Africa-Press – Malawi. The Reserve Bank of Malawi (RBM) Friday loosened its control of the local currency by introducing forex auctions, which would be used as an instrument to determine the true value of the local currency.

A forex auction is a system when the central bank regularly sells a given amount of foreign exchange through a bidding process and buys foreign exchange in the intervening periods at the previous auction-determined rate.

The introduction of the forex auctions come at a time many players in the economy had argued that the local unit, the kwacha, was overvalued with the official rate seen at around K1031 to the dollar when the parallel market was trading the green buck at around K1450.

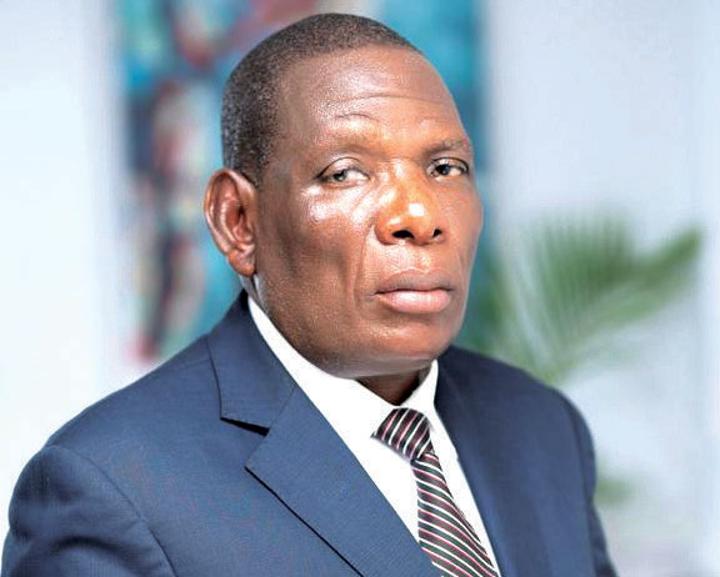

In a statement Friday, RBM Governor, Wilson Banda, said during the auctions, Authorised Dealer Banks will be submitting bids to sell foreign exchange to the Central Bank at prices or exchange rates freely determined by each participating bank.

Banda said the bids shall be for a minimum of $50,000 and in multiples of $10,000 thereafter. “These auctions will facilitate the discovery of a prevailing market clearing exchange rate for the Malawi kwacha against major currencies and thereby promote transparency in the determination of the exchange rate,” Banda said.

Through the forex auctions which will be held once every month, individual commercial banks will be submitting the price at which the kwacha should be bought or sold during that month and the average price will be adopted by the monetary authorities as the ruling exchange rate for that month.

Before the introduction of the forex auctions, RBM could take the administrative responsibility of devaluing the kwacha but with the introduction, the depreciation or appreciation of the kwacha will solely be determined by the market forces of demand and supply.

In Malawi’s November 2022 Memorandum of Economic and Financial Policies (Mefp) to the International Monetary Fund (IMF), Finance Minister Sosten Gwengwe and RBM Governor, Wilson Banda, promised to facilitate the price formation processes in the market by arranging small pilot foreign exchange auctions.

This, according to Gwengwe and Banda, would help to determine the market-clearing exchange rate and facilitate development of the interbank forex market.

To further build external buffers, Gwengwe and Banda promised the IMF that Malawi would slow down direct foreign exchange sales to the market in support of imports.

“In any event, the RBM will become a net purchaser of foreign exchange. Concurrently, we will gradually wind down the existing swap open position as guided by the foreign exchange accumulation path. We believe that pursuing this reserve accumulation strategy will help achieve a 3-months import cover by the end of the medium term.

“Moreover, we will also monitor reserve liabilities so that the RBM’s net international reserves (NIR) will reach an adequate level as quickly as possible,” the authorities said.

But former Finance Minister Joseph Mwanamvekha, has faulted the monetary authorities for the decision to introduce forex auctions, saying it will lead to further devaluation or loss of value for the Kwacha.

Mwanamvekha, a seasoned monetary and financial economist, said this policy regime was pursued by RBM in early 1990s up to 1995 during the Structural Adjustment Programmes (SAPs).

“I was at the Reserve Bank of Malawi at that time and was working in Financial Market Operations Department and was part of the team managing this policy regime. It failed miserably and was later abandoned.

“At that time, the auctions system of foreign exchange was meant to improve the country’s export competitiveness, provide efficient foreign exchange allocation to banks, maintain price stability, dampen speculative attacks on the Malawi Kwacha and restore investor and donor confidence. All these objectives were never achieved and, in fact, the opposite was achieved,” Mwanamvekha said.

On Wednesday, the Economics Association of Malawi (Ecama) through its Executive Director, Frank Chikuta, pleaded with Finance Minister Sosten Gwengwe to realign the kwacha exchange rate ahead of the 2023- 24 national budget. The Financial Market Dealers Association (Fimda) has since hailed the introduction of forex auctions by the Central Bank.

For More News And Analysis About Malawi Follow Africa-Press