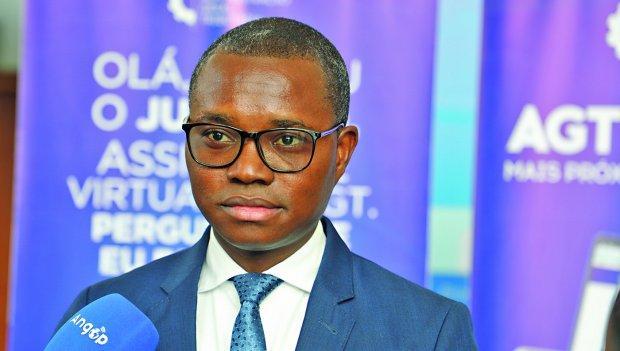

Africa-Press – Angola. The General Tax Administration (AGT) has certified, in five years, a total of 64 Authorized Economic Operators (AEO), a number considered reasonable, taking into account the specificities of the market, the chairman of the institution’s Board of Directors, José Leiria, reported on Wednesday in Luanda.

Speaking to the press on the sidelines of the Methodological Workshop for Authorized Economic Operators (OEA), José Leiria announced that in 2019 the institution began with the certification of the first economic agents and in the current year it authorized seven more, totaling 64 certifications, which he considered to be a reasonable number, taking into account that the major foreign trade operators are certified.

Even so, the AGT CEO recognized the need for certification of more operators, so he stated that the workshop serves to publicize the benefits of being a certified operator and to improve the relationship between operators and the institution.

For more operators to be certified, he explained, they must comply with the requirements, such as having a warehouse with the capacity to accommodate goods under customs control, having a compliant tax situation, a history of complying with obligations in terms of the customs clearance process and not having any proceedings in terms of customs litigation.

“Once these requirements are met, the economic operator can apply for the appropriate certification,” he said.

José Leiria said that the Customs Tariff, published at the beginning of this year, updated the advantages of an AEO certified by AGT. According to him, one of the advantages of a certified operator is that they do not physically inspect the goods at the terminals; this is done at each operator’s warehouse.

From a legal point of view, he said, goods before being cleared are under customs control, where the verification of the goods for the purpose of liberalization must be carried out in designated places (terminals and warehouses).

Another advantage highlighted by the PCA is that AEOs do not pay bail, as in certain situations it is necessary to pay a bail, and if it is an authorized economic operator and is under the trust of the State, then the bail is released”, he said.

The AEO also has the benefit of the clearance of goods with regularization a posteriori, that is, “the goods are considered as a guarantee of compliance with the tax obligations associated with the process”. Therefore, in the clearance process there are duties and other customs charges and the State guarantees compliance with this payment by retaining the goods”.

Technically, the merchandise can be released so that payments associated with the process can be made within a period of up to 60 days, said the person responsible for AGT.

For More News And Analysis About Angola Follow Africa-Press