Africa-Press – Mozambique. China currently receives more money from low-incoome countries than it lends them, revealing a reversal in financial flows that is exacerbating difficulties in countries such as Mozambique, according to a study by Boston University.

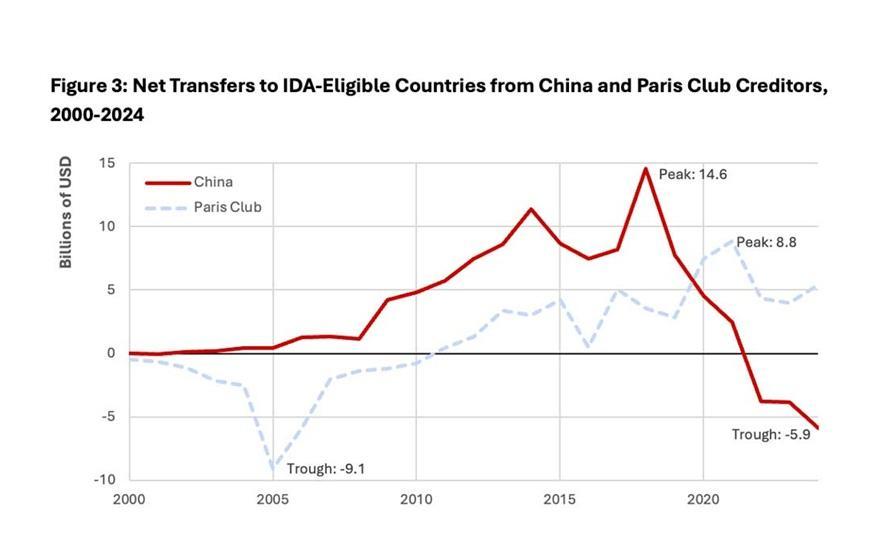

According to researcher Rebecca Ray, a researcher at he Boston University Global Development Policy Centre, in a study released on Monday, China’s “net debt transfers (new disbursements minus repayments) to low-income countries have turned negative” in recent years.

This trend means that poor countries are now repaying China more each year for past years’ lending than they are receiving in new loans.

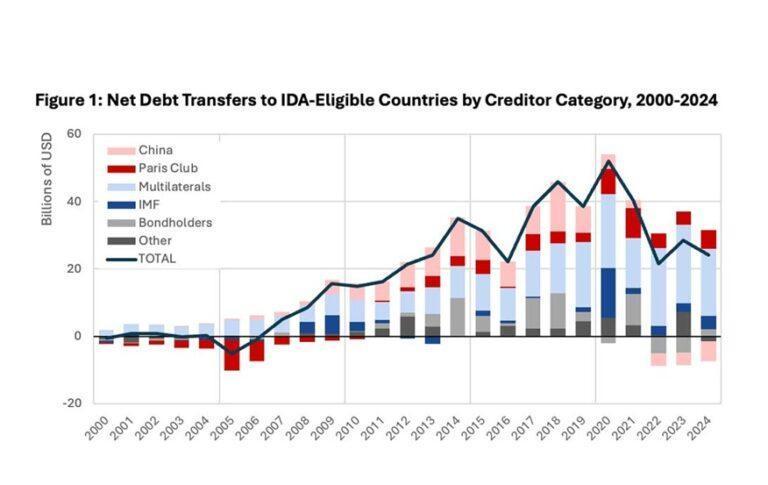

The trend reverses the dominant pattern of the past two decades, in which Beijing was one of the main financiers of infrastructure in developing countries.

The downturn is the result of a sharp drop in disbursements since 2018, when China’s outbound finance disbursements peaked.

As repayments extend for a longer period of time than disbursements this reversal was inevitable, the study ‘Constructive Responses to Net Negative Transfers: What Next for China’s Financial Relationship With Low-Income Countries‘ points out.

The situation is similar to that seen in 2005 among Paris Club creditors, who in that year had negative net flows of US$9.4 billion due to global financial instability. In China’s case, the negative balance amounted to US$5.9 billion in 2024.

Among the Portuguese-speaking countries covered by the analysis, Mozambique is among the most affected. The African country recorded negative net transfers from China and all its creditors combined, which means that, in addition to paying more than it receives from Beijing, it has not been able to offset this flow with financing from other sources.

Between January and March, China remained Mozambique’s main bilateral creditor, despite the interest waiver and the recent €12 million donation announced by Beijing.

Mozambique paid more than €36 million to China in three months for debt servicing, which leads among the country’s bilateral creditors, according to data from the Ministry of Finance.

According to a report on debt management, debt servicing to China weighed most heavily on Mozambique’s accounts in the three months from January to March, with US$35.51 million (€30.6 million) in repayments and US$6.77 million (€5.8 million) in interest.

According to data from the report, Mozambique’s debt to China totalled, at the end of June, $1.347 billion (€1.158 billion), the largest bilateral creditor and surpassed only, among multilateral creditors, by the IDA (International Development Association) of the World Bank Group, with $2.98 billion (€2.566 billion).

Meanwhile, the Chinese government has forgiven the interest on loans granted to Mozambique until 2024 and announced a donation of €12 million to the African country, Mozambican Prime Minister Benvida Levi said on 14th October.

According to the report, this most vulnerable group also includes Myanmar, Samoa, Tonga, Tajikistan and Djibouti, all of which are at high risk of over-indebtedness.

In most of the other countries analysed – all eligible for concessional financing from the World Bank’s International Development Association (IDA) – repayments to China were offset by new financing from other partners, keeping total net flows in positive territory.

While emphasising that the current phase is neither unprecedented nor unusual, Rebecca Ray believes it represents a significant challenge for both low-income countries and China, which is being forced to rethink the sustainability and impact of its external financing model.

The study proposes that Beijing refinance distressed loans by taking advantage of the current spread between Chinese and US interest rates, converting risky credits into long-term renminbi (RMB) denominated bonds, allowing for more sustainable payment terms, or expanding bilateral trade in RMB, facilitating access to the currency needed for future payments.

Lusa / Ray et al 2025 / China Global South Project