Africa-Press – South-Africa. The National Treasury’s choice not to adjust tax brackets for inflation has created a “stealth tax” in South Africa that has raised R15.5 billion from 7.7 million taxpayers.

This has exacerbated the steady expansion of South Africa’s personal income tax (PIT) burden to further increase the pressure on a tiny number of taxpayers.

The use of so-called bracket creep as an explicitly revenue-raising tool is part of the dangerous game the Treasury is playing by relying on only 7.7 million taxpayers to contribute over R650 billion in tax revenue.

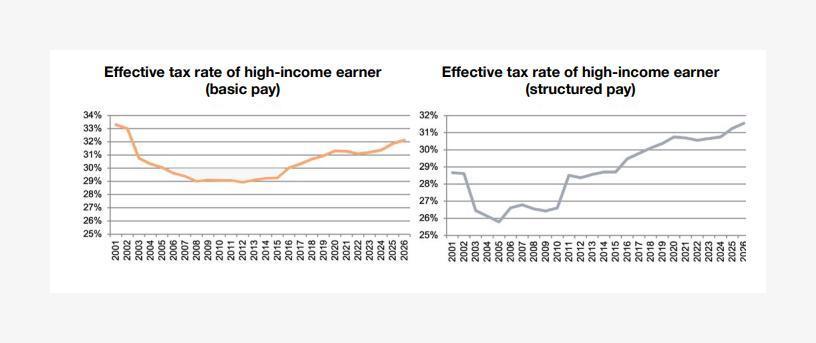

PwC tax experts Simangaliso Manyumwa and Kyle Mandy explained that South Africa’s PIT burden has increased significantly over the past 20 years.

This is despite some PIT brackets being removed or adjusted and the effective tax rate on basic pay declining slightly over the period.

While this is true, the National Treasury has used alternative methods to increase PIT revenue, particularly by clamping down on rebates and deductions while also widening the range of income subject to tax.

This has the effect of creating a broader base for PIT collections, while relying on the same number of taxpayers to generate revenue.

Beyond these explicit legislative changes, the tax burden has also been heightened by a second, more subtle culprit, Manyumwa and Mandy explained.

This is the deliberate use of fiscal drag to generate more revenue from PIT taxpayers. The National Treasury has used this measure effectively over the past few years to generate more revenue, without increasing tax rates.

“Fiscal drag, or bracket creep, occurs when inflation pushes taxpayers into a higher effective tax rate, thereby increasing their real tax liability,” the experts explained.

“In several recent budgets, the National Treasury has chosen not to adjust tax brackets for inflation, using fiscal drag as an explicit revenue-raising tool.”

This tool has proven highly effective and is hitting taxpayers hard, with it expected to raise R15.5 billion in additional revenue in the current financial year.

“This burden is shouldered by a dangerously small number of taxpayers. National Treasury’s data show that only 533,000 taxpayers earning over R1 million are projected to pay 47.5% of all PIT for the 2025/26 fiscal year,” Manyumwa and Mandy said.

Tax base is cracking

South Africa’s tax base is on the verge of cracking under this pressure, with the country having one of the most concentrated PIT tax bases in the world.

This is not for a lack of effort from SARS in forcing South Africans to register to pay tax and enter into its sophisticated system.

Rather, simply put, a large number of taxpayers stack up at zero, with millions unemployed or not earning enough to meet the PIT threshold.

SARS’ latest tax statistics show that only 2.4% of South Africans pay 77% of all PIT in the country. This means that just over 1.5 million people pay R562 billion in tax.

This is largely a result of the broadening of the PIT tax net, with more income becoming subject to tax through legislative changes.

It is also partly due to SARS’ improving efficiency, with the revenue service being under pressure to collect more revenue in a stagnant economy.

Over the past 30 years, tax collections have increased from R113.8 billion in 1994/95 to R1.9 trillion in 2024/25. This is a compound annual growth rate of 9.8%.

The largest share of this revenue comes from personal income tax, which contributes 37.4% of all collections in South Africa. This equates to R729.9 billion.

SARS’ efforts to broaden the tax base, by including more individuals, can be seen in the number of South Africans registered for PIT.

This has surged in recent years after it was made mandatory to receive a tax number from SARS, even if one falls below the income tax threshold.

Over 27 million South Africans are now registered for PIT, with this number compounding at a steady 4% per annum for the past five years.

However, the vast majority of these individuals do not pay PIT as they do not earn more than the income tax threshold, with only 9.1 million South Africans submitting returns. An even smaller number, 7.7 million, have their taxable income assessed.

As a result, a large number of South Africans stack up at zero and do not contribute to PIT collections. This makes it highly vulnerable to economic shocks.

The charts below, courtesy of SARS, show the highly concentrated nature of South Africa’s tax base, with a few individuals bearing the brunt of the burden.

This graphic shows the number of taxpayers as a proportion of those registered for tax, not the entire population of South Africa.

For More News And Analysis About South-Africa Follow Africa-Press