Africa-Press – Ethiopia. Africa’s share of the global USD 2.2 trillion green bond market is less than 1%. To increase its green bonds market share, Africa must mobilise the combined capacity of corporations, municipalities, banks and sovereign governments.

Although the growth of the green bond market in Africa trails the rest of the world, the continent has enormous potential to issue more green bonds. By 2023, over 20 green bonds had been issued by Tanzania, Rwanda, Gabon, Seychelles, Nigeria, South Africa, Kenya, Morocco, Mozambique, Nigeria, Namibia, Mauritius, and Zambia.

Unlocking green bond opportunities requires strong national regulatory frameworks, incentives and consistent collaboration between both public and private sectors and local and international financial institutions.

Guided by past successful issuances by African public and private sectors, new African entrants in the green bond markets can reduce Africa’s trillion-dollar climate finance bill by creating ecosystems that leverage existing capacities in their public, private and environmental sectors.

To turn ambition and potential into concrete action, African countries and their partners will play an important role in enabling opportunities offered by the rapidly growing global sustainable bond markets.

At the upcoming COP29, states must commit to accelerating the creation of enabling environments, capacities and collaborations for green bond issuance in Africa.

Background and context

In 2007, the United Nations predicted that the African continent would be one of the regions most severely impacted by climate change. The 2023 State of the Climate in Africa report indicates that the risks have manifested on an even larger scale.1 With the global surface temperature expected to exceed 1.5 degrees Celsius above pre-industrial levels, Africa’s climate bill is expected to further escalate.2 3 Going by past trends, a combination of African governments’ climate-related budgets and donor pledges will not meet this challenge. Estimates indicate that Africa needs USD 2.8 trillion by 2030 to implement its Nationally Determined Contributions (NDCs).4

To meet their trillion-dollar climate bill, African countries must diversify their climate finance sources to include more non-traditional avenues. Sustainable finance markets, for example, are platforms for debt securities that raise money for sustainable projects and initiatives globally. According to the International Finance Corporation (IFC) and Amundi, by 2023, the sustainable finance market in general – and green bonds in particular – continue to grow, making them a promising source of climate finance for the developing world.5 Despite this global growth, however, Africa’s share of the global USD 2.2 trillion green bond market is less than 1%.6 The impact of the ongoing climate crisis on the continent and its sheer wealth of natural capital make Africa a potential market for green bond proliferation.

What is a green bond?

A green bond is a fixed-income instrument, similar to a traditional bond, but specifically used to raise capital for projects that deliver positive environmental or climate benefits. First issued in 2007 by the European Investment Bank, green bonds direct funds toward sectors such as renewable energy, sustainable agriculture, water management and green infrastructure.7 Issuers of green bonds include governments, corporations, municipalities and international organisations, who must include a ‘use of proceeds’ clause in the bond to ensure that the funds are allocated to environmentally beneficial projects. 8 9

In sum, what sets green bonds apart from traditional bonds is their focus on sustainability and climate outcomes. In addition to the ‘use of proceeds’ requirement, green bond issuers often seek third-party verification to validate the environmental credentials of their projects. This process involves regular reporting on the bond’s usage and environmental impact, ensuring transparency and accountability. Green bonds are issued and regulated based on national frameworks and voluntary international guidelines that align with global climate goals, such as the Paris Agreement and the UN’s Sustainable Development Goals (SDGs).10 Certification of green bonds ensures that they meet best practices for reporting, tracking and compliance with environmental objectives. Key initiatives, such as ICMA’s Green Bond Principles and the CBI’s Climate Bonds Standard, help standardise issuance. Alignment with these international standards further strengthens the integrity of green bonds.12 13 Global agreement on eligibility criteria and reporting remains essential to avoid greenwashing and ensure credibility.14 15 16

