Africa-Press – Eswatini. Credit to businesses has benefited from the recovery of the economy from recent headwinds as well as gains from investments thus supporting ongoing expansionary initiatives.

The credit to businesses grew by 5.8 per cent from E8.540 billion in the first quarter of 2023 to a total of E9.040 billion in the second quarter of 2023.

This is outlined in the Ministry of Economic Planning and Development and Macroeconomic Analysis and Research Unit Quarterly Economic Bulletin for the second quarter of 2023. The report states that the growth in this category was in line with improved activity observed in the second quarter of 2023.

“Demand for money increased in key industries, including mining which grew by 3.2 per cent, construction that grew by 6.1 per cent, as well as distribution and tourism which grew by 14.9 per cent,” reads the report.

It indicates that credit for the transport industry grew by 3.8 per cent, community, personal and social services grew by 1.3 per cent, while real estate grew by 9.2 per cent as well as other industries, which grew by 20.2 per cent.

“On the contrary, the increase was dampened by a fall in credit to industries, including agriculture, which grew by-7.2 per cent, and manufacturing which grew by -4.1 percent,” highlights the report.

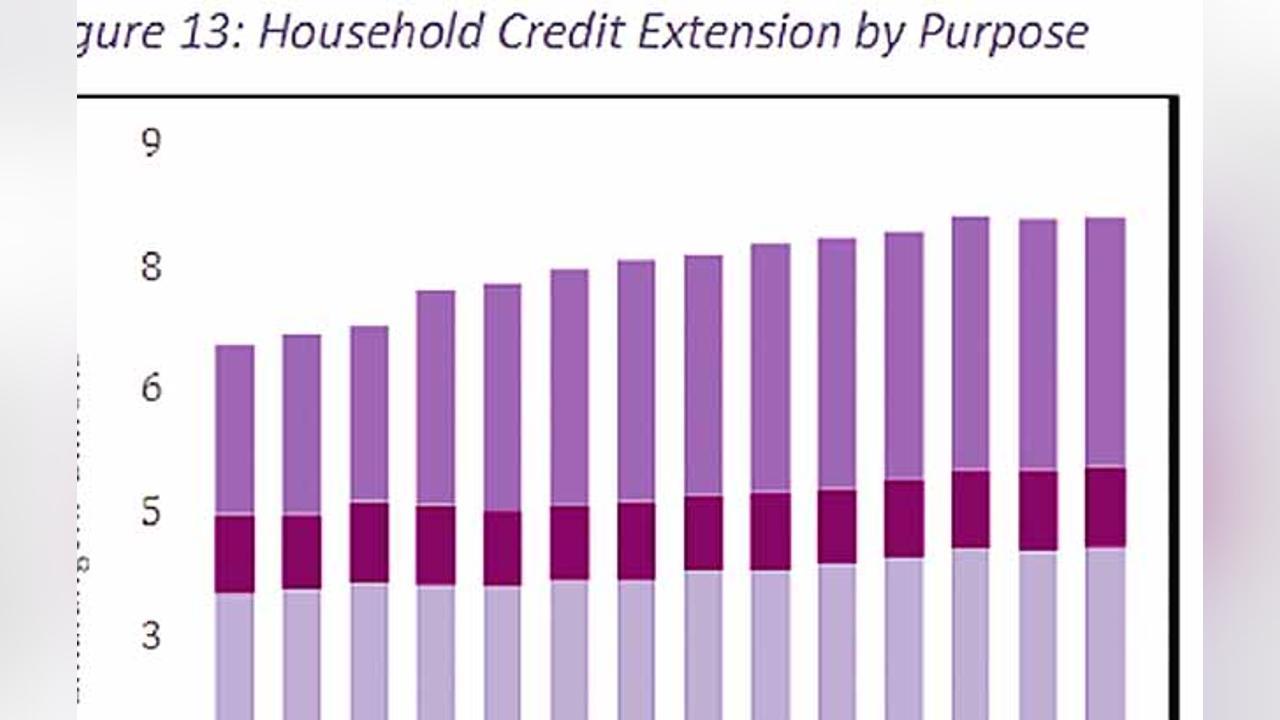

On the other hand, the reports states that credit to households grew marginally by 0.2 per cent to E8.078 billion in the second quarter of 2023 from E8.061 billion in the previous quarter.

“The marginal growth emanated from a 1.0 per cent growth in housing loans while there was a slow-down in the growth of motor vehicle loans and other personal (unsecured) loans, both falling by 0.5 per cent, moderated the growth,” reads the report.

Increased

It states that total private sector credit increased by 3.6 per cent in the second quarter of 2023, amounting to E18.151 billion following the sluggish 1.6 per cent growth in the preceding quarter.

“The quarter-on-quarter growth in private sector credit was attributable to credit demand by other sectors such as financial corporations, parastatals and local government,” reads the report.

Furthermore, it states that growth increased by 12.1 per cent; credit extended to businesses which grew by 5.8 per cent, and the marginal growth of 0.2 per cent credit extended to households, in the period.

For More News And Analysis About Eswatini Follow Africa-Press