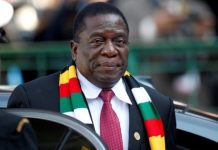

Our News Editor Gift Phiri sits down for a wide-ranging interview with President Emmerson Mnangagwa’s spokesperson George Charamba about the stuttering economy and what government is doing to address the worsening crisis.

Find below excerpts of the interview.

Q: President Mnangagwa is set to leave for Belarus, Azerbaijan, Kazakhstan and Russia this week, before making a second appearance at the prestigious annual gathering of world leaders, economists and captains of industry at the World Economic Forum (Wef), in the resort town of Davos in Switzerland. What is the objective of these trips?

A: They are outstanding invitations which we couldn’t fulfil last year because of the sheer congestion of his programme.

Q: The opposition is saying he is taking his begging bowl to eastern Europe, that he is going on a “dictatorship refresher course” because most of these are countries under autocratic leadership.

A: We look for investors, we don’t ferry begging bowls.

Q: One of these countries is an energy giant, is he lookingfor fuel?

A: We always have a drought period of foreign currency between (the) second half of the year up until when we start having tobacco sales. I’m surprised you guys have not come to grips with the cyclical shortages of foreign currency.

Q: In years gone by it wasn’t this bad.

A: Because the economy has been static in the sense that demand for foreign currency was not as big as it is now. There is more activity in the economy which means the demand for foreign currency is larger.

Q: What is stimulating this demand?

A: Because there is more activity in industry. You were the first person I gave that story remember, and you were sceptical at the time. You said it was “spin.” You didn’t realise I was actually equipping you for things to come.

There is increased activity in the economy much of it which requires raw materials whereas in the past it was as if we had good foreign currency position. It was simply because there was inactivity in the economy.

The simple way of understanding this is to look at the quantity of consumption of fuel. It will tell you (the full) story; (we are consuming) 4,3million litres daily. Suddenly a false surplus position or near let me say a limited shortage which we had in the past was a false one to the extent that it was founded on inactivity, economic inactivity.

Q: What do you mean?

A: It was due to a depressed economy. There was no (economic) activity.

Q: Isn’t a pricing issue because foreign truckers refuelling here at knock-down prices because of distortions in the currency?

A: Zimbabweans are notorious for single-cause reasoning. From currency, we go to pricing. Gift, if your raise the price, you restrain demand, you follow? It doesn’t mean you have met the demand, you have only restrained it.

There is a basic difference and sometimes I fail to understand why our economists mislead people. In terms of regional pricing, we are slightly cheaper but it has its own positive side in the sense that, then you keep inflation under check.

When you raise the cost of fuel per litre, what it means is to tell Gift that if you have fuel covering 200km per week, don’t embark on the trip because I am making it more expensive for you to do so. It causes demand restraint; that is a way of coping with a scarcity situation. It doesn’t solve the scarcity issue. It simply allows you to cope better because you are also restraining activity.

Q: Last time we spoke about the fuel crisis, which is worsening, you blamed it on transport economics. Now, why is this fuel crisis not going away?

A: There is fuel in the country, (it is just that) we can’t afford it. Fuel suppliers in the country, such as Trafigura and Glencore have fuel stocks running into millions but those millions have to be paid for in terms of foreign currency.

Q: Is government broke?

A: Why is it broke? I am saying it is our priorities. Allocations of fuel are expending on the basis of increased economic activity. This is a simple point. I don’t like this propensity for negativity which I find rather difficult to explain.

Q: There is no negativity here; we are trying to understand the crisis.

A: Then why rush to say the government is broke? Well government is not the sole trader of fuel in the market, you follow? Why are you attributing it to government? By the way RBZ is not a shareholder. You need to do an enlightened coverage of this story.

Your discourse has never gone beyond the retail side of fuel.

Q: Retail side?

A: Yes. The retail side is what is visible; it is not the full supply chain. There are bulk suppliers, the international oil companies like Trafigura, Glencore and Engen. If you got to their storage facilities right now, they are actually holding huge quantities of fuel, but that fuel has to be paid for.

Q: By who?

A: It has to be paid for by the retail companies, such as Sakunda and Zuva who do not have foreign currency.