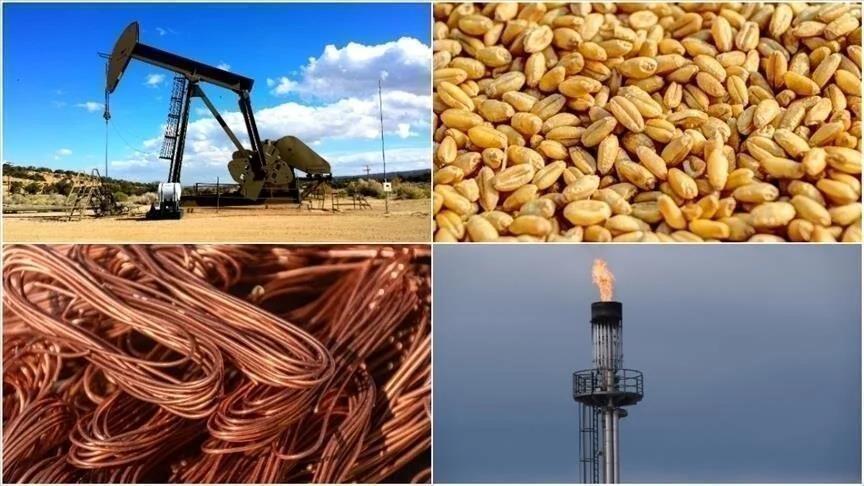

Africa-Press – Mozambique. Commodity prices were on an upward trend in January, led by strong economic activity in the US, continuing demand from China, and uncertainties over US President Donald Trump’s tariffs, while precious metals and coffee rose.

Commodities increased despite the rise of the US dollar and future bonds, as investors turned to commodities to hedge against the ongoing inflation risks, fiscal debt concerns, and tariff threats.

While Trump’s statements were regarded not as harsh as expected right after his inauguration, boosting risk appetite in commodity markets, his lack of a real plan on tariffs supported the demand outlook in commodities, as hopes for an easing of trade tensions came to the fore.

Ongoing concerns over the Chinese economy did not stop the ongoing strong demand in China.

Precious metals drive commodity prices

Gold rose 6.8% per ounce, led by lower-than-expected core inflation in the US, fueling the expectations that the Fed may not be done with the rate cut cycle yet, leading to higher demand for gold.

Gold leasing rates in London increased, as gold bullion holders in London lent their metal to other buyers in the short term, further pushing prices upwards.

Analysts say that private investors in India and China purchased large amounts of gold due to a lack of other investment opportunities, while India’s reduction of import taxes on gold fueled gold demand.

Many investors turned to gold due to its safe-haven feature, as the confidence in the US’ financial stability declined. Uncertainties over the impact of the Trump administration’s tariffs and trade policies on global trade continue strengthening the save-haven feature of gold.

Meanwhile, China continues increasing its gold reserves as the share of the US dollar in global reserves declines.

Gold may keep up the upward trend in 2025 if volatility in the stock market escalates.

At the same time, silver rose 8.4% due to ongoing geopolitical tensions, while the strong demand for solar energy and the limited supply of silver contributed to the growth.

The increase in silver will depend on industrial demand, which depends on Trump’s tariffs, due to its use in automobiles, solar panels, electronics, and jewelry.

Mexico is among the leading countries in silver mining. Analysts say that tariffs against Mexico might bring about supply concerns in silver.

Palladium rose 11.5% per ounce last month, as Trump said the US would “save” the auto industry, which increased the demand estimates for palladium.

Palladium is used in electric vehicles (EVs), and the estimates that the demand for combustion engine cars may decline with the prevalence of EVs, demand concerns in palladium became prominent.

Over 70% of the global palladium demand is from the auto sector, and if the demand for gasoline cars increases, there may be an increase in demand for palladium, analysts note, adding that palladium may reach $1,100 per ounce.

At the same time, Trump’s moves to reduce tensions with Russia, a leading palladium producer, increased the expectations that the heavily sanctioned country may gain access to the global market again, further pressuring the prices.

Platinum climbed 8.7% in January due to its use in the auto industry, led by Trump’s statements of “saving” the auto business, while supply concerns from Russia stemming from geopolitical risks also contributed to the rise.

Copper rises highest among base metals

Copper rose 6.8% per pound in January, pressured by the strengthening of the dollar, high interest rates, and estimates that Trump’s tariffs would come gradually. Meanwhile, China’s better-than-expected foreign trade data upwardly influenced copper among other base metals and pulled downwards the risks of a global recession.

China’s foreign trade data had an overall positive impact on the commodity market at large.

The rise of copper was driven by the fall of copper stocks in China, while copper imports increased. Despite the economic concerns over China, the demand continued due to rising activity in EV, wind, and solar panel sectors, as the country’s investments in the electricity infrastructure continue.

Aluminum climbed 1.5% as the EU plans to ban aluminum imports from Russia in a new sanction package.

Analysts estimate that the slowing production growth in China could lead the aluminum market to shrink this year.

At the same time, nickel and zinc fell 0.9% and 8%, respectively, while lead followed a flat course last month.

Brent rises from supply concerns

Brent crude oil rose 1.7% per barrel due to supply concerns after the US intensified sanctions on Russia’s oil production and exports. The Treasury took comprehensive steps to reduce Russia’s energy revenues, putting Russian firms Gazprom Neft, Surgutneftegas, and subsidiaries on the sanctioned list.

The winter season led to a rise in demand for Brent crude oil, pushing prices upwards, while supply concerns in Libya also contributed to the rises after an oilfield in southern Libya closed.

Natural gas prices declined 15.4% due to higher temperature forecasts for February.

Agricultural commodities rise across board due to weather

Corn tested its highest level since October 2023 at $4.9750 per bushel, as concerns that tariffs could result in grain supply shortages pushed prices higher, while wheat climbed 1.5% in January.

Soybeans increased 3.1% amid ongoing dry weather in Brazil and Argentina, while rice fell 1.8% as rice exports brought demand concerns.

Meanwhile, coffee soared 18.2% following Trump’s tariff threats on Colombia. Coffee had risen before due to a tightening supply outlook in Brazil and Vietnam.

Dry weather conditions in Brazil and Vietnam affected coffee prices, while other coffee producers in South America are facing the same tariff threat as Colombia.

Sugar climbed 1.1% as sugar production in India declined and oil prices rose.

Cocoa fell 7% and cotton 3.1% at the same time.

For More News And Analysis About Mozambique Follow Africa-Press