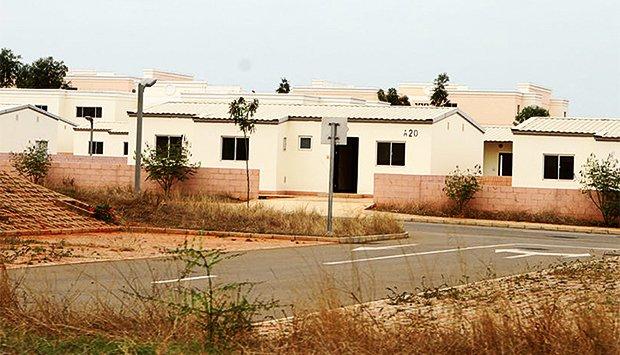

Africa-Press – Angola. The National Institute of Housing (INH) plans to make available, by the second half of next year, more than five thousand T3-type houses in the Centrality of Kilamba and in the KK 5,000 project, informed yesterday in Luanda, the director-general of the institution supervised by the Ministry of Public Works, Urbanism and Housing.

Speaking to the press, on the sidelines of the conference on “Credit to Housing”, alluding to the October/Urban commemorations, António da Silva Neto said that in the first phase, 1,400 homes will be available.

António da Silva Neto informed that the National Housing Institute is working, in cooperation with public and private institutions, in the rehabilitation of vandalized residences in several housing projects.

“The rehabilitation process is in progress and as soon as it is finished, we will deliver the housing”, he underlined.

The official recalled that the National Housing Institute has, in the capital, the centralities of Zango 0, Marconi and Kalawenda, where the construction of more buildings is planned. “I believe that this month the minister will be able to pay a visit to the urbanization of Vida Pacifica (Zango 0), where he will deliver more buildings”, he underlined.

“We will start with the second phase after the end of the first, because it is an urbanization that has been very vandalized and at the same time we are reviewing the project, to see what is done and what remains to be done and whether there may be changes or not. “, he said, still referring to the Centrality of Peaceful Life (Zango 0).

Home Loan

Regarding the housing credit process, António da Silva Neto indicated that it “is on the right track”. He informed that, since the publication of the Notice by the National Bank of Angola (BNA), which authorizes commercial banks to make mortgage loans available, the INH has made contacts with commercial banks and the results are satisfactory.

The director of the INH guaranteed that the mortgage loan will be implemented later this year.

He added that after analyzing all the technical issues with the commercial banks, it was concluded that the situation “is satisfactory”.

He made it known that there is a concern regarding the legalization of properties, without which banks will not be able to make loans, in the context of housing credit.

“For commercial banks to make credit available, properties must be legalized, so we have to resolve the situation of legalization of properties”, he underlined.

António da Silva Neto recalled that people must demonstrate the ability to benefit from credit. “The INH will evaluate person by person and each interested party is validated by the institution. If the candidate is able to acquire the loan, it is validated, and must sign an acceptance term, with which the person receives a guarantee document, which gives comfort to the bank “, he clarified.

He added that the second phase of the process is the responsibility of the banks, which will be able to validate the process of the candidate who receives the housing credit.

Housing Prices

According to the official, the National Housing Institute has available T3-type houses, including houses and apartments. The T3 apartments are priced at 25 million, while the villas are worth 30 million kwanzas. Of this amount, 70 percent will be used to pay for the restoration of housing and the 25 percent to pay for infrastructure.

He mentioned that the payment methods will depend on the availability of each candidate, because there are people who pay in cash and others within the limits of what is established.

He informed that the resolvable income modality will continue to be the norm in any country.

“At the beginning of the year, we invited real estate developers, fundraisers and other housing specialists and launched the challenge to give a social bonus of 5 to 10 percent of their social housing projects and we had the acceptance. In this way, we will guarantee more housing inclusive”.

The director general of the INH regretted the fact that many real estate companies do not have documents for their housing. “Our institution is working with the Ministry of Justice and Human Rights, in order to speed up the process, not only for those houses that were built with public funds but also those recovered by the State”, he added.

He informed that the National Housing Institute is working with several entities, namely the Order of Architects, the General Tax Administration (AGT), the National Directorate of Identification, Registries and Notaries and other sectors to have control of the database of the qualification system in the country.

Single Window For Surface Rights

Participants at the conference on housing credit, promoted by the National Housing Institute, yesterday defended the creation of a Single Window for the speedy issuance of surface rights, as well as the standardization of procedures for granting surface rights.

According to the final communiqué of the conference, the participants also defended the creation of special courts for the resolution of disputes related to real estate.

They also understand that the State should be responsible for building the macro-infrastructures of the real estate market and letting real estate developers promote the private offer of housing in the country.

The conference aimed to collect and analyze experiences and proposals for the effective implementation of housing credit.

It is expected, with the holding of the conference, that the different actors will be equipped with tools, greater availability and better sensitivity to adopt mechanisms and procedures that facilitate the implementation of NOTICE 09/22, of the BNA, that its requirements and procedures are adequate to the housing credit objectives, under the terms established by the BNA, and, consequently, cooperation mechanisms are established, so that the housing credit processes are more fluid, quick, safe and efficient and that effectively allow the acquisition and access to own home.

Housing Credit Is Open To All

The representative of the Angolan Commercial Banks Association (ABANC), Ana Tavares, guaranteed that housing credit is open to all, as long as the applicant has a fixed source of income and fulfill the conditions set out in Notice no. 9 of the National Bank of Angola (BNA).

Among the conditions for granting housing credit, Ana Tavares pointed out the year of construction of the property, mortgageable records and the borrower’s financial capacity.

He recalled that the policies demonstrate three broad delimitations, such as the year of construction of the property, it has to be from 2012 and acquired in housing projects.

He found it difficult, these days, to find properties with mortgage documents and records. “The person must have the financial capacity to acquire the credit of 100 million kwanzas”, he recalled.

For More News And Analysis About Angola Follow Africa-Press