Africa-Press – Eswatini. While Eswatini’s economy shows healthy signs of growth in credit extension, the Central Bank’s May/June 2025 release signals a need for increased financial vigilance due to tightening liquidity and declining reserves.

As of May 2025, domestic liquid assets dropped to E7.1 billion, reflecting a 5.3% monthly and 3.5% annual decline. The Central Bank explains, “Accounting for the decrease was a fall in balances held by banks at the Central Bank, investment in Government securities, as well as Rand balances in their vaults.” Although liquidity levels remain above the regulatory minimum, the trend suggests mounting pressure on financial buffers.

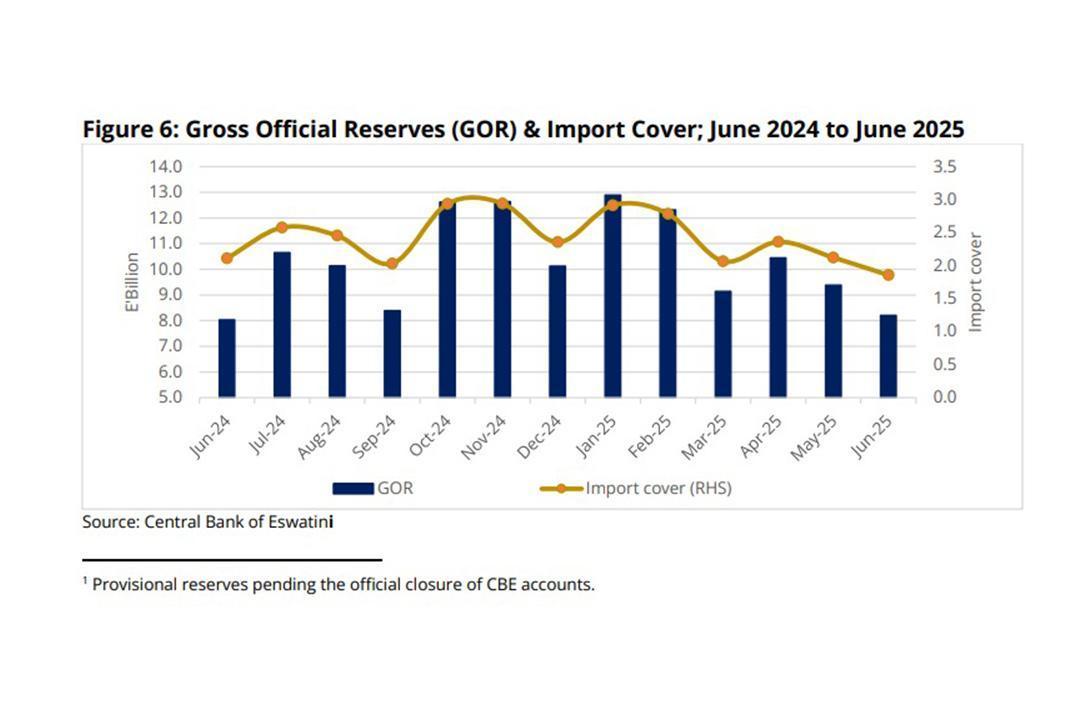

The situation is mirrored in Eswatini’s external reserve position. Gross official reserves dropped sharply by 12.6%, falling from E9.4 billion in May to E8.2 billion in June 2025, while still maintaining a 2.2% annual growth. “The month-on-month contraction was attributed to a net outflow of Rands from trades with local banks, coupled with the payment of Government fiscal obligations,” the Bank stated. This decline in reserves reduced the import cover from 2.1 months in May to 1.9 months in June, dipping below the recommended three-month threshold for economic security.

Moreover, government deposits fell by 9.0% to E6.1 billion, while government claims rose by 6.2% to E8.3 billion. This dynamic was “on account of an advance from the Central Bank over the month under review,” signalling increased fiscal expenditure and reduced savings.

Despite these pressures, the broad money supply (M2) grew by 0.7% to E23.8 billion, driven by a 3.7% rise in quasi money, particularly in time deposits. However, narrow money (M1) contracted by 3.9%, signalling reduced availability of cash for immediate spending.

The Central Bank maintained a discount rate of 6.75%, while the commercial bank prime lending rate stood at 10.25%, balancing inflation control with credit accessibility.

These financial indicators point to a crucial balancing act: Eswatini’s growth-oriented credit expansion must now be complemented by prudent fiscal management and strategic reserve rebuilding to ensure long-term stability.

WHAT DOES THE LIQUIDITY DROP MEAN FOR ESWATINI

According to an economist, the decline in Eswatini’s liquidity and reserves signals a tightening of the country’s financial safety nets. With liquid assets dropping to E7.1 billion and import cover falling to just 1.9 months, Eswatini faces increased vulnerability to external shocks, such as global commodity price fluctuations or currency volatility. This could limit government’s flexibility in responding to emergencies or stimulating the economy during downturns. While private sector credit growth remains strong, the falling reserves underscore the need for prudent fiscal discipline, enhanced revenue mobilisation, and strategic foreign investment to restore financial buffers and safeguard economic stability.

“The situation is cautionary rather than outright negative, but it offers an opportunity for strategic improvement. While the decline in liquidity and reserves suggests short-term financial pressure, it also highlights areas where Eswatini can strengthen its economic resilience. The fact that private sector credit is expanding, especially in productive sectors, shows that the real economy is active and growing, which is a strong positive,” explained the economist.

If the country responds by tightening fiscal management, rebuilding reserves, and encouraging export growth or foreign direct investment, this period can serve as a turning point. In this light, the situation is not inherently negative, it’s a wake-up call with positive potential if met with the right policy actions.

For More News And Analysis About Eswatini Follow Africa-Press