Africa-Press – Angola. China is willing to provide new financing to Angola without oil as collateral, says Yu Yong, deputy director general of the Chinese Ministry of Foreign Affairs. According to him, demonizing Africa’s debt to China is a narrative created by “Western experts” that distorts what development financing is.

The use of oil as collateral in the contract should be a proposed option for Angola and not for China, according to Yu Yong, one of the three deputy directors general of the Chinese Ministry of Foreign Affairs (MFA), during a meeting with Angolan journalists in Beijing.

“If Angola understands that there is a better method, we are happy to hear about it,” added the person also responsible for the Department of African Affairs of the Chinese Ministry of Foreign Affairs, stressing that for a developing economy, debt is a “false issue”, since the country needs financing to develop.

During a conversation with Angolan journalists, on a day dominated by the reciprocal tariffs applied by President Donald Trump, Yu Yong recalled that the US had, at the time, refused a proposal to finance Angola, using oil as collateral, and China offered to “offer” this capital, an investment with which Chinese banks also received money. With this, Angola “achieved great development”, which translated into infrastructure projects and a focus on its productive sector.

China is Angola’s main trading partner in Africa, with trade of USD 18.251 billion in 2024, 36% of the country’s trade. China is, at the same time, Angola’s largest customer, largest supplier and also largest creditor.

“For a developing country, the issue of debt may be false. At the beginning of the reform and opening up, we also borrowed from the World Bank and the Asian Development Bank, but we turned this debt into dynamism for our development,” the government representative explained.

When questioned by Expansão, the Angolan Ministry of Finance said that it “has no elements to confirm Yu Yong’s statement”, clarifying that this “was a financing structure widely used at a time when access to financing was limited in the country”.

Regarding China’s willingness to negotiate new loans, in a form that may be proposed to Angola without oil as collateral, the ministry led by Vera Daves de Sousa admitted that “new financing may emerge”. However, the “engagement of the [Angolan] State will depend on alignment with the Debt Strategy and the budgetary capacity to implement the initiative”, it clarified.

Last year, Angola signed a financing agreement with China’s Eximbank, securing resources for the country’s Broadband Network Construction Project, equivalent to US$250 million, with interest rates of 2% and a repayment period of 20 years.

Momentum to pay collateralized debt

Angola’s debt to China fell by 35% between 2020 and 2024, from USD 21,993.1 million to USD 14,353.6 million, according to calculations by Expansão based on external statistics from the National Bank of Angola. The debt collateralized by oil, as Expansão wrote in its March 21 edition, “also sank in this period to USD 9,029.4 million, the first time it has fallen below double digits since 2015”. If this continues, as Dorivaldo Teixeira, director of the Debt Management Unit of the Ministry of Finance, admitted in January in the presentation of the Annual Debt Program for 2025, the debt to the Asian giant, the only country with which Angola has a debt collateralized by oil, could be “completely repaid” in 2028.

Regarding Angola’s drive to pay off its debt to China, the deputy director of the Ministry of Foreign Affairs called for an alert regarding what he called the “aid trap” and the debt to Western funds, through which Angola obtains money that is not invested in the productive sector. Asked by Expansão to identify these funds, Yu Yong declined to respond. “They are open funds, they are public, we do not want to name names,” he replied.

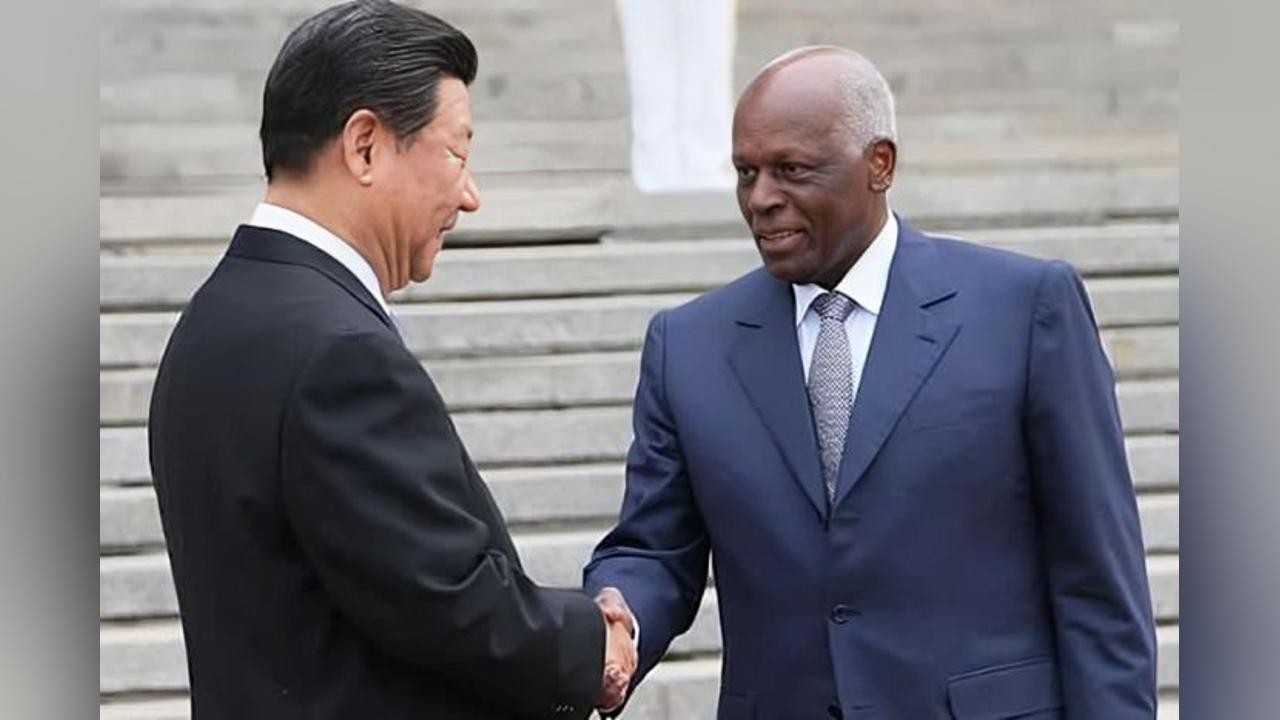

At the Forum on China-Africa Cooperation (FOCAC) summit in Beijing in September last year, President Xi Jinping pledged to increase support for the continent, with a $50.7 billion funding commitment that countered speculation about waning interest in the continent.

For More News And Analysis About Angola Follow Africa-Press