Africa-Press – South-Africa. South Africa is at risk of giving up its position as Africa’s most developed economy as it is increasingly losing out to its peers on the continent, which have faster economic growth.

While the country’s economy remains dominant in the region, providing over 23% of Africa’s exports, the era of state capture and a decade of poor economic growth has weakened its appeal to foreign and local investors.

Standard Bank CEO Sim Tshabalala told Daily Investor that slow economic growth and a lack of reform will result in South Africa missing out on investment as companies look elsewhere for returns.

He explained that Standard Bank has to prioritise shareholder returns, which may mean it will invest more outside its home market.

“We’re focused on shareholder return, absolutely focused on it and on managing our portfolio of businesses with discipline,” Tshabalala said.

“Clearly, the fastest-growing parts of the African continent are the countries outside of Africa and, in particular, East Africa, which is growing at an annual rate above 5%.”

“Therefore, you want to allocate your capital to these faster-growing parts of your business for obvious reasons – to grow lending, insurance products, and making acquisitions.”

“The world competes for capital. We compete for the money we need to finance our nation’s budget deficit and compete globally for the money to finance infrastructure investment, fund Eskom and Transnet, and finance corporate projects.”

“We are competing on the continent and with emerging markets for this capital. So if they have decreased the risk of investing in their country and generated greater returns, the money will rather go to those places than South Africa.”

South Africa’s poor economic performance is beginning to weaken its standing among African countries, making it less attractive as an investment destination.

In the recently released Africa Export Competitiveness Report 2023, South Africa ranked first for only one criterion.

While it remains the largest exporter on the continent, Egypt overtook it in export competitiveness and GDP.

The country slipped to third in export policy rankings, behind Mauritius, Egypt, and Morocco.

In terms of workforce and output, the country also ranked third in Africa and only eighth with regard to business dynamism.

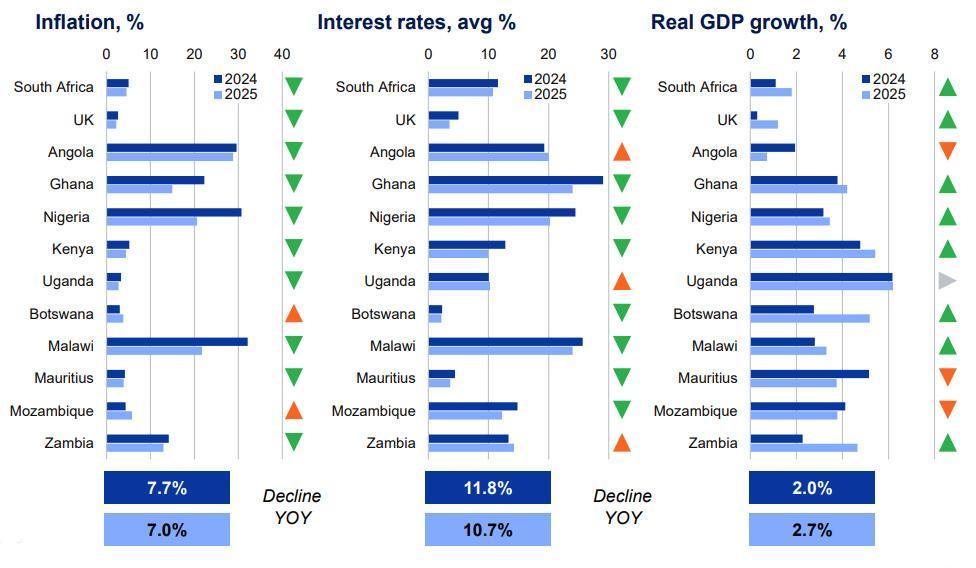

The graph below reflects the growing divide between South Africa and its peers, which have much faster economic growth.

Tshabalala’s fears are already becoming as South Africa slipped to fourth in the RMB Invest in Africa rankings.

South Africa ranked first in only one category – forex stability and liquidity – while it lost the top spot in terms of economic output to Egypt.

Worryingly for the future, it also came in last place on the continent regarding GDP growth forecasts, income inequality and unemployment.

South Africa’s economy has been relatively stagnant over the past decade, hovering around 1% GDP growth annually.

“Long the continent’s economic powerhouse, South Africa faces major headwinds that have seen other countries supersede it in a variety of consequential rankings,” RMB said in the report.

“At fourth place overall, Africa’s southernmost nation lags the two idyllic island nations, as well as northern powerhouse Egypt.”

The investment bank did say a recovery is possible, spurred by the formation of a Government of National Unity (GNU) and renewed investor optimism.

“Foreign investors will likely wait for evidence that South Africa’s many reform plans and procedures to stabilise multiple dire metrics are gaining traction before investments turn a corner.”

Tshabalala agreed with RMB’s comments, saying the entire investment landscape could be flipped on its head if South Africa’s economic growth picks up.

“There is a beauty in having a portfolio of countries. South Africa is an absolute giant in the portfolio.”

“You might say its economic growth is pedestrian, but if the country suddenly grows at 2% or 3% then the base is significantly bigger, and it makes sense to allocate more capital to the country.”

“So, we are sanguine about this, and we are not religious about where growth is. We will pursue that growth, servicing our clients and providing them with solutions.”

“The summary is that we will follow GDP growth and client activity. We will have strict discipline in how we allocate capital and keep going where we can grow the most.”

For More News And Analysis About South-Africa Follow Africa-Press