Africa-Press – Tanzania. UNDER the leadership of President Dr Samia Suluhu Hassan, Tanzania has taken significant strides in strengthening its economy.

One of the most notable initiatives has been the Central Bank of Tanzania’s move to start gold purchases, a strategy designed to bolster the nation’s financial stability.

This approach, carefully managed by the Bank of Tanzania (BoT), aims to enhance the Tanzanian shilling’s resilience against global currency fluctuations.

The analysis carried out utilising data generated by the Central Bank of Tanzania, strongly indicates that the shilling is poised to maintain stability in 2026.

Given that not many might be aware, the appreciation of the Tanzanian shilling in the second half of 2025 was attributed to central bank intervention, stricter regulations on domestic US dollar usage and positive developments in the external sector.

As we begin 2026, the shilling has appreciated by 6.5 per cent against the USD in the second half of 2025.

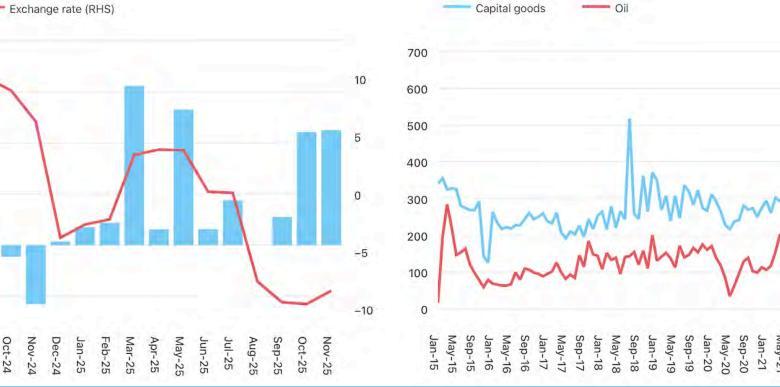

This indicates significant central bank intervention, exceeding 260 million US dollars by the end of November (compared with less than 170 million US dollars in the same period in 2024), with a marked escalation of support in October and November, attributed to heightened dollar hoarding in the lead-up to the election.

Unquestionably, it is well known that the central bank has progressively implemented stringent regulations regarding the use of domestic US dollars.

In March 2025, as you may recall, the central bank declared that all pricing and payment for goods and services within the nation must be conducted in Tanzanian shillings.

Based on BOT’s data, an analysis of dollar sales, the USD exchange rate and the USD per TZS % y-o-y, briefly illustrated below, indicates that shillings remain strong.

In conjunction with the robust performance of the Tanzanian shilling, a favourable trend in the trade deficit has further bolstered the currency.

Rising gold prices, strong horticultural exports and sustained government backing for import substitution have collectively boosted export levels and moderated import demand.

An examination of the BOT monthly economic review reports shows that Tanzania has achieved self-sufficiency in essential construction materials such as cement, tiles, iron sheets and steel and is now aiming to enhance domestic production of sugar and fertiliser.

From an economic point of view, these trends are bolstering the external sector and strengthening the shilling.

Nonetheless, demand for higher-value capital inputs, excluding raw materials, is expected to remain elevated due to robust infrastructure development.

However, this pressure on the import bill has been somewhat mitigated by declining global energy prices; for example, oil accounted for 19.9 per cent of goods imports in 2024.

This interplay has helped moderate import expenditure and bolster the country’s overall trade balance, as briefly shown in the figure below, which illustrates how rising capital goods import demand is partially offset by lower oil prices.

Given this trend, the Tanzanian shilling is projected to average approximately 2,550/- per USD by 2026.

In light of possible lender withdrawals that could reduce financial inflows, the Bank of Tanzania has both the readiness and capacity to intervene, thereby ensuring the stability of the shilling.

The recent international scrutiny of the Tanzanian government’s management of the October 2025 general elections could affect the immediate demand for Tanzanian assets.

Several of you may remember the European Parliament’s request that the European Commission retract its proposed decision on the financing of the EU’s Annual Action Plan for Tanzania, valued at EUR 156 million (approximately 181 million US dollars).

Notwithstanding donors’ apprehensions and heightened domestic demand for US dollars, the central bank, led by Governor Mr Tutuba, has shown commendable readiness to intervene to stabilise the currency.

The BoT’s initiative to buy gold more strategically has indeed enhanced reserves, which, according to the BoT’s calculations, totalled 6.2 billion US dollars at the end of October.

The rise in gold receipts, coupled with ongoing central bank initiatives to amass reserves, will undoubtedly equip the Bank of Tanzania with the capability and resolve to intervene, thereby bolstering dollar liquidity and currency stability.

Undoubtedly, a reduction in the current account deficit will contribute to the stability of the shilling.

An in-depth analysis of BOT data shows that the current account deficit is projected to fall from 3.2 per cent of GDP in 2025 (a revision from the previously estimated 2.5 per cent , based on Q3 outcomes) to 2.5 per cent in 2026 (adjusted from an earlier forecast of 2.3 per cent ).

Although primary income outflows are expected to remain substantial due to high debt servicing obligations, strong performance in trade and services exports especially from gold, horticulture and the projected completion of the East African Crude Oil Pipeline by late 2026, will help to offset this.

In the mining sector, data from the London Metal Exchange (LME) indicate that gold prices are projected to rise further in 2026, averaging USD3,700/oz, up from USD3,400/oz in 2025. With gold accounting for 39.4 per cent of Tanzania’s goods exports in 2024, the path to a stable shilling appears clear.

Enhanced regional connectivity and competitive port costs are expected to further bolster exports of transport services. Regarding the implications of currency revaluation, a weaker dollar, coupled with an expanding real interest rate differential between Tanzania and the United States, is poised to mitigate the shilling’s depreciation against the US dollar in 2026.

In my assessment, the DXY is likely to experience a period of restraint in 2026, oscillating between 95 and 100.

This is attributable to robust US growth and solid corporate earnings, which prevailing policy uncertainties and ongoing fiscal deficits will offset.

In my assessment, the Bank of Tanzania is likely to maintain its policy rate in 2026, in contrast to the expected 50-basispoint reduction by the US Federal Reserve.

This divergence will likely widen the real interest-rate differential between Tanzania and the United States, thereby enhancing the relative appeal of Tanzanian assets.

Based on my analysis, I do not foresee significant risks; however, despite the potential for mixed uncertainty, the inclination appears to lean towards the downside.

A significant drop in global gold prices, for instance, would adversely affect export revenues and hinder reserve accumulation, thereby diminishing the Bank of Tanzania’s ability to intervene in foreign exchange markets and putting pressure on the shilling.

While other partners have not explicitly endorsed the European Council’s decision to freeze or cancel the Annual Action Plan for Tanzania for 2025, there are indications that they recognise Tanzania’s assertiveness on issues affecting its citizens and the reality on the ground, as the picture of what happened during the election slowly unfolds.

In light of this, Tanzania’s alignment with entities such as China, for instance, in the rehabilitation of the Tanzara railway line and its cooperation with other partners adopting distinct approaches to collaboration, will serve as mitigating factors.

Ultimately, in my view, an extension or renewal of the IMF’s programmes, which are set to conclude in May 2026, will provide additional support for inflows and help maintain Tanzania’s currency stability.

Source: Daily News – Tanzania Standard Newspapers