Africa-Press – Liberia. Liberia has recorded the highest domestic revenue collection in its history, closing Fiscal Year 2025 with an extraordinary performance that underscores the country’s growing capacity to finance its own development, despite significant fiscal gaps, policy setbacks, and institutional constraints.

This achievement marks a turning point in the country’s ability to finance national development from its own resources and stands out not only for its scale, but for the conditions under which it was delivered.

Provisional figures indicate that the FY2025 approved national budget of approximately US$880.7 million – comprising US$804.6 million in domestic revenue and US$76.0 million in external resources and borrowing – has been exceeded. As of December 31, 2025, total collections reached about US$885.0 million, surpassing the approved target even before final reconciliation.

Crucially, this performance was driven overwhelmingly by domestic revenue, which reached US$847.0 million, representing an overperformance of US$42.4 million against the domestic revenue target.

This is the highest domestic revenue outturn in Liberia’s post-war history and the second consecutive year the country has achieved this milestone.

Compared to FY2024 domestic revenue of US$699.7 million, the FY2025 outcome reflects a US$147.3 million year-on-year increase, the largest single-year domestic revenue growth Liberia has ever recorded.

In just two fiscal years, Liberia’s domestic revenue has expanded by US$235.0 million, surpassing the cumulative growth achieved over the previous thirteen years combined.

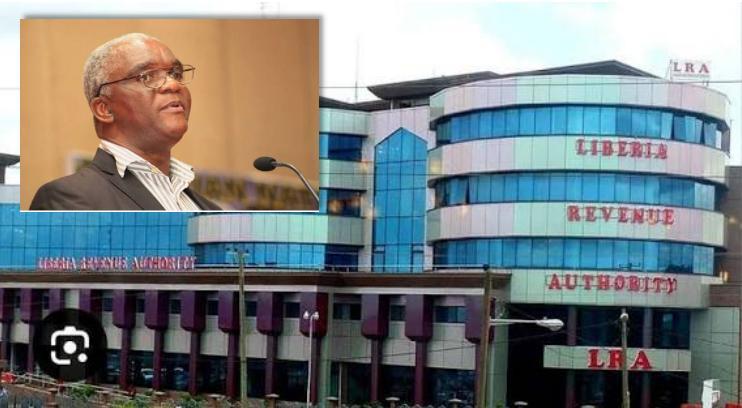

James Dorbor Jallah, Commissioner General of the Liberia Revenue Authority (LRA), has since described the performance as both historic and institutional.

“This outcome demonstrates that Liberia can finance a growing share of its development from its own resources when domestic revenue systems are strengthened, and compliance improves.”

Taxpayers and Institutional Reforms at the Center of the Surge

Beyond the headline figures, the FY2025 revenue performance reflects significant improvements in taxpayer compliance, enforcement discipline, and administrative efficiency.

Over the past two years, the LRA has intensified digital tax administration, strengthened audit and compliance regimes, enhanced border revenue controls, and expanded taxpayer education, resulting in measurable behavioral change across the tax system and a stronger culture of compliance.

“This performance tells us something very important,” Commissioner General Jallah said. “Liberians are complying more, not because of force alone, but because confidence in the revenue system is improving. When enforcement is fair, systems are digital, and institutions are credible, voluntary compliance rises.”

The domestic revenue surge is therefore not accidental. It reflects greater voluntary compliance by Liberian taxpayers – individuals and businesses alike – combined with firmer and more consistent enforcement of existing laws.

In this regard, FY2025 represents a strengthening of the social contract between the state and its citizens, with taxation increasingly understood as a civic responsibility tied directly to national development.

“What makes this achievement exceptional is that it was delivered despite the non-realization of several major revenue assumptions totaling US$93.8 million embedded in the national budget,” Commissioner General Jallah noted.

Contingent Revenues That Did Not Materialize

The FY2025 Budget included US$18.8 million in contingent revenues, comprising US$12.8 million in petroleum signature bonuses linked to agreements with Oranto Petroleum and Total Energies, overseen by the Liberia Petroleum Regulatory Authority, and US$6.0 million expected from the Liberia–China Maritime Agreement through the Liberia Maritime Authority.

