Africa-Press – Rwanda. The new FinScope 2024 Refugees Financial Inclusion Thematic Report shows that 99 percent of refugees in Rwanda are financially included, marking the country’s ongoing effort to integrate refugees into socio-economic activities and empower them to be self-reliant.

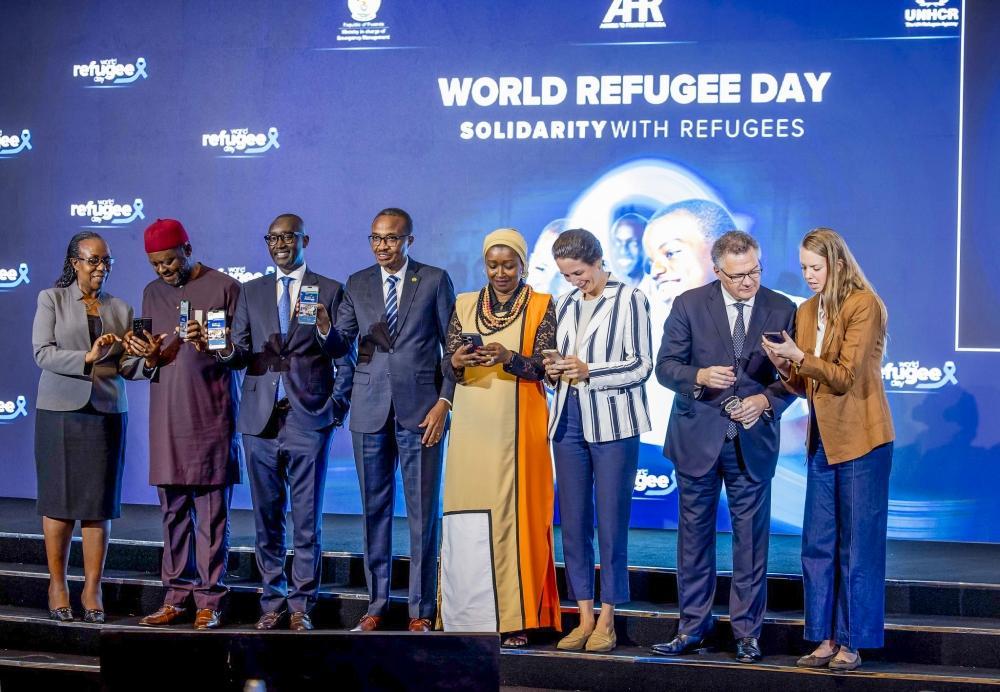

Launched on June 20, the report was developed and presented by Access to Finance Rwanda (AFR) during the celebration of World Refugee Day 2025 under the theme “Solidarity with refugees,” in collaboration with the Ministry in Charge of Emergency Management (MINEMA) and the UN Refugee Agency (UNHCR).

The event was held in Kigali in the presence of government officials, AFR’s partners, UN organisations’ representatives, refugees and their communities, and representatives from different non-government organizations.

According to the report, 99 percent of refuges aged 16 years and above living in Rwanda have access to formal or informal financial services. Of these, 37 percent use bank accounts, while 62 percent rely on non-bank formal services such as mobile money or microfinance institutions.

Jean Bosco Iyacu, AFR’s Chief Executive Officer, commended the government of Rwanda for its steadfast commitment to providing a safe and dignified environment for refugees, which allows them to survive and thrive.

“When individuals leave their countries of origin, they are not merely looking for shelter. They are in search of inclusive communities that welcome them, integrate them, and provide opportunities for their growth and resilience,” Iyacu said.

“Refugees carry with them their skills, knowledge, dreams, and ambitions. When they are not seen as a burden but as partners, and when they are given the opportunity, they contribute meaningfully to the socio-economic development of their host countries.”

He noted that this report is the first one focusing exclusively on refugees’ access to financial services. AFR’s 2018 study about refugees and their money, focusing on monthly cash transfers , revealed that despite refugees’ engagement in economic activities, they lacked access to a broad range of financial services.

