Africa-Press – Malawi. By Benadetta Chiwanda Mia:

The Kwacha experienced a 3.1 percent depreciation against the United States (US) Dollar in 2024, closing the year at K1,749.93 per dollar, an annual economic report published by Bridgepath Capital Limited shows.

The development highlights persistent economic challenges facing the country when compared to the K1,697.98 to a dollar rate recorded at the end of 2023.

The report further reveals that the local unit depreciated by 1.2 percent against the British Pound and 1.8 percent against the South African Rand.

The only bright spot was a 2.5 percent appreciation against the Euro.

Furthermore, the report shows that the country’s foreign exchange reserves took a significant hit, plummeting by 23.5 percent to $516.90 million as of November 30 2024, down from $675.59 million at the end of 2023.

This dramatic decline has directly impacted the nation’s import capacity, with the import cover shrinking from 2.7 months to just 2.1 months.

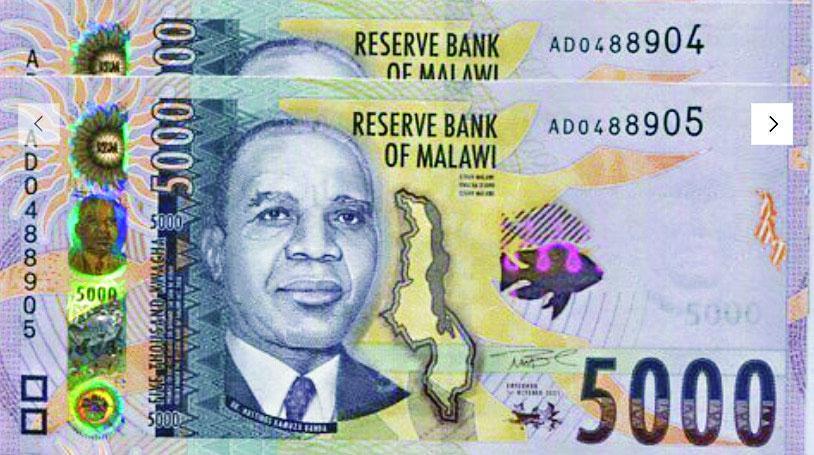

This is coming at a time the Reserve Bank of Malawi (RBM) has been implementing strict foreign exchange controls since November 2024, including capping monthly forex withdrawals for diplomats and diplomatic staff, mandating public institutions to open foreign currency accounts at RBM and requiring institutions to convert 80 percent of their foreign currency holdings into local currency.

In an interview, President of the Financial Dealers Association of Malawi Leslie Fatch highlighted the negative trade balance and accumulated payment backlogs as key factors driving the Kwacha’s depreciation.

Marvin BandaHowever, he expressed cautious hope that recent monetary policy initiatives might provide temporary relief. He emphasised the need for fundamental changes in forex supply.

“We are yet to address the supply side of the forex equation. The persistent mismatch between demand and supply continues to challenge our currency’s stability,” Fatch said.

In an earlier interview, economist Marvin Banda said currency valuation against the dollar experienced frequent volatility over the past year on account of constrained availability and supply of forex on the official market.

“A tremendous backlog in the import component of dynamics of the current account and the prevalence of an exorbitant price of black market forex had a huge impact. It was envisaged that currency chasing would subside with the ensuing tobacco season that promised a lot for the forex coffers.

“However, this optimism was one of near-desperation because it is well documented that the sparsely generated forex earnings from tobacco sales can barely cover the [bill of] imports for two months with earnings of around $396.28 million in 2024,” Banda said.

For More News And Analysis About Malawi Follow Africa-Press