PRESIDENT Emmerson Mnangagwa’s government has upped the ante on its quest for a bailout package from China in a desperate bid to rescue the floundering economy with Finance minister Mthuli Ncube and Reserve Bank of Zimbabwe (RBZ) governor John Mangudya visiting Beijing on a “relations management trip”, the Zimbabwe Independent can report.

This comes after several failed attempts to secure a US$2 billion bailout package with the Chinese government demanding Zimbabwe to service US$700 million in loans that have since accumulated about US$300 million in arrears.

“The minister and governor were in China last week for a relations management mission which included meetings with government officials and departments, the private sector and financial institutions,” a source said.

“Basically, they were trying to bilateral issues. This means economic, trade, investment and funding issues.”

While Zimbabwe remains isolated by international financial institutions as its re-engagement drives continues to face hurdles due to political problems and gross human rights violations, China has remained a viable option for a bailout package, although the Asian giant has been cautious in its engagement.

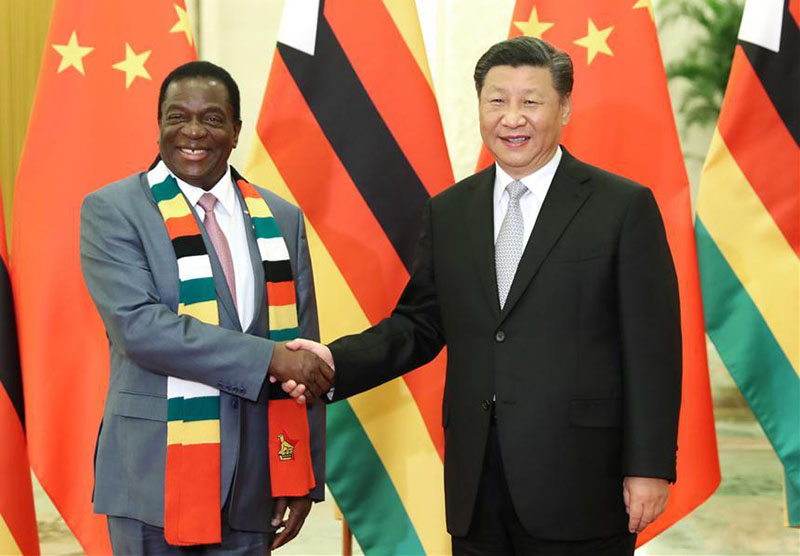

Although Mnangagwa in February denied approaching his Chinese counterpart Xi Jinping asking for a US$2 billion bailout package on the sidelines of the Forum on China-Africa Co-operation in Beijing last September, last week’s trip by Ncube and Mangudya shows Harare is keen to get fresh funding from Beijing, sources said.

This follows reports that Harare has tabled a request for the critically needed bailout in a desperate bid to ease the country’s crippling liquidity crisis, although Beijing insists that Zimbabwe must clear its arrears with the world’s second largest economy first before getting new funding.

Zimbabwe has for some time been engaging funders to help raise US$1,8 billion to clear arrears to multi-lateral institutions under the Lima Plan to enable the country to secure US$2 billion in fresh funding.

After several deadlocks, Zimbabwe turned to South Africa for as alternative source of funding to the tune of US$1,2 billion, but was last December turned down when Pretoria cited its own domestic obligations and Harare’s record of failure to repay loans.

Ncube and Mangudya left Harare last week Monday for Beijing where they met Chinese government authorities, department officials, financial institutions, the private sector and other stakeholders.

Mnangagwa’s emissaries also used the visit to motivate for a rescue package in the form of loans and grants. Zimbabwe has benefitted from Chinese loans at concessionary rates of between 2% and 2,5% per annum.

Although the Chinese have kept doors of negotiation open and pledged to continue funding infrastructural projects, Beijing has maintained that repayment of arrears was a precursor to fresh funding.

The Chinese have told Zimbabwe that it would also require credit guarantee by the China Export and Credit Insurance Corporation — Sinosure — to get funding.

Sinosure is a major Chinese state owned enterprise under the administration serving as the provider of export credit insurance, in particular coverage for the export of high-value added goods in China. Zimbabwe owed it money.

Ministry of Finance and RBZ officials have also been negotiating for a loan from the Industrial and Commercial Bank of China and the Export-Import Bank of China, but a breakthrough has been slow in coming as the Chinese remain worried about Zimbabwe’s country and political risk profile, lack of creditworthiness and the capacity to repay.