Africa-Press – Malawi. Pressure persists on the Kwacha despite the spread of rates between the parallel market and most authorised dealer banks (ADBs) seen narrowing, while the spread between the official telegraphic transfer rates and cash rates re-emerges.

The Kwacha is trading at around K1,500 per dollar on the parallel market compared to K1,455 in most ADBs. But figures from the Reserve Bank of Malawi (RBM) show that, as of this week, the official exchange rate was at K1,036 against the US dollar.

This difference is more than what caused the Kwacha to be devalued by 25 percent by RBM in May this year, when the average difference was around K200.

In its third quarter Financial and Economic Review, the central bank indicates that the Kwacha appreciates against all the currencies of the country’s major trading partners in the third quarter of this year, except for the US dollar and Zambian Kwacha.

It added that, in particular, the local currency marginally depreciated by 0.04 percent against the US dollar and traded at K1,033.79 per US dollar at the end of the third quarter of this year.

“The outturn was attributed to strengthening of the US dollar, as the tight monetary policy stance adopted by the Federal Reserve Bank attracted foreign inflows into the US economy,” the statement reads.

Malawi University of Business and Applied Sciences economist Betchani Tchereni said this means that business people are getting the forex at an expensive rate, which in turn makes their products expensive.

Tchereni added that there could be no short fixes to the Kwacha pressure, as Malawi needs to work towards taming its appetite for imports while maximising output of export commodities.

“However, there are some projects that can turn things around in the short term such as the mega farms where it can take three months only to produce things and sell on the international market,” he said.

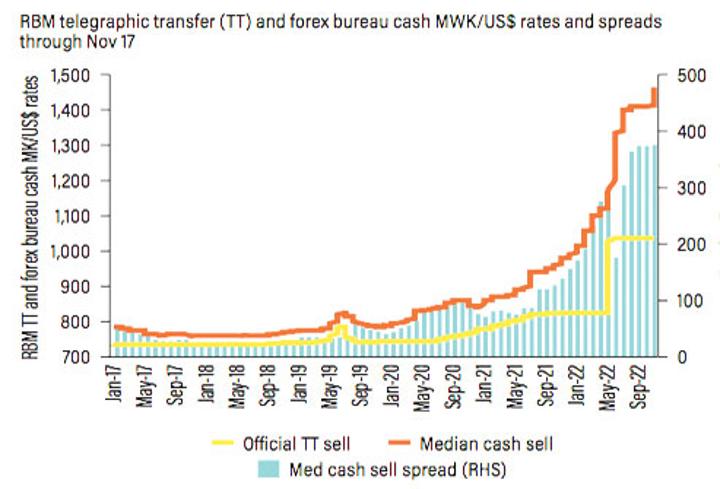

In its Malawi Economic Monitor issued last week, the World Bank warned that the spread between official telegraphic transfer rates and cash rates has reemerged after the RBM devalued the official Kwacha-$ exchange rate by 25 percent in May 2022.

Between July 2021 and May 2022, according to the World Bank, the official Kwacha exchange rate for telegraphic transfers (TT), through which most foreign exchange transactions are carried out, had only marginally depreciated by 1.4 percent.

“Meanwhile, foreign exchange bureaux cash exchange rates depreciated by 25.6 percent, widening the spread against the TT rate to 42 percent.

To align official rates with market rates and address foreign exchange shortages, the RBM devalued the official Kwacha-US dollar exchange rate by 25 percent,” the report reads.

However, the spread between the official TT rates and foreign exchange bureaux cash rates now has surpassed the pre-devaluation level, according to the World Bank.

It says increases in current money supply in the domestic economy and inflation differentials are considered to have a depreciating impact on exchange rate movements. The exchange rate adjustment has had a limited impact on addressing foreign exchange shortages.

The exchange rate adjustment was aimed at improving external sector competitiveness and building up official reserves, aligning the exchange rate with market fundamentals, as well as improving the circulation of foreign exchange in the market.

While imports and other international foreign exchange transactions have declined, banks and other businesses continue to hoard foreign exchange despite the devaluation in May.

Justin Mkweu is a fast growing reporter who currently works with Times Group on the business desk. He is however flexible as he also writes about current affairs and national issues.

For More News And Analysis About Malawi Follow Africa-Press