Africa-Press – Malawi. The Reserve Bank of Malawi (RBM) has said the economy was relatively stable in the last six months of 2021 on account of low and stable interest rates, among other factors.

A December 2021 Financial Stability Report the central bank published on Friday shows that the economy withstood risks such as the fourth wave of the Covid pandemic, a modest acceleration of the inflation rate, depreciation of the exchange rate and tight liquidity conditions in capital and money markets.

RBM has since maintained its 3.9 percent estimate for economic growth in 2021, following subdued growth of 0.9 percent in the preceding year. It further projects that the domestic economy will grow by 4.1 percent in 2022, notwithstanding downward risks such as the uncertainty regarding the evolution of the Covid pandemic and its containment measures as well as erratic weather patterns.

“Inflationary pressure heightened risks to financial stability from inflation developments as at end December 2021. Domestic headline inflation rate accelerated to 11.5 percent at the end of December 2021 from 9.1 percent at the end of June 2021.

“This outturn reflected heightened pressures on headline inflation emanating from both food and non-food inflation which increased to 13.6 percent and 9.5 percent in December 2021 from 11.2 percent and 7.2 percent in June 2021,” the report reads.

It says the increase in inflation compounded with job layoffs from the impact of the Covid pandemic likely increased pressure on disposal incomes thereby undermining borrowers’ ability to service outstanding facilities and hence affecting bank balance sheets” the report reads.

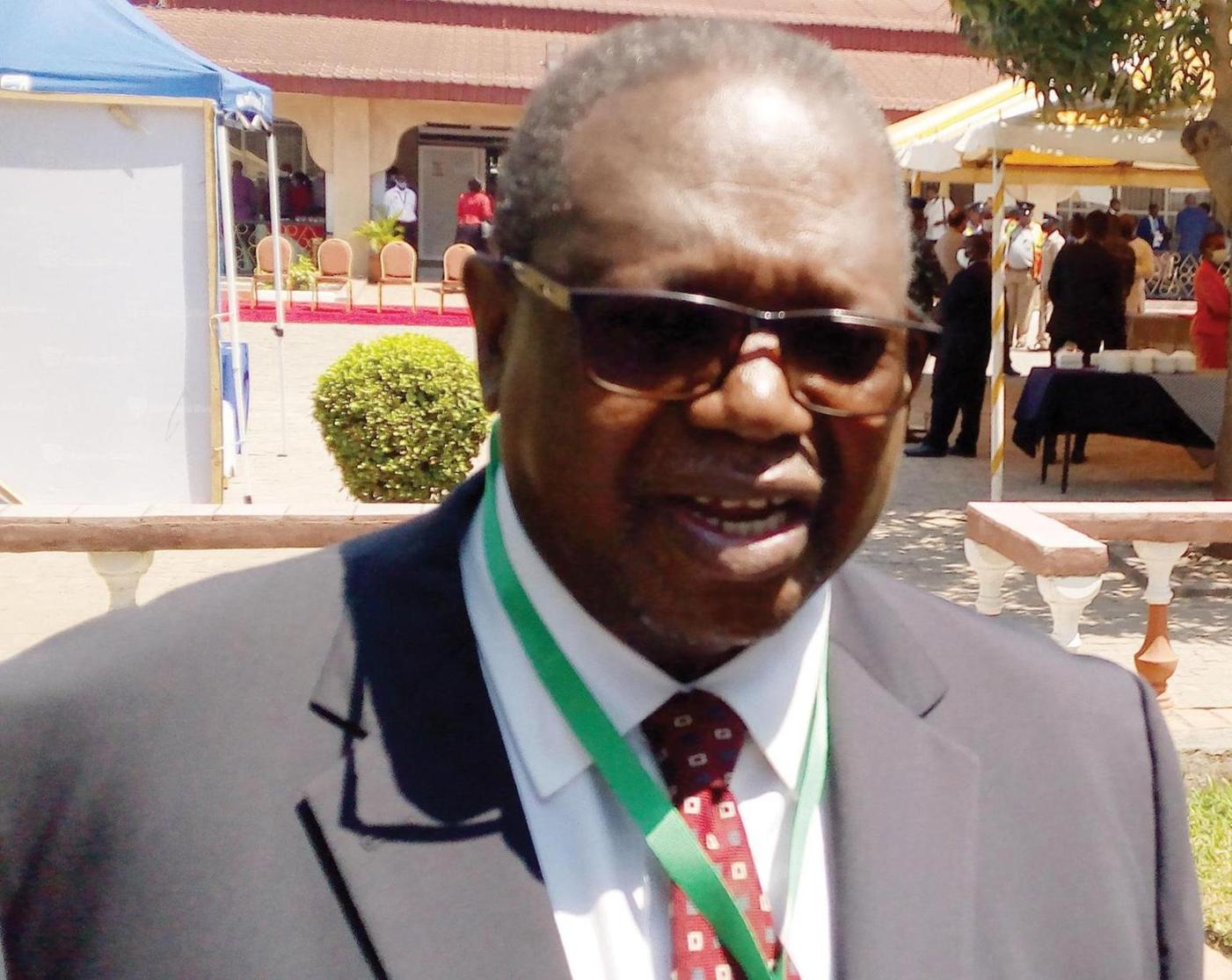

RBM Governor Wilson Banda said the relatively low level of economic activity had disrupted the financial conditions of households and businesses, with knock-on effects on credit, liquidity and operational risks in the banking system.

He added that this increased uncertainty in the financial sector, negatively affecting credit intermediation. Economics Association of Malawi Executive Director Frank Chikuta said the conclusion is based on actual data; so, there is no reason to doubt it.

“The indicators of financial system stability, as presented, show an adequately capitalised financial system with a healthy level of non-performing loans. So, it is true, based on the data, that, during the period under review, the financial system was stable.

For More News And Analysis About Malawi Follow Africa-Press