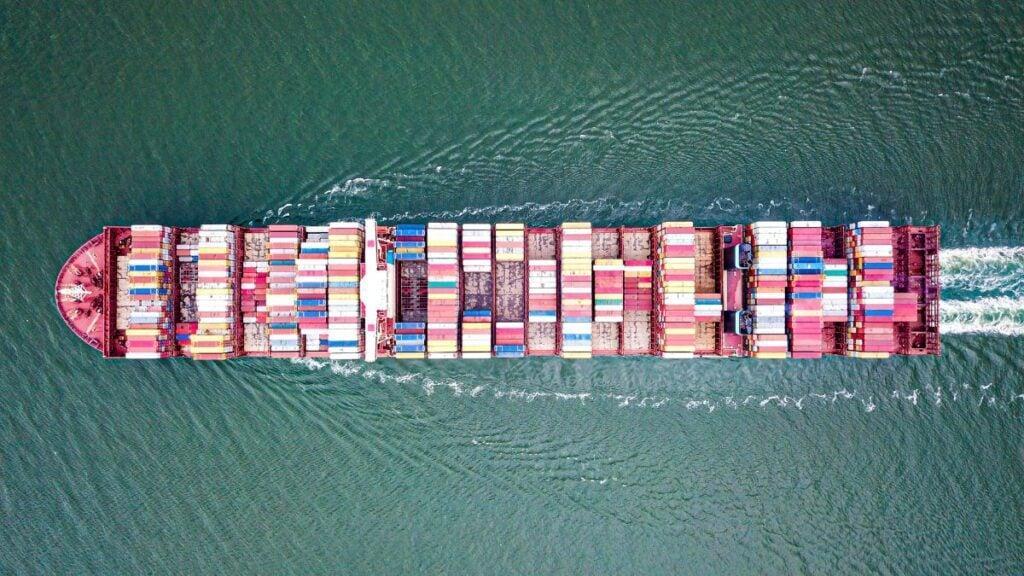

Africa-Press – South-Africa. An important trading route for South African exporters is being cut. Global shipping giant Maersk has announced it will no longer offer direct shipments between South Africa and the United States.

From 1 October 2025, Maersk will transition to a transhipment model, rerouting goods through European hubs before they reach US ports.

This means that South African cargo will first stop in Europe, where it will be offloaded and reloaded onto another vessel before heading across the Atlantic, delaying delivery times and increasing costs for exporters.

The decision comes as pressure mounts on local exporters who rely heavily on efficient, predictable shipping lines to meet contractual and market obligations.

In a notice to customers, Maersk confirmed the change and its exit from its current co-share agreement with the Mediterranean Shipping Company (MSC).

Under this agreement, known as the AMEX service, Maersk and MSC have jointly operated direct shipments to the US, sharing container space on vessels under the now-defunct 2M Alliance.

That collaboration officially ended in 2023, and now Maersk is pulling back from the route entirely. With Maersk’s withdrawal, MSC will become the only major shipping company offering direct service between South Africa and the US East Coast.

In anticipation of the shift, MSC announced in May that it would boost its service by deploying four additional vessels, increasing its total fleet on the route to eight ships.

The weekly service will operate from the South African ports of Durban, Gqeberha, and Cape Town, before heading directly to key US destinations including New York, Baltimore, Norfolk, Charleston, and Freeport.

However, while MSC’s expanded capacity may offer some relief, concerns remain about whether it can adequately serve all exporters who previously relied on Maersk.

Unathi Sonti, Chairperson of the Maritime Business Chamber, warned that the implications of Maersk’s exit are already being felt, particularly by industries that depend on timely deliveries.

“The number one key to all of that would be for time-sensitive sectors. There will now be issues with them not having the weekly shipping line routes directly to the US,” said Sonti.

Room for healthy competition

Sonti explained that the new routing model introduces the risk of delays, especially for goods departing from Western Cape ports.

This uncertainty around schedules and delivery windows adds to the logistical challenges South African exporters are already facing.

Companies dependent on stable, frequent shipments will now need to adjust to longer lead times and potential disruptions in their supply chains.

These complications are especially problematic for perishable goods, just-in-time manufacturing, and sectors bound by strict delivery timelines.

When asked about the possibility of government intervention or broader market solutions, Sonti clarified that the route itself is not being shut down entirely.

“The USA line is not closed. That line was a partnership between MSC and Maersk, and now you’re touching on something else, which is healthy competition,” he noted.

Even though MSC has stepped up its operations, Sonti questioned the extent to which this would compensate for Maersk’s exit.

“Now that will leave MSC in a position of being the only one. Even though they have committed to putting in additional resources to continue the line, we don’t know what that means in practical terms,” he added.

Sonti sees the development as a potential opening for other international carriers to enter the market.

He suggested that this shake-up could encourage new players to offer direct South Africa–US routes, but only if there is enough consistent cargo demand to make it worthwhile.

“You don’t really want to have a vessel available if it’s not going to make economic sense,” he said. In the short term, exporters will need to navigate this new reality with longer shipping times and less predictability.

For More News And Analysis About South-Africa Follow Africa-Press