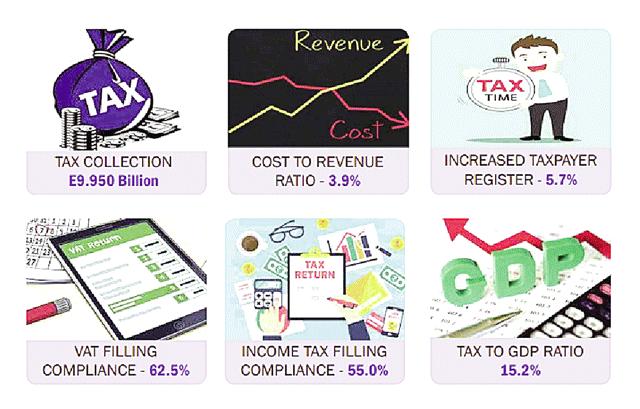

Africa-Press – Eswatini. This adjective best describes the role of outgoing Eswatini Revenue Service (ERS) Commissioner General Dumisani Masilela who during his tenure grew domestic revenue collection from E3.821 billion to E9.945 billion at the end of March 2021. Minister of Finance Neal Rijkenberg pointed out that this was an average annual growth rate of 10.1 per cent, which was above inflation and economic growth combined.

“This was achieved through him leading the organisation in the implementation of various revenue administration modernisation initiatives during his time,” said Rijkenberg when congratulating Masilela on his new job at the revered International Monetary Fund (IMF). Masilela’s role in the IMF will be to promote the development and implementation of medium term revenue strategies in the countries covered by the fund’s technical assistance centre that looks after the East Africa region.

These are Ethiopia, Eritrea, Kenya, Malawi, Rwanda, South Sudan, Tanzania and Uganda. At ERS, Masilela, who has been at the helm since establishment in 2011, assembled a capable team and through them he managed to change the taxpaying attitude among many taxpayers in the country, from that of being optional to where every taxpayer knows that it remains their responsibility and obligation to contribute to the fiscus.

The minister said worth noting was that, during his tenure in the ERS, Masilela has led the development and implementation of three strategic plans, with the fourth one currently running until March 31, 2024. When asked to elucidate on strategies that led to sustained growth in domestic revenue and how this subsequently contributed to the betterment of the nation, Masilela said clearly the only sustainable source of financing the budget was tax (domestic resource mobilisation). He said it was, therefore, critical that any government ups its game in this regard.

He explained that they had been able to deliver the remarkable growth mainly through focussing on measures to improve compliance. The outgoing CG recounted that they when they took over the function of tax collection, there were too many taxpayers that were sitting outside the tax net.

He disclosed that the strategies were focused on measures to identify them and then enforce the law. When they started, Masilela said, the processes employed in this regard were predominantly manual and labour intensive but they worked as taxpayers realised that they were now paying attention.

Over time, the CG said they had gradually improved information technology (IT) systems and trained staff in the enforcement of legislation. He stated that they recently moved into the data analytics space, where ERS relied less on gut-feel and whistle-blowing activities to identify non-compliance. “This is at a rudimentary stage but has already revealed several areas of non-compliance, which we are working on.

The intention is to strengthen this approach so that we are more targeted in our interventions. This will improve our cost to revenue ratio considerably as more revenue comes in. The benefit to the economy is of course the ability to finance its development agenda without having to resort to the other sources such as debt, which are costly,” said Masilela.

For More News And Analysis About Eswatini Follow Africa-Press