant government ministries.

“The solutions that emerged are tailor-made for the Zimbabwean environment, and the students clearly understood the challenges that exist and proposed systems that fit hand in glove with our regulatory needs,” Mushambadope said.

NUST Computer Science Department head Sibangiso Ngwenya praised his team’s efforts.

“When SecZim presented the challenges it was facing, we were inspired to act and apply our skills and knowledge to address money laundering issues in Zimbabwe,” he said.

Ngwenya said the prototype was developed collaboratively by students and staff, adding that winning the competition validated the university’s approach to problem-solving.

“This solution has the potential to reduce financial crime and strengthen confidence in financial transactions, both in the public and private sectors,” he

said.

“It also shows that Zimbabwe can develop its own solutions instead of relying on expensive foreign systems.

“So, when SecZim actually introduced the challenges that they were facing, we were inspired to get into action because we wanted to actually use our skills and knowledge to solve the challenges that Zimbabwe is facing.”

Tawanda Makombe, from HIT’s Business and Management Sciences, said the competition offered valuable student experience in teamwork and strategic problem-solving.

“And these solutions enabled SecZim to have something that is automated, and we hope these systems are going to reduce some loopholes and increase efficiency in terms of the uses of resources,” he said.

By combining regulatory oversight with local innovation, SecZim and Zimbabwean universities are pioneering home-grown, technology-driven solutions to tackle money laundering and improve prudential supervision, strengthening confidence in the country’s financial system.

For More News And Analysis About Zimbabwe Follow Africa-Press