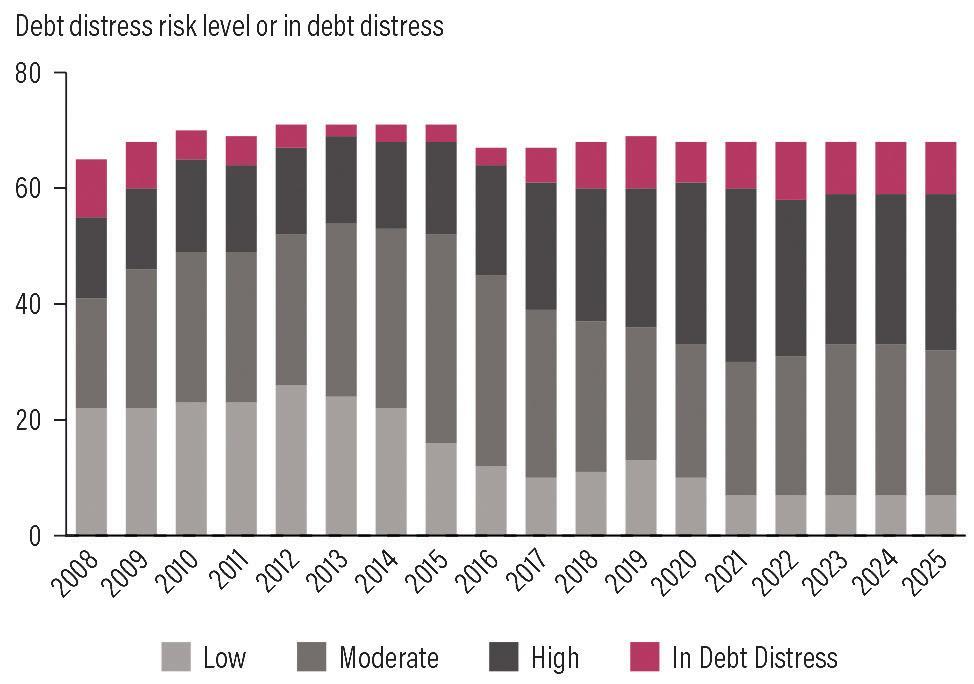

Africa-Press – Malawi. The Malawi economy faces immense pressure in the short to medium terms due to elevated risks emanating from the rising public debt.

This is contained in the Monthly Economic Report for July 2025 by the investment management and financial advisory firm, Bridgepath Capital Limited.

In its analysis, the firm noted that persistent fiscal deficits are being plugged by costly domestic borrowing, a condition that not only does it crowd out private sector credit but also affects critical public investment and social programmes.

In 2024, interest payments on domestic debt alone reached seven percent of the gross domestic product (GDP), swallowing 45.8 percent of domestic revenue, according to the report.

It says slow progress in restructuring agreements with external commercial creditors is worsening the government’s financing challenges.

Despite the headwinds, according to the report, there are untapped opportunities that could revive growth such as diversifying agricultural exports to include soybeans, tea, and cannabis, while boosting service exports through tourism.

“Moreover, promising developments in the industrial sector, specifically uranium and rare earth mining, could also lead to the much-needed diversification away from agriculture,” the report adds

Several institutions revised downwards Malawi’s growth projection, with forecasts ranging between 1.6 percent and 3.2 percent.

Bridgepath Capital then warns that without decisive action to address debt distress and unlock external financing, Malawi’s growth potential could remain stifled, even as new sectors show promise.

Economic analyst Marvin Banda warned that a debt distress situation might serve as an impediment to current efforts to restructure public debt.

“The hope is that debt contracted on a sub-governmental level including local council will finally be recorded and reported with greater accuracy to improve the understanding of the current debt burden,” Banda said.

For More News And Analysis About Malawi Follow Africa-Press