Africa-Press – Angola. In a universe of 30 million inhabitants, the banking system has only 6,200 housing credit processes, with half corresponding to credit granted to bank employees and the other to employees of companies with agreements with commercial banks, he said, Thursday( 31) in Luanda, the governor of the BNA, to explain the financing facility announced, Wednesday, to facilitate access to home ownership in the country.

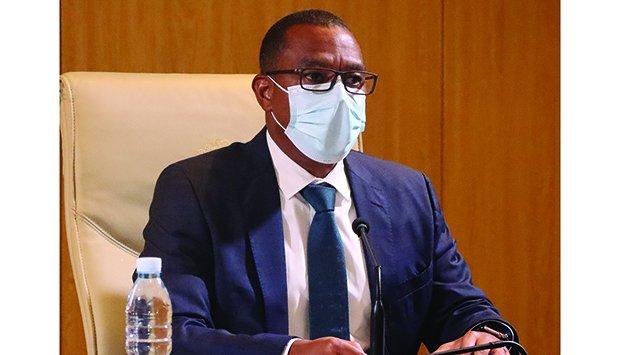

José de Lima Massano made these statements at the end of the meeting of the Monetary Policy Committee of the National Bank of Angola (BNA) held this Thursday (31), one day after, at the Economic Commission of the Council of Ministers, he presented the credits housing loans that allow the population to access credits of up to 100 million kwanzas, with repayment periods of up to 25 years.

“It is a concern”, said the governor yesterday, adding that any citizen can apply for the housing credit established by Notice 10/20, as long as they have income or guarantees to assess the ability to settle the required amount with the commercial bank in which they are domiciled. .

The process is also open to real estate companies that want to build projects to sell, but the settlement period is three years, with rates of 10 percent, as opposed to the 7.0 percent set for individuals.

In response to questions posed by journalists about impediments of various kinds, such as low salary, social status or having already acquired real estate in central areas, the governor reiterated that “the credit of 100 or 50 million kwanzas is open to all interested parties, provided they have guarantees”.

The objective, he said, is to take advantage of the availability of resources to reverse the current situation of housing deficit on the part of public and private sector officials, through a more advantageous modality than the ones that exist so far, giving the banks two months to comply. and start the process.

The housing credit granting program, he pointed out, also aims at price stability, creating channels that allow companies to continue to offer goods and services that society needs to find well-being, in a space of price balance in the economy.

market reactions

In reaction, leaders of the Real Estate sector contacted yesterday by Jornal de Angola, such as the president of the Executive Committee of Imogestin, Víctor Costa e Silva, and the vice-president of the Association of Real Estate Professionals of Angola (APIMA), Cléber Corrêa, considered that the credit facility has the potential to resolve, at least partially, the issues of economic restriction on access to housing.

According to the chairman of Imogestin’s Executive Committee, “the maximum term of credit to be granted under this BNA diploma is 25 years, which is quite reasonable”, with “a significant improvement from 20 to 10 percent of the requirement by banks entry with own resources”.

APIMA’s vice-president also appreciates the multiplier effect generated by this financing instrument, noting that “often, it is necessary to use consumption incentives that result in economic growth and greater State revenue. the bonus is granted, on the other hand, with the growth of the economy, the money is recovered”.

The benefits of the facility multiply again, based on the argument presented by real estate developers who, in prior consultations for this process, told the bank that it does not make sense that, after through Notice nº 10/2020 (for financing production ), the BNA has broadened the range of products and started to consider the production of inputs for the Civil Construction sector, stimulating supply, in this case, ceasing to stimulate demand induced by the Real Estate sector.

“In other words, it didn’t make sense to only stimulate the product and not stimulate its acquirer”, said the president of the Executive Committee of Imogestin, with which Cléber Corrêa agrees.

“Civil construction moves the entire economy: we may have the reform of the national business fabric as well as the expansion of national industries of civil construction materials. Everything will depend on the amount made available for financing and the cost of this money to the population”, predicts the vice president of APIMA.

Cléber Corrêa cited official figures declaring that the country has a deficit of 3.5 million homes: “the available supply is tiny and far from the purchasing capacity of the national citizen”, lamented the businessman, defining the country’s real estate offer by a large amount of real estate occupied in leasing operations and an overwhelming supply of idle offices.

Victor Costa e Silva indicated that, in order to estimate unsatisfied demand, one must take into account “a population growth rate of around 3.2 percent per year, exerting strong pressure on the demand for housing”, than “the offer made available, whether through centralities and other social projects, as well as in other private projects aimed at the middle and upper middle classes” must be discounted.

For More News And Analysis About Angola Follow Africa-Press