Africa-Press – Mauritius. Mauritius registered company Magister may soon own the majority share in sugar producer giant Tongaat Hulett by partially underwriting the company’s R4-billion rights issue.

South Africa’s largest sugar producer on Wednesday last week announced major plans to address its debt issue through a rights offer of new shares underwritten by Magister Investments Limited, an unlisted company and Tongaat Hulett shareholder.

Tongaat Hulett’s share prices plummeted by 30% after the company shared news of the rights issue, noting that Magister could become the majority shareholder.

Magister, which intends to underwrite half of the R4-billion debt, could then own 60% of Tongaat Hulett’s shares. The rights offer has been capped, and may not exceed R2-billion.

Magister Investments Limited is owned by Zimbabwe’s billionaire family, the Rudlands. The sugar producer’s market value took an almost 90% dive over the last 3 years after it disclosed overstating its assets by up to R4.5-billion in its 2018 financials.

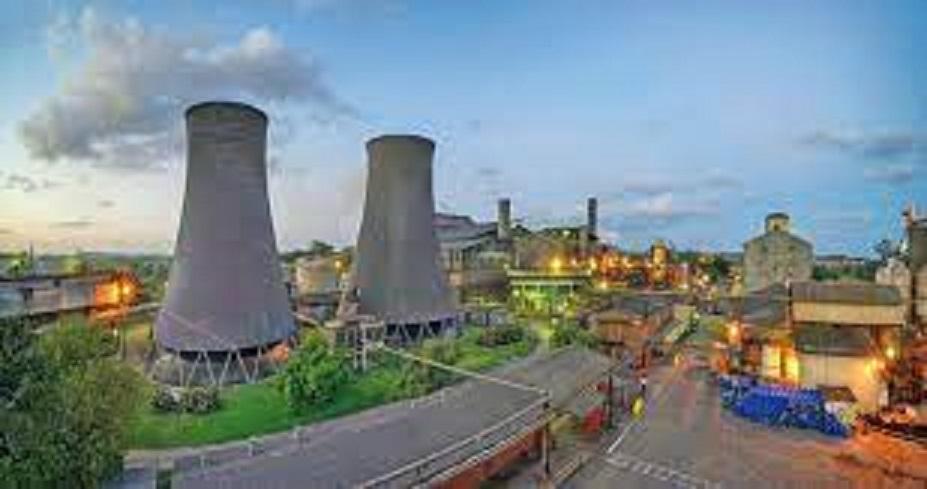

One of the largest employers on the North Coast, Tongaat Hulett introduced stringent cutbacks in 2019 to avoid financial disaster in the wake of the accounting irregularities.

In February last year, the company sold its starch business to Barloworld for an enterprise value of R5.35-billion, significantly reducing the company’s debt.

Further cost-cutting methods included the closure of the sugar giant’s 175-year-old Darnall operation earlier this year, which resulted in almost 400 workers being retrenched. Darnall Sugar Mill was established in 1846.

Tongaat Hulett said the proceeds from the rights offer would be used to reposition the group and help secure its future and that of its 29 000 employees (during peak harvest season) across its various operations, both locally and abroad.

The company has operations in South Africa, Botswana, Zimbabwe and Mozambique. It is hoped the move would aid future growth for Tongaat Hulett by improving operational efficiency, reducing debt and driving cash flow.

Since taking action following the overstating of assets, the company has managed to decrease its debt by some 42%, but said it may consider closing further operations or selling these.

Magister’s shareholding will only be determined next year at the end of the rights offer. Tongaat Hulett chief executive officer, Gavin Hudson, said Magister’s underwriting commitment is a key step in securing the future of the company.

“We look forward to it contributing to the market value of the company, which is more reflective of the underlying value of the group’s various components.

” For breaking news follow The North Coast Courier on Facebook, Twitter, Instagram and YouTube. Join our Telegram Broadcast Service at: https://t.

me/joinchat/yJULuN8NaCs5OGM0

Join our WhatsApp Broadcast Service: Simply add 082 792 9405 (North Coast Courier) as a contact to your phone, and WhatsApp your name and surname to the same number to be added.

For More News And Analysis About Mauritius Follow Africa-Press