Africa-Press – Malawi. National Bank of Malawi (NBM) Pensions Administration Limited, a subsidiary of NBM plc, has raised concerns over prevailing microeconomic challenges and its impact on businesses’ ability to achieve real returns on investments.

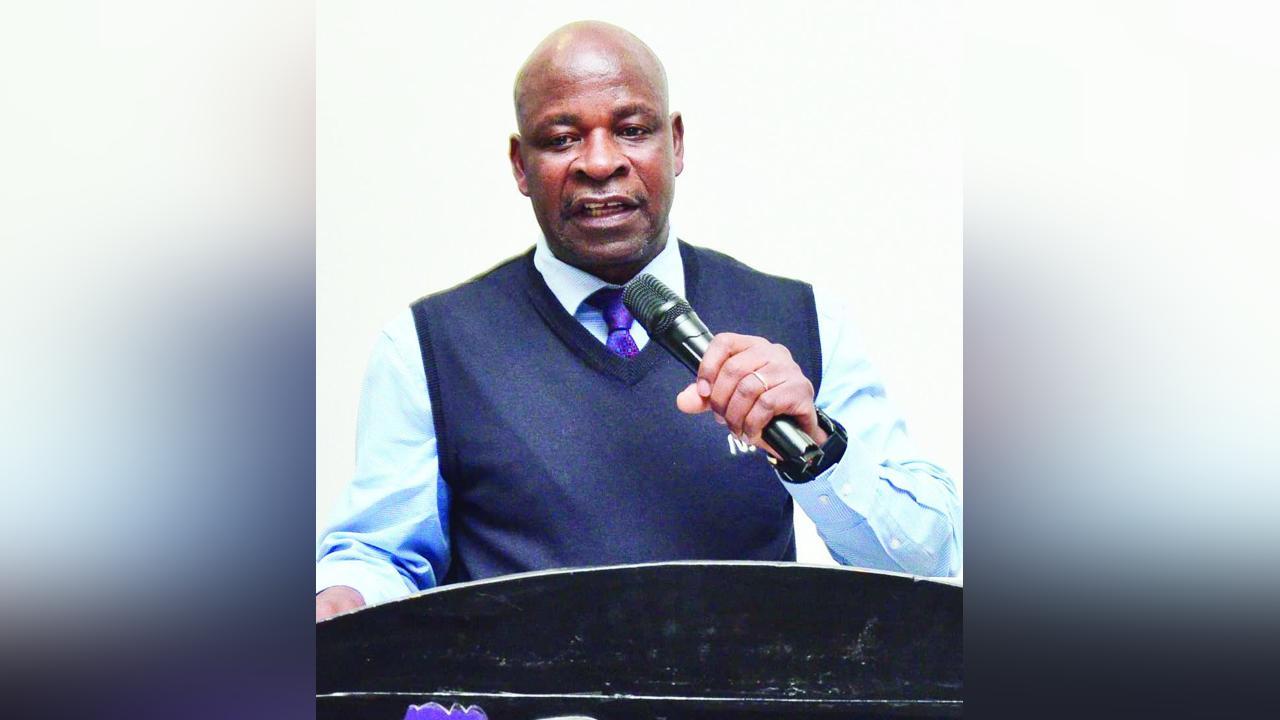

Speaking at the annual Pension Engagement Forum held in Blantyre on Tuesday, NBM Pensions Administration Chief Executive Officer William Mabulekesi said the fund posted a nominal return of 34.5 percent in 2024.

However, he noted that the country’s average inflation rate of 32 percent during the same period significantly eroded gains, leaving a real return of just 2.5 percent.

“So, largely, we would say the Malawian economy is bleeding due to an acute shortage of foreign exchange, which has in turn contributed to high inflation,” Mabulekesi said.

He further pointed out that the challenging operating environment is affecting companies and employers, leading to rising default rates in pension remittances.

Despite these setbacks, Mabulekesi said the institution has continued to make sound investments, achieving strong returns — largely driven by the positive performance of financial sector counters on the Malawi Stock Exchange in 2024.

“We are pleased that our investment income has outpaced inflation. If returns fall below inflation, it means members are being short-changed. But in this case, they have enjoyed a real return, which translates into meaningful growth of pension funds,” he said.

During her presentation on Sustainable Investing in Turbulent Times, Nenauthe Nkoloma, Business Development Manager at NBM Capital Markets Limited, cited high inflation, currency depreciation, and market volatility as major challenges facing the investment climate.

“However, we assure our pension clients that we are committed to growing their funds through sustainable investment strategies. We ensure your pension fund retains its value and is not eroded by economic shocks,” Nkoloma said.

One of the attendees, Wisdom Mpinganjira, HR Business Partner at Nacala Logistics, described the forum as valuable and expressed satisfaction with the fund’s ability to achieve above-inflation returns in 2024.

For More News And Analysis About Malawi Follow Africa-Press