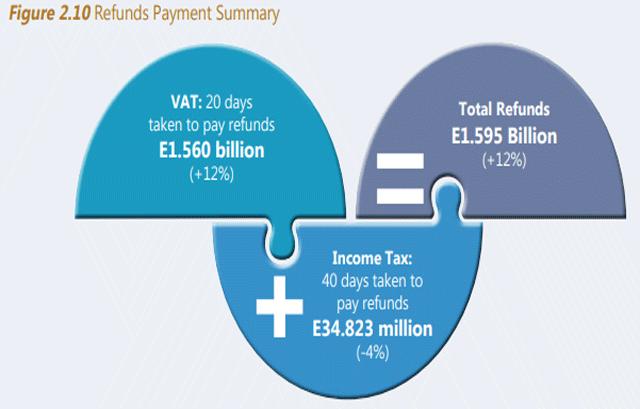

Africa-Press – Eswatini. The Eswatini Revenue Service (ERS) paid out nearly E2 billion as refunds during the 2020/2021 financial year. In the latest annual report, it was disclosed that a total of E1. 595 billion was processed in refunds for 2020/21 of which 98 per cent were for value added tax (VAT).

The actual tranche of money issued towards VAT refunds was E1.560 billion while E34.823 million was paid out towards income tax.

The revenue service explained that in its quest to improve the paying taxes aspect of the ease of doing business index, the organisation also improved the average time it takes to pay a VAT refund from 25.5 days to 20.1 days. However, the time taken to pay an income tax refund increased from 25 days to 40 days due to system issues and measures to improve on these timelines were being implemented.

“Timely processing of refunds is important for businesses, as they need to be liquid for day-to-day operations,” ERS emphasised. ERS pointed on time payment for VAT, Pay As You Earn (PAYE) and income tax were all below their targets for 2020-21. However, there was an improvement in on-time payments for VAT and PAYE when compared to the previous year.

VAT benefitted from significant growth in the information, communication and technology (ICT) and wholesale and retail sectors while PAYE saw improvements from the public administration, particularly health related services. On the other hand, income tax recorded a deterioration compared to the previous year due to a decline in on-time provisional payments, mainly underpinned by reduced profitability and a shift in the deadlines.

To promote compliance, bulk SMSs for on-time filing and payment reminders were sent to taxpayers. It should be mentioned ERS acknowledged that the year 2020-21 had been the most difficult in the history of the existence of the ERS.

It was reported that total tax revenue collections amounted to E9.945 billion against a target of E11.403 billion, which was a 13 per cent below target performance. It was stated that the revenue collections showed a shortfall of E1.458 billion on the set target and was also lower than prior year collections by 0.1 per cent.

Performamnces Mixed performances were observed among the tax types with a few recording an above target performance while all major types recorded a below target performance. Other income taxes were above target due to an increase in taxes paid by non-residents, while import motor vehicle levy recorded an above target performance due to an upward revision of the levy in the later part of the financial year.

Company taxes, individual taxes, graded tax, road toll, lotteries and gaming, fuel tax and alcohol and tobacco levy were all below target, mainly due to the impact of the various restrictions put in place to combat the COVID-19 pandemic.

Sectors that observed noticeable increases in revenue collections were the construction, agricultural and ICT sectors. However other sectors such as the financial, manufacturing and other services sectors observed a decline in their contribution to revenue.

Government, through ERS, provided support through establishment of a E90million fund aimed at relieving businesses that were affected by COVID-19.

This was later reduced to E45 million as the other half was repurposed by government. The funds were disbursed in the form of refunds on income tax paid during the tax year that ended June 30, 2019 and the total amount of refunds paid under this relief fund was E794 071 where 55 taxpayers benefitted.

For More News And Analysis About Eswatini Follow Africa-Press