An overview of the global green bond market

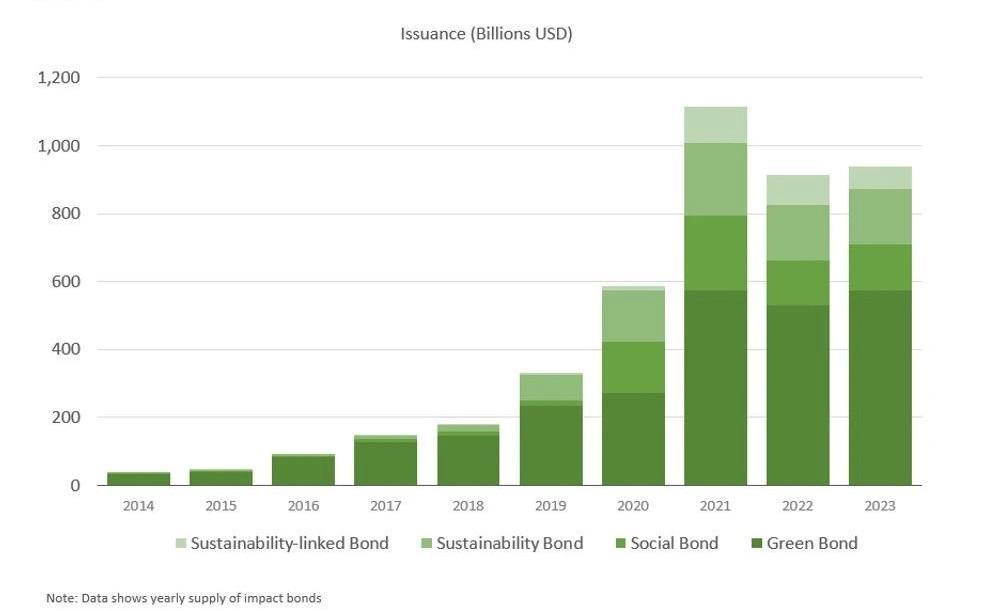

The global green bond market has experienced exponential growth, surging from under USD 50 billion in 2015 to approximately USD 2.8 trillion in 2023, with USD 575 billion issued in 2023 alone (see Fig. 1).17 18 This growth has been driven largely by the increasing demand for climate-positive investments following the Paris Climate Accord, as investors and issuers alike prioritise sustainability.

The market has seen a diversification of issuers, including corporations, municipalities, banks and sovereign governments. This broad participation underscores the widespread appeal of green bonds as a tool for financing environmental projects. Regulatory developments are also playing a significant role, with governments introducing guidelines and taxonomies to support market growth and ensure the integrity of green finance.19 20 As a result, green bonds now dominate the sustainable finance space, with rising demand signaling their central role in addressing the climate crisis.

