Africa-Press – Angola. The National Bank of Angola (BNA) managed to mobilize around 858 billion kwanzas (equivalent to just over US$1.7 billion) so that the population can have their own housing using bank credit, said Wednesday, in Luanda, the governor of the Central Bank.

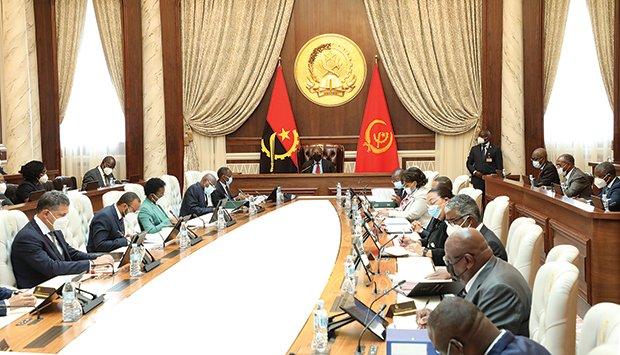

José de Lima Massano, who was speaking at the end of the 3rd ordinary meeting of the Economic Commission of the Council of Ministers, guided by the President of the Republic, João Lourenço, said that the initiative aims to stimulate credit for housing in the country, allowing citizens to easily access your own home.

According to the governor of the BNA, commercial banks will be allowed, by deducting mandatory reserves, to grant housing loans up to a limit of 100 million kwanzas per borrower, in the case of a couple.

He stressed that the bank will require, for the granting of the banking facility, guarantees that can be personal or by surety. He added that, on an individual basis, the credit limit to be granted is 50 million kwanzas. The maximum maturity is 25 years, with an interest rate of 7.5 percent.

José de Lima Massano stressed that commercial banks will have up to 60 days to organize the process of facilitating housing credit and housing construction in the modalities to be indicated.

PDN targets executed at 65.75%

The targets programmed in the National Development Plan (PDN) 2018-2022 were implemented by 65.75 percent until last year, says a statement produced at the end of the 3rd ordinary meeting of the Economic Commission of the Council of Ministers, held yesterday under orientation of the President of the Republic, João Lourenço.

The report on the implementation of the PDN 2018-2022 states that the national economy showed signs of recovery in 2021 and that remarkable results were recorded in terms of fiscal, monetary and external accounts (including the stabilization of the exchange rate), as a result of the relative measures to the Macroeconomic Stabilization Program in 2018.

Regarding the implementation of the Integrated Plan for Intervention in Municipalities (PIIM), last year the number of projects able to be implemented rose to 1,983, compared to 77 in 2019 and 1,494 in 2020. This represents an increase of 13, 37 percent compared to the 1,749 initially programmed, says the statement from the Economic Commission of the Council of Ministers.

Under the Integrated Program for Local Development and Combating Poverty, 75,551 citizens were reintegrated into income-generating activities, of which 12,298 were ex-military, with direct visibility in municipalities and a positive impact on communities. Here, we also highlight the distribution of 320 tractors to 277 cooperatives.

Regarding the Kwenda Program, in 2021, 536,333 households were registered to benefit from disbursements, totaling 11.9 million kwanzas. The report also refers to the training of staff, having recorded, in the period under analysis, the return to the country of 931 masters and 183 doctors who benefited from external scholarships.

51 health units in operation

In the health sector, the communiqué of the meeting of the Economic Commission of the Council of Ministers highlights the entry into operation of 51 health units, of which 37 under the Public Investment Program (PIP) and 14 under the PIIM.

The document states that the opening of new services in public hospitals has made it possible to handle most of the requests from patients in the country. It underlines that the percentage of patients proposed to be transferred abroad with the medical board dropped from 92 to 39 percent in 2021.

Projects to promote national production

The PDN 2018-2022 execution report indicates that, regarding the promotion of national production, financing was approved for 182 companies and 179 cooperatives. In total, until 2021, financing for 1,024 projects was approved, of which 615 refer to companies and 409 to cooperatives. The global value of the financing was 732.3 billion kwanzas.

To encourage an increase in the purchase of national products, 2,226 contracts were signed for the purchase of national production, of which 1,147 were signed last year.

In the field of National Planning, the Economic Commission of the Council of Ministers yesterday approved the timetable for the preparation of macroeconomic management instruments, namely, the General State Budget (OGE), the Executive Macroeconomic Programming and the Financial Programming of the National Treasury. .

The objective is to provide a framework of assumptions that guarantees the alignment of these instruments, to allow an integrated, consistent, comprehensive and coherent perspective between the financial management of the main macroeconomic variables and operations with a direct and indirect impact on treasury, in a given economic year. .

The Economic Commission also approved the Regulation for the Preparation of Macro-Executive Programming (PME). This document defines the structure, procedures and deadlines inherent to the elaboration, execution, monitoring, evaluation and revision of the Executive Macroeconomic Program, for a good articulation and compatibility between the economic and social policy objectives and the macroeconomic policy and management measures.

The PME also aims to ensure consistency between national, fiscal, monetary and external accounts, as well as the respective policy measures and instruments, as well as ensuring the conditions for macroeconomic stability as a condition for the country’s economic growth.

For More News And Analysis About Angola Follow Africa-Press