Africa-Press – Eswatini. Eswatini’s financial landscape closed 2025 on a strong upward trajectory, as new data from the Central Bank of Eswatini shows impressive gains across key monetary indicators.

The latest Monthly Statistical Release highlights a surge in liquidity, rising reserves, and expanding money supply, all pointing to strengthened economic confidence and stability.

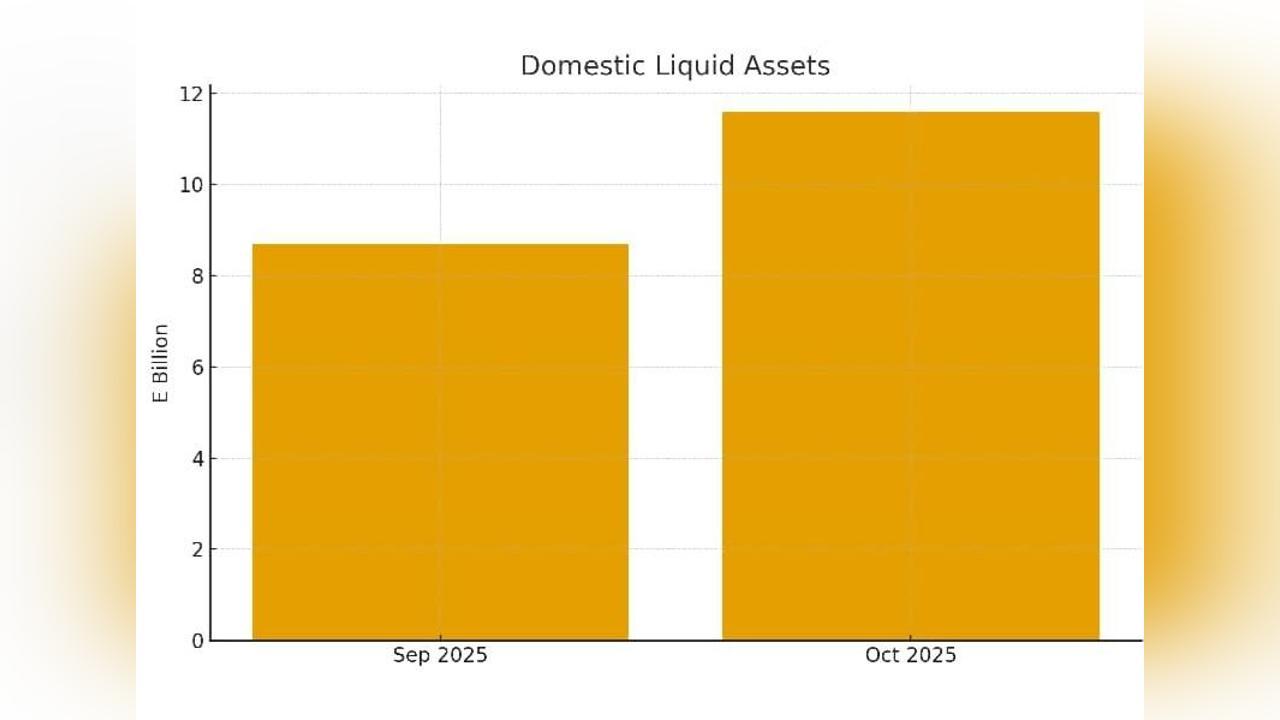

Liquidity Soars by 33.6%, Reaching E11.6 Billion

The banking sector recorded one of its strongest performances in recent years, with domestic liquid assets rising by 33.6% in October 2025 to E11.6 billion. This major increase boosted the liquidity ratio to 42.3%, up from 34.3% the previous month. This sharp rise reinforces the ability of local banks to support households, SMEs, and large enterprises with increased lending, a positive signal for economic expansion.

Reserves Strengthen to E15.4 Billion as Import Cover Improves

Eswatini’s gross official reserves climbed to E15.4 billion by the end of November 2025, marking a 6.8% month-on-month increase and a robust 21.8% rise year-on-year. Correspondingly, the nation’s import cover improved from 3.4 to 3.6 months, offering the country a stronger shield against global financial fluctuations and ensuring continued stability in essential imports.

Money Supply Expands to E28.8 Billion

Broad money supply (M2) grew by an impressive 10.7% month-on-month, reaching E28.8 billion. This was propelled primarily by a significant jump in time deposits, which increased 21.2% to E16.5 billion. The rise signals growing confidence in long-term saving instruments and reflects a strengthening financial culture among both businesses and individuals.

Private Sector Credit Hits E21.7 Billion

Credit extended to the private sector rose to E21.7 billion, representing 8.2% annual growth despite a modest monthly increase of 0.04%. Household credit grew across all major segments, mortgages, vehicle loans, and personal unsecured loans, underscoring improved consumer confidence and purchasing strength.

A Strong Platform for 2026 Growth

The collective rise in liquidity, reserves, and money supply places Eswatini in a favourable position as the country moves into 2026. Stronger reserve levels enhance currency and trade stability, while improved liquidity ensures the banking sector can fuel economic growth through expanded lending and investment.

These indicators present a compelling picture of an economy gaining momentum, and a financial system that continues to build resilience and inspire confidence across the Kingdom.

FacebookXWhatsAppEmailLinkedInMessengerShare

For More News And Analysis About Eswatini Follow Africa-Press