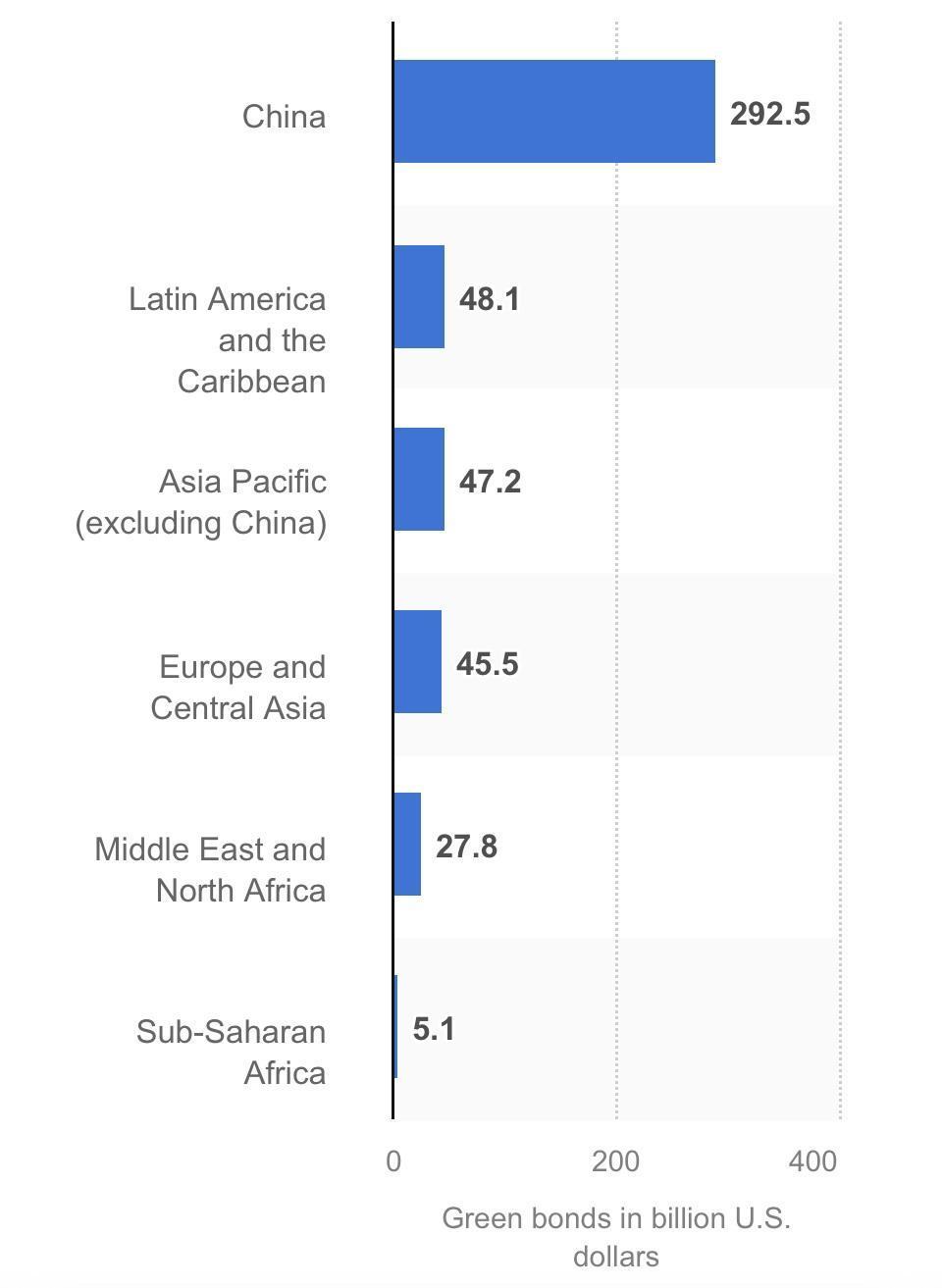

In 2023, green bonds grew exponentially, accounting for 73% of overall bond issuances in emerging markets and 68% in advanced markets.21 Despite the growth in emerging markets, 70% of green bond issuances since 2012 have come from advanced economies, with China leading the pack at USD 292 billion.22 Unlike advanced markets, emerging market bond issuers in 2023 combined green and social projects, reflecting a broader commitment to all of the SDGs. The growth of green bonds globally has been driven by various factors including national climate contributions, investor demand in sustainable projects and macroeconomic factors.2324

An overview of the green bond market in Africa

In spite of the global surge of green bond issuances, sub-Saharan private and public sectors have not fully benefited from this source of climate finance.25 As the figure below shows, the continent represents only USD 5.1 billion of the total USD 2.2 trillion green bond market, compared to USD 47.2 billion for Asia Pacific (minus China) and USD 48 billion for Latin America.

Low liquidity and underdeveloped capital markets across Africa have limited the potential of the green bond market. Despite this challenge, green bond issuances grew by 125% in 2023, reaching USD 1.4 billion, up from USD 600 million in 2022.26 One of the latest and biggest sovereign sustainable bond issuances in 2024 is the Côte d’Ivoire USD 1.1 billion Sustainability Bond,27 which will be used for eligible green projects in line with the ICMA 202128 and CBI 202329 Green Bond Principles.

As of 2024, Africa had issued over 20 green bonds in countries such as Tanzania, Rwanda, Gabon, Seychelles, Nigeria, South Africa, Kenya, Morocco, Mozambique, Namibia, Mauritius and Zambia.30 31 The green bonds issued in Africa have funded climate mitigation and adaptation projects, including renewable energy, forestry, sustainable agriculture, sustainable water and clean transport projects.

Green bond development in Africa

The African Development Bank (AfDB) has become a pioneer for sustainable financing in Africa,33 issuing its first green bond of USD 500 million in October 2013. Several more issuances have followed, including the latest 2023 USD 50 million 15-year Kangaroo Green Bond.34 Other countries have followed suit. South Africa led the African market’s early development with its sustainable finance taxonomy and green listing rules introduced in 2017. This enabled Cape Town to issue its first green bond for climate change mitigation and adaptation, followed by municipal green bonds worth over USD 74 million. Johannesburg allocated USD 138 million for similar bonds.35

