Africa-Press – South-Africa. The South African government has broken its implicit contract with taxpayers, as it is highly corrupt and fails to deliver value for money.

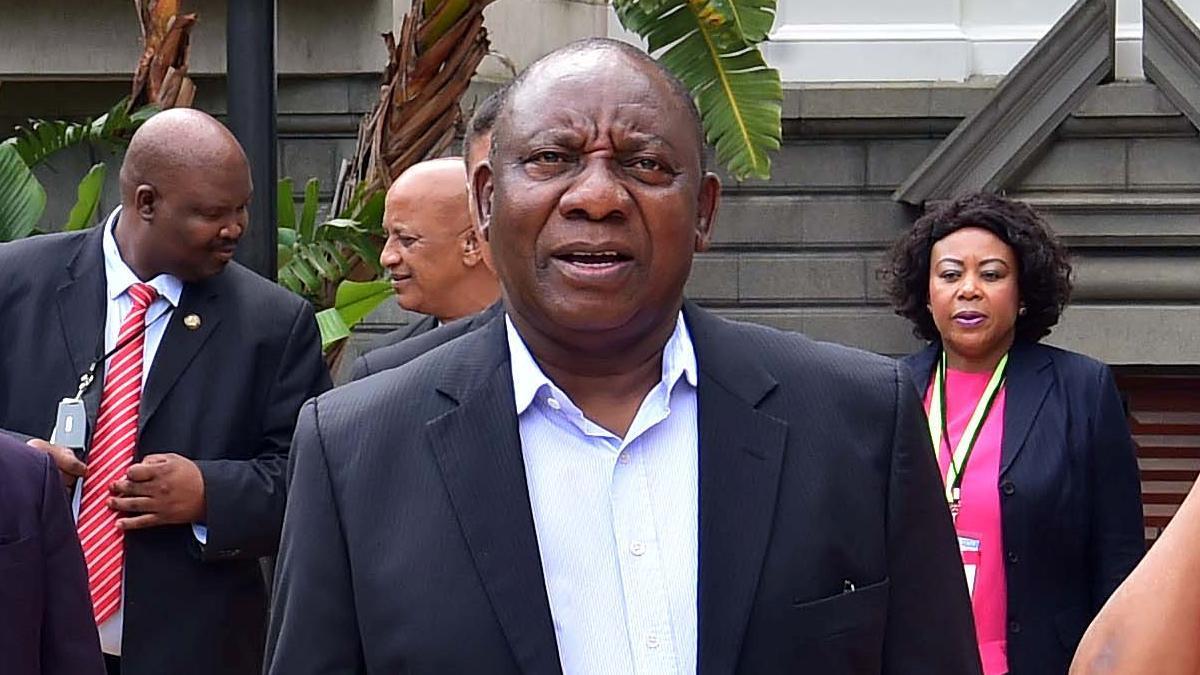

The core of the contract between the state and taxpayers was highlighted by President Cyril Ramaphosa in his first State of the Nation Address on 16 February 2018.

In his address, he said tax morality is dependent on an implicit contract between taxpayers and the government.

In this contract, he said taxpayers can expect state spending to provide value for money and be free from corruption.

It is clear that South Africa suffers enormously from widespread corruption and taxpayers’ money being wasted and stolen.

The Corruption Perceptions Index (CPI), published by Transparency International, showed that South Africa has recently hit historic lows.

The index revealed that South Africa suffers from serious, persistent corruption and a lack of accountability.

The Zondo Commission of Inquiry lifted the veil on widespread corruption and looting in the public sector, involving many high-profile politicians.

The commission processed over 1.7 million pages of evidence and implicated over 1,400 individuals and entities.

Estimates from the South African Reserve Bank and financial analysts suggest the damage during state capture may have reached as high as R1.5 trillion.

Despite this overwhelming evidence, there has been no successful high-profile prosecution. Many implicated officials continue to serve in the government.

Even Ramaphosa is complaining that trust in democracy and governance has been squandered through years of mismanagement, waste and corruption.

During his address at the ANC NEC Lekgotla, the President bemoaned mismanagement and corruption at various levels of government and state-owned enterprises.

He claimed that the devil is in the tendering system and called on the ANC to ensure professional administration is insulated from political interference.

Ramaphosa further warned that public confidence is undermined by allegations of criminal syndicates infiltrating the police.

Value for South African taxpayers’ money

Auditor-General of South Africa, Tsakani Maluleke

The Auditor-General’s (AG’s) reports revealed that billions are lost annually due to inefficiency, poor planning, and a lack of accountability.

The latest estimates indicate that over R400 billion has been wasted through corruption and violations of laws and regulations.

Billions more are squandered through fruitless and wasteful expenditures and unauthorised spending.

Corruption Watch said South African taxpayers have forked out an estimated R521 billion over the last 15 years to keep state-owned enterprises alive.

Despite the bailouts, many companies continue to fail due to financial mismanagement and corruption. Taxpayers, therefore, have not received anything in return.

Various research groups estimate that, when corruption, inefficiency, and wasteful expenditure are combined, the annual loss to the economy is roughly R200 billion.

There are many examples of how taxpayers’ money is wasted, ranging from poor management to outright theft.

For example, Gauteng Human Settlements spent R520 million on feasibility studies for housing projects that were eventually cancelled.

Another example is when the Department of Labour wasted R231 million on software licenses that were purchased but never used.

The Department of Water and Sanitation has also lost R3.68 billion due to project delays, standing-time costs, and overpricing.

Numerous municipalities received “Disclaimed” audit opinions, meaning the AG couldn’t even find the documents to prove where the money went.

Efficient Group chief economist Dawie Roodt said South African taxpayers do not get much value for the money they give to the state.

He said even if a large chunk of the money was not wasted, taxpayers only receive around 5 cents of value for every R1 of tax they pay.

The government broke its contract with South African taxpayers

The data shows that the South African government has broken its implicit contract with taxpayers, which President Cyril Ramaphosa described in 2018.

There is overwhelming evidence that state spending does not provide value for money and is not free from corruption.

According to Ramaphosa’s definition, this destroys tax morality as the state did not stick to its end of the bargain.

Tax morale is the intrinsic willingness of citizens to pay their taxes. In South Africa’s case, people hate paying taxes.

The reason is simple – taxpayers know that their money is wasted and that they receive very little value for their contribution.

Most taxpayers have private healthcare, private education for their kids, and private security to protect themselves and their belongings.

The state fails in its most basic tasks, and taxpayers are tired of funding corrupt and incompetent politicians.

Low tax morale can lead to a feedback loop where lower compliance leads to poorer services, which in turn justifies even less compliance.

Tax evasion, which is typically frowned upon in a healthy society, is becoming something to be proud of as it is seen as depriving corrupt state officials of money.

Tax avoidance and evasion are seen as a protest against perceived corruption and even as a moral act of self-defence rather than a crime.

This is happening in South Africa, which is why the South African Revenue Service is spending millions on audits, legal battles, and surveillance.

Instead of spending money on teachers, the state spends it on tax police. This creates an adversarial relationship between the citizen and the state.

It is also damaging the democratic bond between the government and taxpayers, where one blames the other.

The only way to remedy the situation is for the South African government to clamp down on corruption and mismanagement.

However, because some politicians and state officials benefit from corruption, this is highly unlikely to happen.

For More News And Analysis About South-Africa Follow Africa-Press