Africa-Press – Malawi. The Reserve Bank of Malawi (RBM) has adjusted upwards the country’s annual average inflation rate target to 23.2 percent from an earlier projection of 12.3 percent.

This is due to exogenous shocks emanating elevated commodity prices on the global market due to the Russo—Ukrainian War, among other factors. This adjusted rate is contained in the central bank’s statement released at the end of its 3rd Monetary Policy Committee meeting.

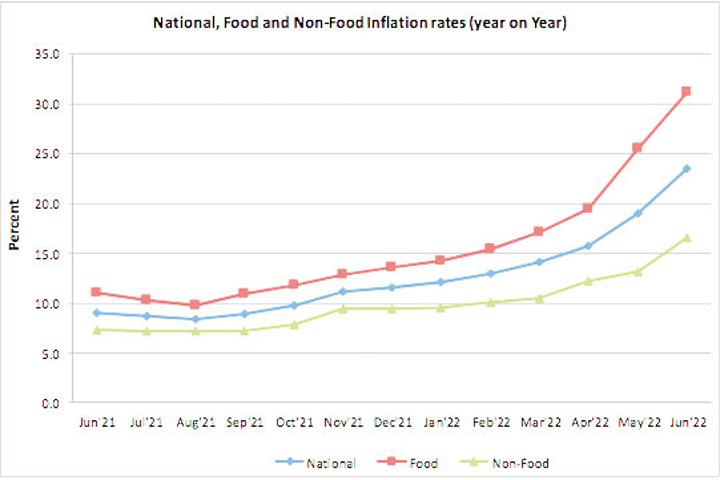

In the statement RBM says inflation continued to rise in the second quarter on account of many factors including rising costs of domestic fuel prices and pass-through of exchange rate depreciation.

Other reasons include price mark-up shocks on domestically-produced agricultural food commodities induced by the high costs of fertilisers, rising global food prices and speculation of low food production following unfavourable weather patterns during the 2021-22 agricultural season.

“Looking ahead, pressures on inflation are likely to continue, largely due to persistence of supply-related shocks to food and energy prices arising from the war in Ukraine, impact of the upward adjustment in domestic fuel pump prices effected on 23rd June 2022, a seasonal increase in prices of domestically- produced agricultural food items, exchange rate pressures, and persistent fiscal slippages,” reads the report.

Since November last year, headline inflation has been on an upward spiral, skyrocketing to 23.5 percent in May 2022. Centre of Social Concern Programs Manager for Economic Governance Bernard Mphepo said the upward adjustment of inflation target means doom for consumers as it entails an anticipated continued rise in prices of commodities.

Mphepo then called on the government to consider reviewing minimum wage to reflect the current economic situation. “As a short term solution, government should [also] charge Admarc to release the maize so that food inflation, which is causing the greatest worry, is arrested and in long term work on producing what we consume as a country,” he said.

RBM maintained the policy rate at 14 percent last week citing that the recent adjustment where it moved from 12 percent in June this year has not yet settled into the economy.

Economist Exley Silumbu from the University of Malawi wondered why the central bank seems to relax in arresting inflation adding that the inflation rate may hit over 30 percent by December and affect economic performance since the assumptions was a lower rate.

“RBM started raising policy rate late because they thought rising inflation rate was temporal but now while it continues to rise, it seems they have given up in fighting inflation, why?,” Silumbu wondered.

The annual budget for Malawi was premised on a number of assumptions including that for 2022 the inflation rate will average 10.4 percent but during the second quarter alone inflation has averaged 19.4 percent.

Rising inflation affects the economy by reducing people’s purchasing power and government misses revue targets which dwindles both recurrent and development budgets.

Justin Mkweu is a fast growing reporter who currently works with Times Group on the business desk. He is however flexible as he also writes about current affairs and national issues.

For More News And Analysis About Malawi Follow Africa-Press