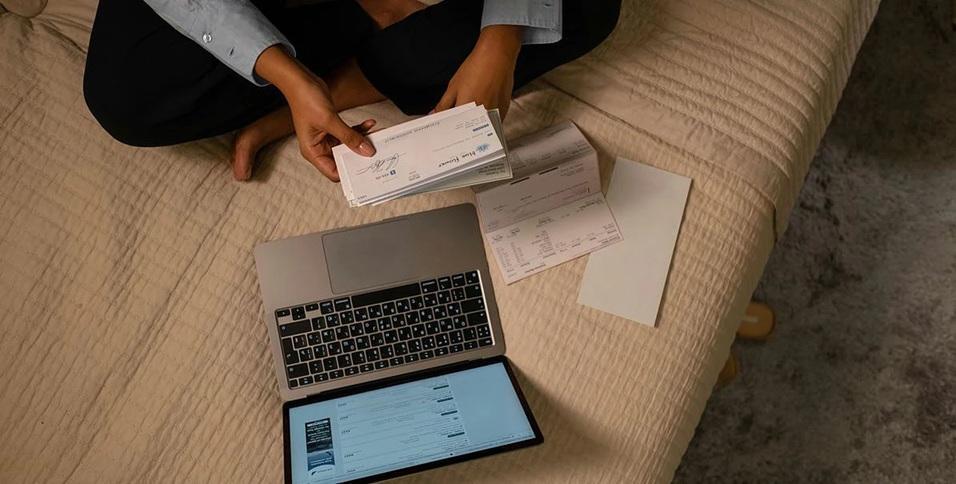

Africa-Press – Mozambique. Cheque use as a form of payment in Mozambique is declining, with 932,000 cheques processed in 2024, in a market increasingly reliant on interbank electronic transfers, according to central bank data.

According to the Bank of Mozambique annual report released this week, banking transactions in 2023 were made using 949,000 checks, totalling 260.8 billion meticais (€3.483 billion), while last year that figure even rose slightly, to 282.3 billion meticais (€3.77 billion). However, the number of cheques processed declined by almost 2%.

“The modernization of the payment system resulted in a reduction, albeit slight, in the use of cheques, against an increase in Interbank Electronic Transfers, also known as Electronic Fund Transfers (EFTI),” the report reads.

The number of EFTI transactions directly between banks reached nearly 3.3 million last year, involving 509.3 billion meticais (€6.8 billion), while in 2023 they reached 2.9 million, worth 500.9 billion meticais (€6.69 billion).

“The number of EFT transactions increased by approximately 12%, against a reduction in the number of transacted cheques of approximately 2%, although the amounts transacted using both instruments saw a slight increase,” the document adds.

There are 15 commercial banks and 12 micro-banks operating in Mozambique, in addition to credit cooperatives and savings and loan organizations, among others.

For More News And Analysis About Mozambique Follow Africa-Press