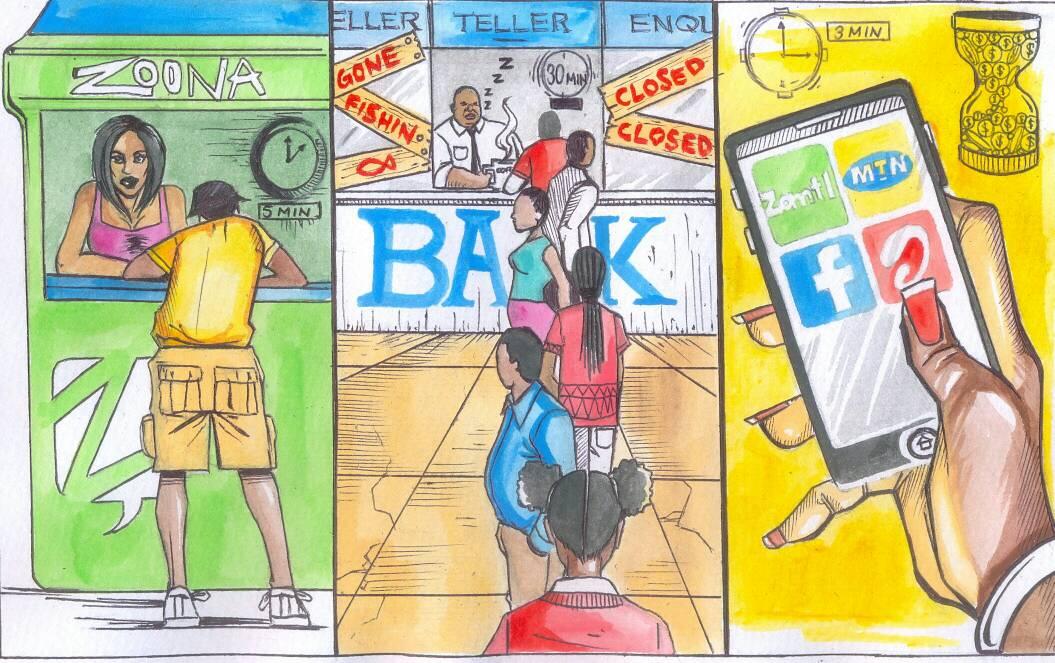

Africa-Press – Zambia. The use of formal financial services offered by the banks has decreased from 24.8 percent to 20.7 percent. German Sparskassentiftung Project Manager and Representative for Zambia, Reinhold Hoernle said this during the official opening of an eighth branch for African Banking -AB in Ndola today.

Mr Hoernle said 58 percent of the adults are instead using mobile money according to the introduction of the new FinScope study for the year 2020 for Zambia.

Mr Hoenle observed that COVID-19 has shown the need for expanding the digital and mobile services which has seen AB bank having 600,000 clients already online and using the platform.

Mr Hoernle said that formal financial inclusion increased to 61.3 percent from 38.2 percent, but that the financial services by adults offered by the banks had decreased.

“According to Fin Scope- study 2020 for Zambia a study about financial literacy stated that the growth in the Zambian economy has been subdued since 2015 with real gross domestic production projected at negative 4.2 percent in 2020,” he said.

He added that the situation has had a direct impact on households as it spoke to fewer opportunities for income generating activities for households. He said the need to open a new branch in Ndola was part of increasing the number of inclusion of more people accessing bank services.

“The doors of the new banks are not only widely opened to offer services and attract customers. This is not about sales figures, but about inclusion. Besides granting loans, AB bank has become a role model when it comes to capacity building and financial literacy,” he said.

Mr Hoernle added that financial services were essential for the development of a region or a country by offering to the small and medium sized entrepreneurs, who are the core clientele for AB bank.

And AB Bank Chief Executive Officer Cosmin Olteanu said that opening of the Ndola branch was in line with the institutions vision 2023 which offered every citizen simple and affordable financial services.