Africa-Press – Botswana. On January 17, the Group CEO, Access Holdings, Herbert Wigwe was one of the several dignitaries that eulogised Abdul Imoyo, the company’s Group Head Corporate Communications, who died last December.

At Imoyo’s Service of Songs held in Lagos, Wigwe spoke glowingly of his ex staff’s commitment to duty and expertise in crisis management.

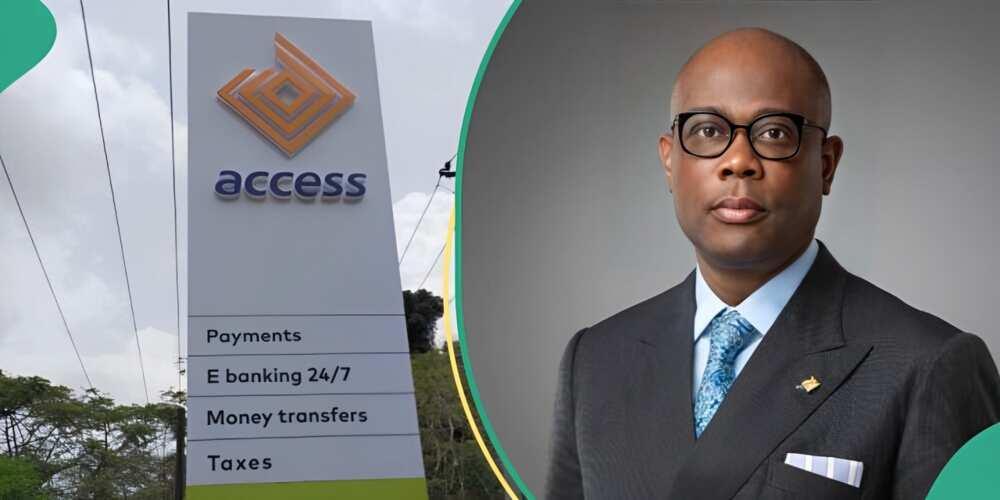

Three weeks after, Wigwe was also gone. On Friday night, a chopper transporting him crashed and killed him, his wife, son and three others in the USA.While the business world mourns Wigwe’s sudden demise, his courageous business deals remain a reference point for generations.

Aided by strong public sector penetration, Access Bank, founded from the scratch by Aigboje Aig-Imouhuede and Herbert Wigwe in 2002, began operation after securing banking licence from the Central Bank of Nigeria (CBN). It operated initially as a one-branch small bank at Burma Road, Apapa, Lagos.Access Bank Plc surprised pessimists that gave it little or no chance for survival when it started operation over two decades ago. An industry leader with group total assets of N20.9 trillion as at June 2023, Access Bank’s success story has proved pundits wrong.

The bank under Wigwe had, from the outset, prioritised raising capital, mergers and acquisitions-based growth. These blueprints were synchronised into the steps it took in the later years and defined the banking giant it turned out to be.

Today, Access Bank is a full service commercial bank operating through a network of more than 600 branches and service outlets, spanning three continents, 12 countries and 36 million customers. This makes it the largest bank in Nigeria and Africa’s leading bank by customer base.Speaking during the listing of Access Bank as a Holding Company at the Nigerian Exchange (NGX) on April 28, 2022, Wigwe recalled the bank’s success story and support that kept it going.

Access Bank’s future started looking bright in 2012 after it acquired Intercontinental Bank Plc, one of Nigeria’s largest banks by customer base in that era. When the dust generated by that acquisition settled, it returned with another trophy – the takeover of Diamond Bank Plc, a grassroots lender with formidable spread across the country, which was completed in March 2019.

The bank sustained its passion for acquisitions. In 2021, it bought 78.15 per cent stake in the African Banking Corporation of Botswana Limited (BancABC Botswana).

For More News And Analysis About Botswana Follow Africa-Press