While South Africa has pioneered green bonds in Africa, Nigeria dominates the public issuance of green bonds. In 2017, Nigeria issued its first green bond to fund solar power and afforestation projects.36 This was the first bond certified by climate bond standards, and today Nigeria accounts for approximately 99% of green bonds listed on the Nigerian Stock Exchange. Private firms, such as Access Bank, North-South Power Company and the Infrastructure Credit Guarantee Company, have followed the government’s lead.37

Meanwhile, African countries such as Morocco, Namibia and Kenya have issued corporate green bonds with government guidance. Morocco’s first green bond was issued by the Moroccan Agency for Solar Energy. In 2023, Africa saw further, important debut issuances such as the Rwanda Development Bank’s sustainability-linked bond (SLB), Gabon’s blue bond through a ‘debt-for-nature swap’, and Zambia’s first corporate-led green bond from Copperbelt Energy Corporation.38

To accelerate Africa’s green bond market, in 2023 the African Development Bank signed a joint partnership with the Global Green Bond Initiative to promote green bonds across the continent.39 Additionally, the International Finance Corporation and Amundi have launched a USD 2 billion fund to purchase green bonds from emerging markets, including Africa.40 These instances reflect African institutions’ growing recognition of green bonds as vital to unlocking climate finance.

Lessons from the Zambia case

Over the past 30 years, climate change has cost the Zambian economy an estimated USD 13.8 billion in GDP losses.41 In addition, Zambia’s GHG emissions rose by 47% between 1994 and 2016, emphasising the need for a low-carbon development path.42 According to the World Bank, Zambia’s national income could decline by 4.8% to 8% by 2050 as a result of chronic climate damage.43 In 2023, Zambia responded by issuing its first-ever green bond, seen as a key tool for enhancing environmentally positive activities and climate resilience.44 Before this issuance, Zambia faced several challenges including a lack of awareness, guidelines, customised incentives, green bond ratings and a pipeline of suitable projects.45 To address the challenges, a working group led by the UNDP Biodiversity Finance Initiative, in collaboration with various government ministries and WWF Zambia, developed green bond guidelines and hosted workshops to raise awareness amongst potential issuers. The Zambia Green Bonds Guidelines were gazetted in 2020 under the Securities Act.46 In 2023, Copperbelt Energy Corporation (CEC) issued Zambia’s first green bond worth USD 200 million, which was oversubscribed by 178%.47 Investing in renewable energy projects, the bond was supported by investors such as ABSA Bank and the Africa Local Currency Bond Fund. The bond is aligned with the EU Taxonomy, and CEC is committed to annual impact reporting based on ICMA Green Bond Principles.48 In 2022, with support from ZANACO, FCDO and WWF Zambia, the Women Leaders for Climate Action (WLCA) was formed to build the capacity of more market players on green and gender bond issuances. This included training on green bonds issued across Africa, including Zambia.

Conclusion and call to action at COP29

Even though Africa has the lowest CO2 emissions in the world, its economy is reeling from climate change-induced water, energy and food crises. Trillions of dollars are needed to address these challenges. Green bonds are an important and under-utilised instrument that can aid in the financing of Africa’s climate adaptation goals. As there is no shortage of economic sectors on the continent in need of greater resilience, the opportunity for scaling green bonds in Africa is enormous.

However, creating a green bond market requires strong and consistent collaboration between public and private sectors and between local and international financial institutions. This will unlock financing opportunities for projects producing environmental, social and commercial outcomes for all parties. Several African countries have already demonstrated that the continent can overcome the barriers currently limiting their market share of the global green bond market. By harnessing and leveraging existing capacities in the public, private and development sectors, more African countries will see increased green bond issuances.

Governments, financial institutions, municipalities, investors and corporations at the upcoming COP29 must commit to accelerating the creation of enabling environments, capacities and collaborations for green bond issuance in Africa. COP29, hosted by Azerbaijan, is poised to be historic if parties to the United Nations Framework Convention on Climate Change (UNFCCC) implement a radically different strategy to unlock the finance needed to confront the climate crisis. Creating a finance strategy which incorporates green bonds will unlock the trillions of dollars Africa needs to combat climate change and thrive. In summary, Africa’s under-utilised green bonds market may be the key to help it bridge its trillion-dollar climate finance gap. By scaling up the green bond market, critical climate projects can be funded to unlock Africa’s potential for sustainable development and resilience, with governments, businesses and international institutions driving the shift.

For More News And Analysis About Ethiopia Follow Africa-Press