The Zimbabwe Investment and Development Agency Act officially came into force on February 7, 2020. As per its preamble, the objectives of the Act is to provide for, “the promotion, entry, protection and facilitation of investment”.

The Act seeks to protect foreign investors and their respective investments within Zimbabwe, which should give foreigners the comfort to bring and or keep their capital in the country.

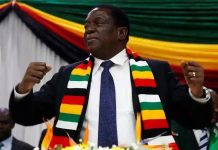

It must be noted that the legislation is part of concerted efforts by the administration of President Mnangagwa to protect foreign investment and give adequate legal apparatus for compensation and resolution framework where this may be required.

President Mnangagwa declared Zimbabwe open for business since assuming the reins in September 2017, setting off with widespread reform of investment laws and policies to jettison the economy on to a sustainable growth path.

Provisions of the Act reveal intention by Parliament to extend the protection beyond established investors to include prospective investors.

Corporate and commercial law experts say this was a progressive step by Zimbabwe, which is in line with the United States Model Bi-lateral Investment Treaty (BIT) of 2004 and the Canada-Peru BIT of 2006.

According to corporate lawyers Scanlen and Holderness, the ZIDA Act applies to foreign investors and investments made, being made or to be made in Zimbabwe under the provisions of the Act itself.

“It should be noted that although it is not the first country and certainly not the last to do so, given Zimbabwe’s difficult past with protecting foreign investments, this may go a long way into mending those past perceptions and issues, particularly if the country harnesses this legislation and strictly adheres to its provisions.”

At the centre of investment protection principles are the non-discriminatory requirements.

The first is the National Treatment (NT), which entails that, a host country should extend to foreign investors treatment that is as favourable as the treatment that is accorded to national investors in like circumstances.

The second principle of non-discrimination is the Most Favoured Nation principle (MFN), which mandates that a favourable treatment or advantage granted to another foreign investor should be extended to all other foreign investors.

As such, Scanlen and Holderness in their analysis found that Zimbabwe has now captured the aforementioned twin principles of non-discrimination of foreign investment in Part III of the ZIDA Act.

These twin principles prevent discrimination of foreign investors and their investments on the host market and at their core, the MFN and the NT simply perpetuate the fair and equal treatment principle.