Iyacu pointed out that the study also revealed a need for formal financial solutions to help refugees manage and grow their businesses and improve livelihoods. That gap led to a multi-stakeholder partnership with MINEMA, Umutanguha Finance Company, and MTN Rwanda, resulting in the establishment of dedicated bank branches within refugee camps.

“As a result, Umutanguha established dedicated branches in refugee camps, enabling refugees and residents to save money, access credit, and obtain financial services without the burden of long travels,” Iyacu added.

Iyacu applauded Rwanda’s move to integrate refugees and asylum seekers into the national identification system, which has made it easier for them to open bank accounts and access financial services.

Mobile money remains the primary channel, with 87 percent of adult refugees actively using it, and 76 percent owning registered mobile money accounts. However, men dominate mobile money account uptake with 81 percent compared to 73 percent of women.

The Minister in Charge of Emergency Management, Maj. Gen (Rtd) Albert Murasira, underscored that the report is in line with the government’s policy aiming at creating a conducive environment for the protection of refugees, ensuring their socio-economic inclusion, as well as empowering them to be self-reliant.

The Minister in Charge of Emergency Management, Maj. Gen (Rtd) Albert Murasira, speaks about the newly launched report on Friday, June 20

He commended AFR’s leadership and stakeholders for launching the report, noting that its findings are vital milestones in understanding and providing avenues for improving the financial inclusion of refugees.

“I wish to call upon all stakeholders, government institutions, development and humanitarian partners, private sector, and civil society to build on the success made and guide our strategies and programming to bridge gaps presented and design inclusive financial and livelihood solutions adapted to the refugee context,” he said.

The new FinScope 2024 Refugees Financial Inclusion Thematic Report was launched on Friday, June 20. All photos by Dan Gatsinzi

He referenced Rwanda’s Refugee Sustainable Graduation Strategy, aimed at reducing dependence on humanitarian support, addressing funding challenges, while empowering refugees to be self-reliant. However, he warned of growing global funding constraints, stressing the report’s timeliness.

“This orientation also comes in the critical moments when we have globally the unprecedented funding crisis affecting the humanitarian interventions across the globe, region, and Rwanda in particular,” the minister said.

“Hence, the need to systematically change the traditional humanitarian approach and put more emphasis on development-led interventions to build the economic capacity of refugees and enable them to be self-reliant.”

UNHCR’s Country Representative, Aissatou Ndiaye-Dieng, commended Rwanda for its continued commitment to welcoming refugees and asylum seekers and for ensuring they have access to opportunities on par with all Rwandans. “Solidarity with refugees is not just a theme, it is a call to conscious, a call to action, and a call to remember our shared humanity,” she stated.

Ozonia Ojielo, the UN Resident Coordinator in Rwanda, echoed these concerns and stressed the importance of aligning financial inclusion with fit-for-purpose financial products.

He noted that while there might be access to finance, there should be consideration of financial products coming out of financial institutions, warning that without a clear product that matches the refugee context, the cost of credit would be high, leading to refugees’ inability to borrow.

“We now need a new conversation on financing products and returns on investment. That’s what allows us to close the loop and address the challenges we’re seeing here for the refugees,” Ojielo added, emphasizing that there is a need for an intersection between the humanitarian and development perspectives.

“Let’s reconceive the new frontier for humanitarian interventions that allows this logic of fresh lands to actually have meaning in the lives of the refugees, but have meaning in terms of the government’s aspiration to address these issues.”

Currently, Rwanda hosts 136,000 refugees and asylum seekers residing in camps and urban settings. By the time the FinScope 2024 Refugees Financial Inclusion Thematic Report this survey was conducted, Rwanda was hosting 63,000 adult refugees and asylum seekers aged 16 years and above.

Ozonia Ojielo, the UN Resident Coordinator in Rwanda addresses delegates at the event,

Participants and officials pose for a group photo at the launch of the new FinScope 2024 Refugees Financial Inclusion Thematic Report on Friday,

Jean Bosco Iyacu, AFR’s Chief Executive Officer delivers his remarks at the launch_

For More News And Analysis About Rwanda Follow Africa-Press