None of these revenues materialized during the fiscal year. The petroleum agreements were ratified only toward the end of December 2025, pushing the associated bonuses into FY2026. Meanwhile, geopolitical tensions and global supply-chain disruptions prevented the maritime agreement from generating the anticipated revenue.

“These were budgeted revenues outside the operational control of the tax administration,” the Commissioner General explained.

SOE Remittances Fell Significantly Short

Several State-Owned Enterprises failed to remit their full budgeted contributions. The National Port Authority, budgeted to contribute US$5.8 million, did not contribute during the fiscal year. The National Fisheries and Aquaculture Authority, budgeted at US$2.0 million, also did not contribute. The Liberia Petroleum Refining Company, budgeted at US$5.0 million, contributed only US$799,000.

“These shortfalls significantly reduced expected non-tax revenue inflows,” the Commissioner General noted, “yet strong domestic tax performance was sufficient to compensate for them.”

Tax Policy Reform Neutralized by Litigation

The FY2025 Budget was also premised on a major tax policy reform designed to promote equity in corporate taxation. Amendments to the Liberia Revenue Code introduced a two-percent quarterly advance minimum corporate income tax for companies operating in the mining and agriculture sectors, projected to generate US$19 million.

While the law was duly enacted and the LRA initiated enforcement, affected companies challenged the measure in court. The matter is currently before the Supreme Court, preventing collection during FY2025.

“We respect the rule of law,” the Commissioner General said. “But it is important for the public to understand that this was a legally enacted fiscal policy whose impact was deferred by litigation, not administrative failure.”

Persistent Road Fund Disparities

Another unrealized revenue assumption related to road maintenance levies. While most consumers pay US$0.30 per gallon, Bea Mountain Mining Company continues to pay US$0.075, citing provisions of its Mineral Development Agreement.

Full compliance, as required under the FY2025 Budget Law, would have generated an additional US$4.0 million for road maintenance.

“This reflects longstanding structural challenges in harmonizing concession agreements with evolving national fiscal policy,” the Commissioner General observed.

External Financing Also Failed to Materialize

The FY2025 Budget assumed US$40 million in budget support from the World Bank and US$16 million in domestic borrowing. Neither materialized during the fiscal year.

As a result, pressure on domestic revenue mobilization increased significantly, with the burden of budget execution falling squarely on internal revenue performance.

“It is important for the public record to reflect that this outcome was achieved without this budget support and without new borrowing,” the Commissioner General emphasized. “Domestic revenue carried the full weight of budget execution, and the LRA delivered within its legal mandate.”

Strong LRA Performance Filled the Gap

All of these unmet assumptions were embedded in the US$880.7 million FY2025 Approved Budget. Yet Liberia still met – and exceeded – its revenue target.

This outcome confirms that the FY2025 performance was not driven by windfalls or extraordinary external support, but by institutional strength and sustained domestic effort.

“What we are witnessing is not luck or a one-off event,” Jallah noted. “It is the result of deliberate reforms, disciplined administration, and the daily sacrifice of revenue officers who understand that domestic resource mobilization is central to Liberia’s sovereignty.

“At its core, this historic performance is a testament to the professionalism, gallantry, and unwavering nationalism of the men and women of the Liberia Revenue Authority and the broader revenue administration ecosystem—Liberia’s unsung heroes standing guard over the nation’s economic future.”

According to the LRA’s public revenue dashboard, approximately US$885.0 million has been collected, with figures expected to rise following reconciliation exercises.

A Clear National Lesson

The FY2025 experience reinforces a clear national lesson: sustainable development will depend on realistic budgeting, policy coherence, accountable SOE governance, and sustained investment in domestic revenue institutions. Above all, it demonstrates that when institutions are empowered and taxpayers comply, Liberia can deliver for itself – even under severe constraints. This is not merely a fiscal success; it is a historic institutional milestone.

For More News And Analysis About Liberia Follow Africa-Press