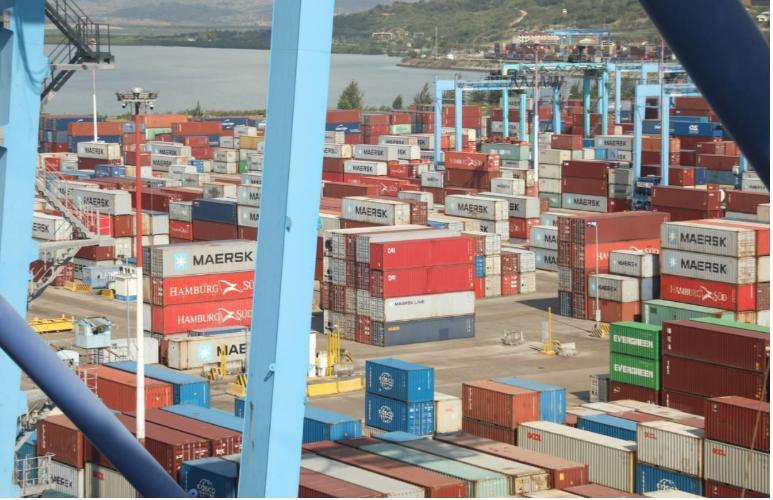

Africa-Press – Kenya. Shippers and traders now want cargo clearance within the Port of Mombasa temporarily stopped for three months, with the processes transfers outside the facility, to allow decongestion of the port.

This is on the back of increased cargo volumes at the country’s and the East African region’s main sea port in the wake of rising trade, with the number of vessels calling having significantly rose in recent months.

Cargo throughput, which is the total volume of goods, is projected to have risen by at least six pper cent in 2025 above the 40.9 million metric tonnes recorded in 2024, which was a 13.9 per cent rise from 35.9 million metric tonnes in 2023.

Container traffic is reported to have gone up by at least seven per cent last year above the more than two million recorded in 2024, leading to congestion at the port towards the end of the year into 2026.

According to the Shippers Council of Eastern Africa (SCEA), which represents the interests of importers, exporters and other stakeholders in the logistics and shipping industries across Eastern Africa, yard population as at December 31, was between 50,000 and 52,000 Twenty-foot Equivalent Units (TEUs)–the standard measure for shipping container capacity.

There has been a high number of ships waiting to berth at the port as a result of slow evacuation of cargoes from the port, with at least 20 waiters as at January 4, 2026.

These included five waiters (vessels waiting for berth) and 15 waiting at vessels convenience, amid berth challenges and resultant delays.

Port stakeholders hence want all cargo clearance to be done at the Inland Container Depots and designated Container Freight Stations to address the congestion challenge, which has led to delays and demurrage charges running into billions.

“We are calling for a temporary stop to port clearance, including the famous within five days, starting January 15th, 2026, for three months to allow decongestion of the port that has received an enormous port throughput and increase in vessels call,” SCEA chief executive, Agayo Ogambi, said.

“We could use CFSs and request that KPA Tariff apply during the three months. CFSs to work 24/7, including Saturdays and Sundays. Let all local cargo clearance be done at ICD Nairobi or the CFSs,”

The ripple effect, traders say, shall include decongestion and fluidity in the port, allowing additional time for loading empties, with clearing agents and cargo owners urged to support the move.

“We urge all to support and cooperate. Failure to undertake this will see further delays and an increase in ships, waiters, congestion and pain to shippers,” said Ogambi.

Apart from a high throughput, delays in moving cargo by rail and a breakdown of scanners at the Port and Nairobi Inland Container Depot, have also been blamed for contributing to slow evacuation hence the congestion being witnessed.

“While the year has presented Kenya with significant business opportunities, we note that operational execution at the Port of Mombasa has struggled for many reasons. Railage is one aspect that requires improvement. In particular, the railing of containers to the Inland Container Depots has become a critical bottleneck, resulting in severe operational disruptions and reputational damage to both the Kenya Ports Authority and Kenya Railways,” said Ogambi.

Importers have proposed that Kenya Railways improves freight services by guaranteeing timely railage and increased containerised trains.

The other big challenge has been return of empties to depots which are full, with trucks also having to wait for four to five days. Shipping companies have since been forced to impose container demurrages, with consumers paying the final price on higher commodity prices.

Kenya Ship Agents Association (KSAA) says delays in ships berthing at Mombasa is costing shipping lines heavy loses in terms of daily running usage and charter, with demurrage fees running between $20,000 (Sh2.6 million) and $50,000 (Sh6.5 million) daily, depending on the vessel size.

Lines have also not been able to load full tonnage of ships leaving Mombasa, according to KSAA, with instances where vessels are made to vacate berths without completing cargo operations.

While Kenya Ports Authority and Kenya Revenue Authority agreed on a decongestion plan, which involves the use of Container Freight Stations (CFSs), Mombasa has been hit by a shortage of storage facilities.

“There is need to create more handling and storage space ,” KSAA chief executive Elijah Mbaru told the Star.

KPA managing director Captain William Ruto recently confirmed there is a shortage of storage facilities in Mombasa, with the port being chocked by containers.

According to Ruto, Mombasa port can only support up 8,000 TEUs in storage but has been forced to accommodate up to 12,000 containers, which has since increased further.

The closure of Mahati Container Freight Station, a key facility in Mombasa, has contributed to the congestion. Current empty container depots are Hakika, APM, Dodwell, Fortune, Cargo Haven, and Portreitz.

“Currently, we are storing more than 50 per cent of empties earmarked to be delivered in port.Investments in empty container storage facility is low, I agree there has been a problem, and we are helping where we can,” Ruto told the Star.

The empty container shortage in China means Kenya could be affected on her imports, a move like to push up commodity prices. Delays in returning empties at the ports of Mombasa and Dar es Salaam is said to be contributing to the shortage.

Increased calls by shipping lines at the Port of Mombasa and the recent Red Sea crisis strained Mombasa Port’s capacity last year, leading to delays, with the port falling in ranking in the latest World Bank’s 2024 Container Port Performance Index.

The Red Sea crisis saw vessels re-route through the Cape of Good Hope, with some vessels avoiding other ports and opting to drop cargoes at Mombasa for onwards delivery, hence a rise in transshipment cargo.

The Port of Mombasa was last year ranked 375th globally out of 403 ports in the World Bank index , falling 89 places from the previous year.

This was pegged on persistent inefficiencies in vessel turnaround with the drop placing the port behind several sub-Saharan African peers, including Dar es Salaam (367th).

According to shippers, Mombasa witnessed an unprecedented increase in cargo throughput both containers and conventional cargo, stretching its capacity.

“One shipping line for instance increased vessels call to 20 from eight due to challenges in some ports which experienced congestion and longer vessel waiting time. This put pressure on Mombasa,” Ogambi noted.