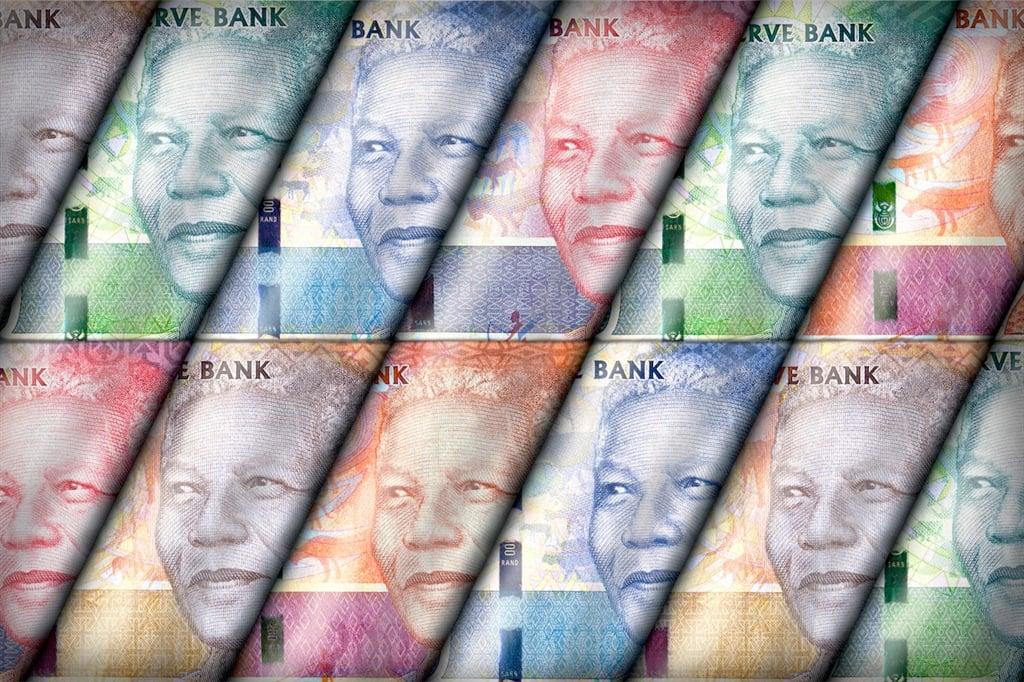

Africa-Press – South-Africa. On Friday morning, the rand was in free fall, hitting a record R19.47/$ amid the South African arms-to-Russia scandal.

The previous record-low level (R19.35/$) was reached during the pandemic panic of April 2020.

On Thursday, US ambassador to South Africa, Reuben Brigety, claimed that Russian forces received arms from South Africa last year.

This sent shockwaves through the market, and the rand lost 30c of its value in minutes following the first News24 report on Thursday.

“[The Russian arms accusation] is likely to have dire consequences for SA, which could lose its African Growth and Opportunity Act (AGOA) preferential duty-free market access to the US,” noted Nolan Wapenaar, co-chief investment officer of Anchor Capital.

If the US sanctions South Africa in this way, this could put trade of as much as R400 billion at risk, Bloomberg reported.

Publications across the world, including the Financial Times and New York Times, reported extensively on the crisis.

Even before the Russian crisis, the rand was bleeding due to continuing concerns about the economic impact of load shedding and greylisting. Also, following aggressive US rate hikes the differential between the US and local rates has now shrunk, and South African rates are not that attractive anymore.

The rand was trading at R21.24 to the euro and R24.36 to the pound at midday on Thursday.

The rand slump will fuel more inflation, as most of SA’s fuel is imported. This may have cemented a 25- or 50-basis-point hike at the end of May.

Government bond yields were also hard hit by the latest crisis, which will have a knock-on effect on the state’s borrowings.

For More News And Analysis About South-Africa Follow Africa-Press