Africa-Press – Cape verde. The company founded by David Chow, which owns the investment in the “Djeu” complex, in the city of Praia, is on the verge of financial collapse. It cannot pay two loans to Luso and CMB Wing Lung banks, which could dictate its bankruptcy at any time. It becomes increasingly difficult to implement the Gamboa complex.

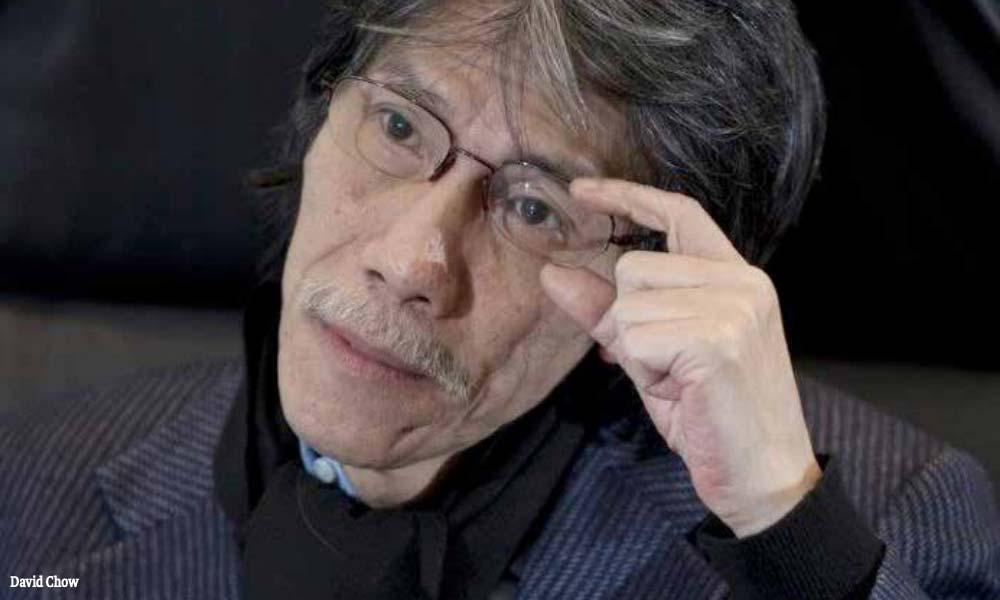

2023 has been a difficult year for Macau Legend Development Ltd., a company founded by the Macanese David Chow, with business in Cape Verde, namely, the mega tourist development on the islet of Santa Maria, in Praia, better known as the “Djeu ”. From a majority shareholder, Chow became a minority, but even so, he continues to see his name associated with that firm, with interests in casinos and other businesses in Macau and Hong Kong.

default

According to the newspaper “Hoje Macau”, this Wednesday, 14th, Macau Legend Development Ltd. failed to pay two loans to banks Luso and CMB Wing Lung. As of June 30, the group had loans of US$2,373 million and needs to repay US$237 million over the next 12 months. This, despite the group only having 66 million Hong Kong dollars available.

“On June 30, 2022, the group broke some clauses of a certain loan agreement, and on the day of the approval of the report and accounts, it was trying to negotiate a restructuring with the creditor bank”, advances the same source, who cites the audit revealed in a report on the results of the first six months of this year.

“Failure to comply with the contract constitutes a situation of default, and banks can exercise their rights and notify the group so that it immediately returns all bank loans, including interest payments”, highlights “Macau Hoje”.

The fact is that, in the first half of this year, with interest on bank loans and other financing costs, Macau Legend spent 49.1 million Hong Kong dollars, an increase of 19.5 million compared to last year, when it had paid 29.5 million. But in terms of losses, between January and June, they were around 485.5 million Hong Kong dollars. These figures, according to the same source, “are an improvement over the same period last year, when losses totaled 688.6 million Hong Kong dollars”.

But probably not enough to save Legend from bankruptcy.

mitigation measures

To try to get around the situation, when the company itself admits that there are “doubts” about the continuity of operations, in addition to resorting to restructuring of loans with banks, the same newspaper reveals that Macau Legend is resorting to financing through the injection of capital. , in the form of loans, by the main shareholders.

This year alone, shareholders have already been responsible for capital injections in the amount of 200 million dollars. The company also has plans to sell debt securities it has in its possession in order to cash in, also, 200 million dollars.

Despite the measures in progress, the same source also reveals that, in order for the company to remain alive, “it is necessary that banks accept to negotiate debts, continue to provide current credits, and that those against which there are default situations show their willingness to restructure overdue debts”.

Audit had already warned

It should be noted that last July 18, a news article published on “iGT”, an economics and finance website, reported that the concerns of the independent audit of “Ernst & Young” about the future of Macau Legend Development Ltd.

These concerns contradicted, according to the same source, the company’s board of directors, which said, at the time, that there were “no major risks that jeopardize the future of the business”.

The Ernst & Young report showed another reality, however, by listing the size of the current debt obligations the company faces.

“These conditions, together with other matters described in note 2.1 to the consolidated financial statements, indicate the existence of material uncertainties that could significantly cast doubt on the Group’s ability to continue as a going concern”, clarified the auditors.

At the time, they pointed out that the company’s continuity would depend on “the lenders’ agreement to change the terms of the loan or otherwise agree to an extension of the current waiver of loan clauses”.

The project for the “Djeu” complex, in the city of Praia, which includes a casino, marina, offices, among other things, was announced in 2001. Interestingly, on the same day as José Maria Neves’ first government took office.

However, the first stone would only be laid 15 years later, in February 2016. At the time, David Chow himself had said that in three years (2019) “Cape Verdeans” would see “the results” of your enterprise, which did not materialize.

Initially the investment was 250 million euros, but, after changes and additions to the project, the investment rose to 90 million euros, in a first phase, between some “comings and goings” from Chow to the Cape Verdean capital, always, with new requirements and requests to take the enterprise forward. One of his requests was to have a certain number of passport books, to be managed by him, which was not accepted by the Cape Verdean authorities.

As previously mentioned, in several editions of A NAÇÃO, the works of “Djeu” have advanced little or nothing, raising questions as to whether the undertaking will ever become a reality. At the moment, the visible part of the physical construction of the completed project continues to be a set of offices (tower) and the bridge that connects Gamboa to Djeu.

What is certain is that after being involved in the scandal of the arrest of Levo Chan, co-president of the company, on suspicion of being part of a criminal group that carried out illegal gambling and money laundering operations, in Macau, now, once again , Macau Legend Development Ltd. is faced with liquidity problems to meet bank loans.

25-year gaming license

It should be noted that David Chow even received a 25-year license to exploit the game, 15 of which on an exclusive basis in Santiago. To these is added a special license to explore, also on an exclusive basis, the online gambling market in Cape Verde and the sports betting market, for a period of 10 years. For this, the Macanese paid around 1.2 million euros.

In parallel with the ongoing business in the archipelago, Chow also tried to open a bank in Cape Verde, formalizing the request to the national authorities in 2018. However, two years later, the same was rejected by Banco de Cabo Verde.

At the time, a source from the BCV revealed to A NAÇÃO that the request by Legend Globe Investment, chaired by David Chow, for the opening of Banco Sul Atlântico (as it was called) was not in accordance with the legislation in force in the country, that is, , was not “instructed with all the necessary information and documents”. One of the BCV’s arguments is that the Chinese businessman from Macau did not have “banking suitability”.

For More News And Analysis About Cape verde Follow Africa-Press