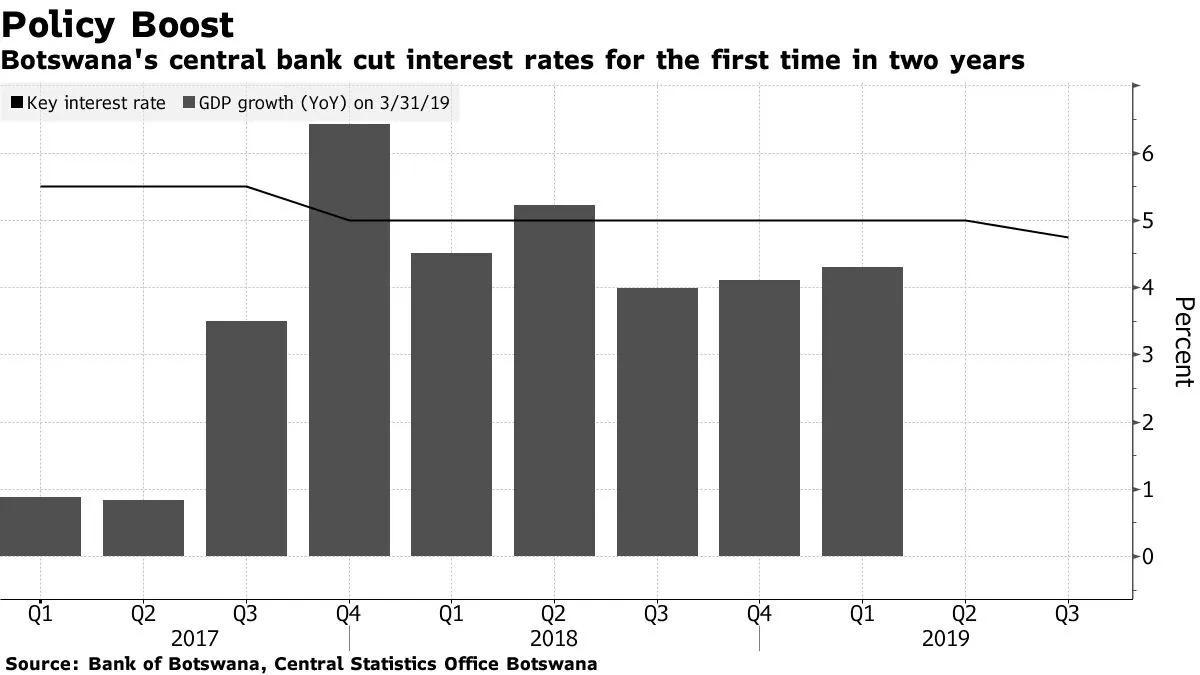

Africa-Press – Botswana. The Bank of Botswana (BoB) has announced a major 25 basis point reduction in interest rates in an effort to encourage economic growth and stability. This decision represents the first rate cut since April 2020, giving borrowers facing financial difficulties much-needed relief in a year that has been difficult for households.

Monetary Policy Decision and its Aims

The BoB’s monetary policy action aims to ease the burden on borrowers by reducing the cost of borrowing. The bank’s decision is expected to stimulate economic activity by encouraging both investment and spending. It’s a responsive measure to the economic conditions affecting the country’s citizens and a strategic move geared towards bolstering economic growth within the confines of its monetary policy framework.

International Monetary Trends

Internationally, major developed economies are also considering interest rate cuts as inflation rates decelerate. The Bank of Japan remains the only exception, persisting with its negative rates policy. At the same time, the U.S. Federal Reserve has flagged potential rate cuts for the upcoming year, a decision heavily influenced by political events and supply chain disruptions.

Chinese Banks Follow Suit

China’s major banks, including the Bank of China and Agricultural Bank of China, have also slashed interest rates on certain deposits. The Industrial and Commercial Bank of China (ICBC) announced similar steps to reduce deposit interest rates. These cuts are designed to alleviate the pressure on banks’ net interest margins and provide room to minimize lending costs, a move encouraged by the government to bolster economic support.

Botswana Bonds and Pension Fund Rule 2

Meanwhile, the BoB projects a downward trend in bond yields from next year due to an increase in capital inflows into the local market. This is attributed to modifications to the Retirement Funds Act, which mandates local pension funds to allocate at least 50% of their assets domestically by December 2027. Known as Pension Fund Rule 2 (PFR 2), this regulation enforced by the Non-Bank Financial Institutions Regulatory Authority (NBFIRA) represents a significant increase from the previous domestic investment requirement of 30%.

For More News And Analysis About Botswana Follow Africa-Press